USDCHF Price Analysis – January 21

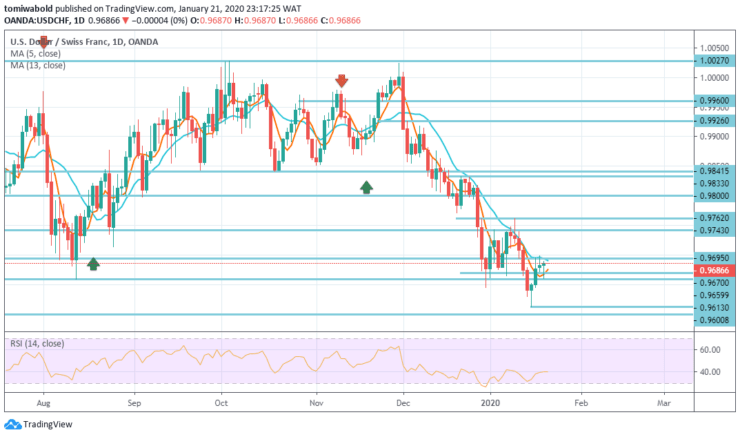

The USDCHF pair fluctuated in a narrow trading range beneath 0.9695 level with the latest optimism about the long-awaited US-China trade deal at the first stage, which supported the recent rally in global financial markets and continued to put pressure on the perceived safe-haven status of the Swiss franc.

Key Levels

Resistance Levels: 1.0231, 1.0027, 0.9762

Support Levels: 0.9659, 0.9613, 0.9540

USDCHF Long term Trend: Bearish

The FX pair rebounds from multi-day lows, trading beneath the main daily moving averages of 5. USDCHF plunge from the level of 1.0231, which is the handle within the structure and can aim the level at 0.9600 (low).

Maybe another increase may happen, a leap forward of the level at 1.0231 is important to show the resumption of an uptrend. Else, we can watch progressively further rallies with the danger of another dive.

USDCHF Short term Trend: Bullish

USDCHF is restricted in consolidation from the level at 0.9613, and the intraday predisposition remains flat. Maybe there’s another recovery, the development potential might be limited by the barrier level of 0.9762. Then again, a leap forward of the 0.9613 level may proceed toward the downtrend up to 100% of the projection of the level at 1.0231 to 0.9659 from 1.0027 to 0.9600.

Notwithstanding, given the condition of bullish convergence in the 4-hour time frame with the cooperation of RSI and moving average, a break of 0.9762 level may demonstrate a momentary inversion and turn the bull pattern for a more grounded bounce back to the level of 0.9800.

Instrument: USDCHF

Order: Buy

Entry price: 0.9670

Stop: 0.9613

Target: 0.9762

Note: Learn2Trade.com is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.