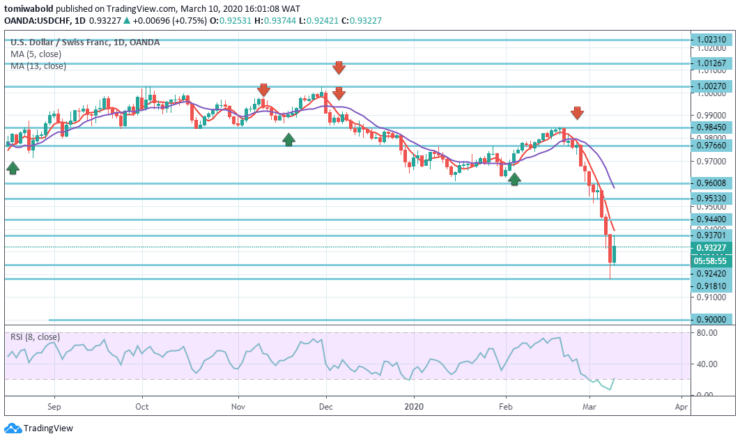

USDCHF Price Analysis – March 10

The USDCHF is recovering from a low level of 0.9181 as it is bidding towards 0.9370 level, up 0.83% ahead of the US session on Tuesday. The pair got tips from a signal from global politicians to further stimulate the economy, as well as China’s mitigating barriers for travelers from Wuhan.

Key Levels

Resistance Levels: 1.0231, 0.9845, 0.9600

Support Levels: 0.9181, 0.9000, 0.8839

USDCHF Long term Trend: Bearish

Long-term lows near the 0.9440 level may limit the recent rebound of the pair, otherwise, it may lead to an expansion of recovery to the September 2018 lows near the level of 0.9533.

However, any flaw beneath 0.9242 level may recall bears targetting the level at 0.9000 psychological magnets. A persistent gap there may prove that the USDCHF is in a long-term downtrend that would target the 138.2% forecast at 0.8839 at the next level.

USDCHF Short term Trend: Bearish

The US dollar has declined 6.27% versus the Swiss franc since February 20. The currency pair tested the weekly support level at 0.9242 during the previous trading session.

Other things being normal, the USDCHF exchange rate is likely to make a slight upward movement during the trading sessions this week. The potential target for the pair will be in the area of 0.9600 level.

Instrument: USDCHF

Order: Buy

Entry price: 0.9181

Stop: 0.9000

Target: 0.9600

Note: Learn2Trade.com is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.