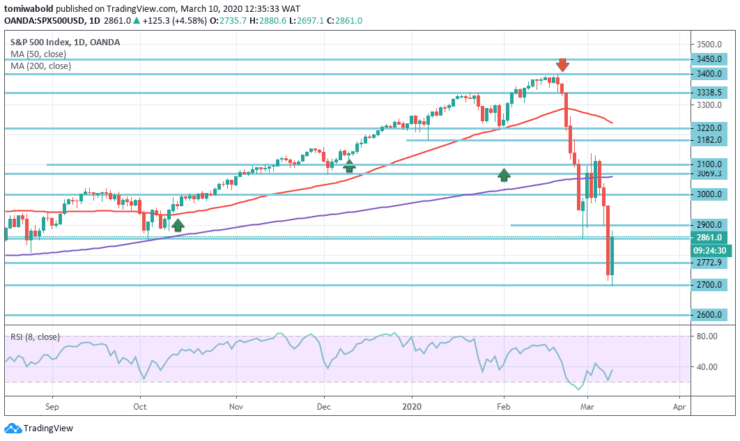

S&P 500 Price Analysis – March 10

The recent selling in oil price led to a further decrease of the S&P 500 index and it declined by -7.60%, which strengthened the tone of risk already prevailing in the markets due to the outbreak of coronavirus outside of China. After the previous decline, the S & P 500 began to recover in the short term, as most governments are preparing financial support for their economies.

Key Levels

Resistance levels: 3400, 3220, 3100

Support level: 2772, 2600, 2500

S&P 500 Long term Trend: Bearish

The S&P 500 dropped further to start the week, dropping beneath the level of 2900. After that, the market plunged to the level of 2700. Meanwhile, as financial actions are being undertaken by several governments around the world, the S&P 500 is recovering from a low level of 2697 towards the 2900 level.

When the rebound stabilizes, the price may rise past the resistance of 2854 to 2900 levels, which may return it to the spotlight. Above this market price of 2900 and 3000 zones, it may meet resistance in front of the 200-day moving average (MA), which is currently at 3060 levels.

S&P 500 Short term Trend: Bearish

On the other hand, showing on the 4 hours, the market will likely continue to move towards the range, even though we are likely to get some resistance at about 2,900 levels.

Alternatively, a break beneath the 2700 level would be terrible when it comes to trends. If this happens, then it is likely that the target will be the level of 2600.

Instrument: S&P 500

Order: Buy

Entry price: 2772.9

Stop: 2700

Target: 2900

Note: Learn2Trade.com is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.