USDCHF Price Analysis – June 9

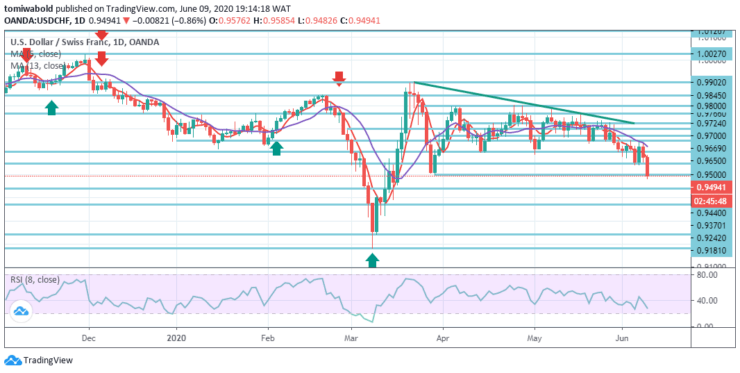

Since the recent North American session, the USDCHF pair plunged to new 10-week depths, amid bears already aiming to somehow extend the weakness beneath the main 0.9500 psychological marks. The safe-haven Swiss franc profited from a marginal weakening in the global risk sentiment – as seen by a weaker tone across equity markets.

Key Levels

Resistance Levels: 1.0231, 1.0027, 0.9766

Support Levels: 0.9440, 0.9242, 0.9181

In the broader context, a downward trend from level 1.0231 is seen as the third phase of the trend from level 1.0342. Having attained 0.9242 main support (low) level, it should have ended at 0.9181 level.

The 0.9902 level breach may stretch the 0.9181 level rebound form through 1.0027 level resistance. After all, medium- to long-term trade in ranges is likely to persist for some longer between 0.9181/1.0231 levels.

Short-term bias is bearish and if we get a steady breach and close underneath 0.9500 level, bears may look for weak pullbacks into the broken support which should then act as resistance with the next support coming in at around 0.9242 level as seen on the daily chart.

Unless, on the contrary, we see a sharp reversal and return above 0.9550 level, then we are probably looking at an inaccurate break that might put 0.9766 level back into focus.

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.