USDCAD Analysis – May 15

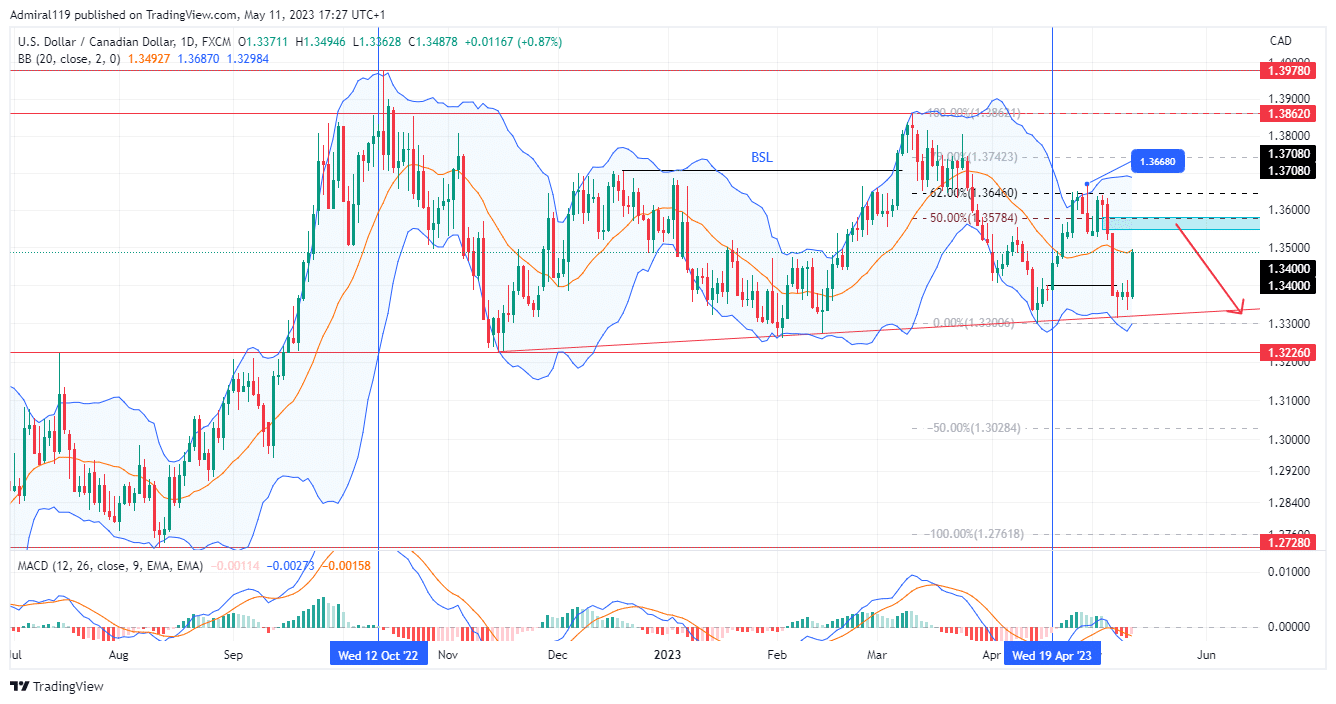

USDCAD surges upward after bouncing off the rising trendline five times. The market is in a phase of consolidation over a long horizon. For more than six months, the USDCAD price has been ranging between 1.386200 and 1.322600. However, the price continues to abide by a rising trendline, giving the impression that buyers are in control.

USDCAD Significant Zones

Demand Zones: 1.322600, 1.272800

Supply Zones: 1.386200, 1.397800

USDCAD Long-Term Trend: Ranging

The market was moving in a bullish direction before USDCAD setting to converge within the trading range. The price shot up into the trading range when the prior resistance at 1.322600 failed to hold. The price reversed after reaching the 1.272800 demand zone approximately six weeks before the invalidation. The sudden increase that followed the change in the market’s environment was caused by this. Till October 12, 2022, the MACD (Moving Average Convergence Divergence) was above the zero line. The supply zone of 1.397800 was reached at this time.

The reversal at the 1.397800 supply level marked the end of the explosive move as the buying pressure deteriorated. USDCAD headed downward to retest the 1.322600 price level, thereby confirming the significance of the level. A rising trendline emerged thereafter. The rising trendline has been successfully keeping prices from experiencing a massive decline since its emergence. Following the buy-side liquidity grab above the 1.370800 price level, the bears raided the market. However, the rising trendline appears to be resisting the selling pressure as the price bounced again for the fifth time.

USDCAD Short-Term Trend: Bearish

The 1.366800 and 1.331500 price levels make up the present trading range on the four-hour chart. The USDCAD appears to be in an upward retracement as it approaches the premium. Once the premium’s diagonal resistance is reached, the upward retracement is likely to come to a halt.

Do you want to take your trading to the next level? Join the best platform for that here

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.