S&P 500 Price Analysis – May 19

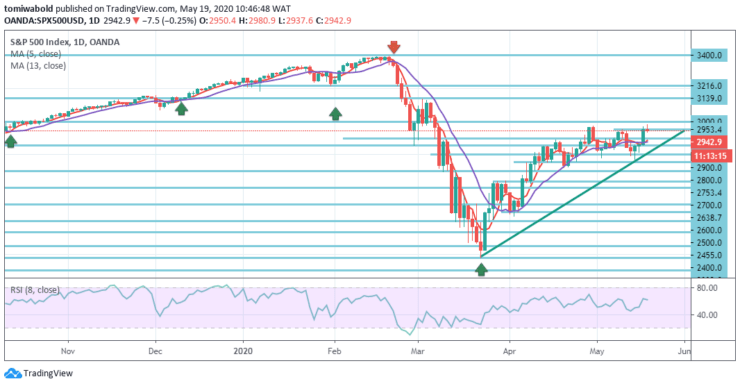

S&P 500 is projected to expand its rebound to level 3000, with fresh sellers at the upper edge anticipated. Although the lockdowns started to ease globally, the U.S. also lifted investor sentiment. Over the weekend, Federal Reserve Chairman Jerome Powell said the central bank had reserves to stimulate economic growth.

Key Levels

Resistance Levels: 3216, 3139.0, 3000

Support levels: 2854, 2800, 2700

S&P 500 Long term Trend: Ranging

Technically, the S&P 500 stays on a bull run (far more than 30 percent from the low market crash of March 23) so the 2,179.3 level remains a significant downside technical support, with probable intermediate support along the ascending trendline.

We are looking for additional intensity to level 3000, but around level 2953, we probably expect fresh sellers to turn up. Over 2953 level although that would imply intensity may reach 3000/3139 level at the high end of the range. A further step higher, the index may experience high levels of 3,139 and 3,216 before the emphasis shifts to a retest of the all-time high.

S&P 500 Short term Trend: Ranging

S&P 500 prices are holding steady at the mid-2.900 level and again seeing the post-crash highs, though one session alone isn’t enough to establish a trend, when this growing volatility trend extends as the market bounces then this will pose a significant major concern as to whether the momentum from March has turned corrective.

The support shifts to level 2854 momentarily, with a break beneath level 2800 nevertheless required to reestablish a bearish note again through support then seen at levels 2753/00 beyond level 2638 and then market-main support at level 2600.

Note: learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.