USDCHF Price Analysis – May 19

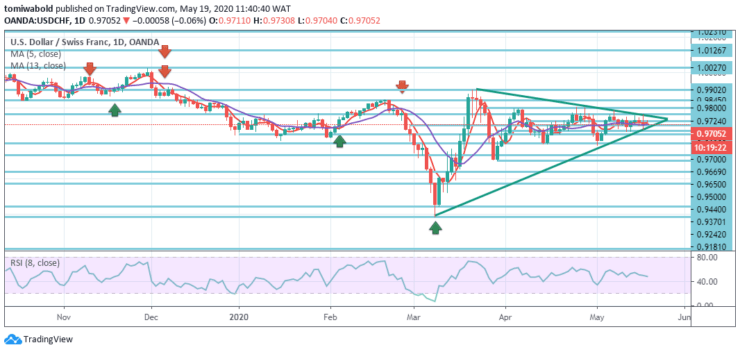

USDCHF posts a slight gain of about 0.10 percent after flickering as a quote at 0.9724 level amid early Tuesday’s session. The pair exchange within a triangle in a consolidation bout while anticipating a breakout. The widespread uncertainty in the USD does seem to encourage USDCHF to trade sideways.

Key Levels

Resistance Levels: 1.0231, 1.0027, 0.9766

Support Levels: 0.9669, 0.9440, 0.9181

In the wider sense, a fall from level 1.0231 is seen as part of the trend from level 1.0342. Having reached 0.9242 main support (low) level, it should have finished at 0.9181 level.

A 0.9902-level breach may stretch the 0.9181-level rebound phase to a 1.0027 resistance level. Simply put, medium- to long-term range trading is sure to persist for some longer around level 0.9181/1.0231.

USDCHF intraday bias remains neutral, and the trend remains constant. The corrective trend from level 0.9902 may continue to grow. A breach of 0.9669 minor support level may transform bias to the downside for it and then probably beneath 0.9533 support level.

All in all, nevertheless, the downside included a turnaround of 61.8 percent from 0.9181 to 0.9902 at 0.9440 levels. On the contrary, a test at 0.9902 high level may seek a breach of 0.9800 level.

Note: learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.