Market Analysis – February 8

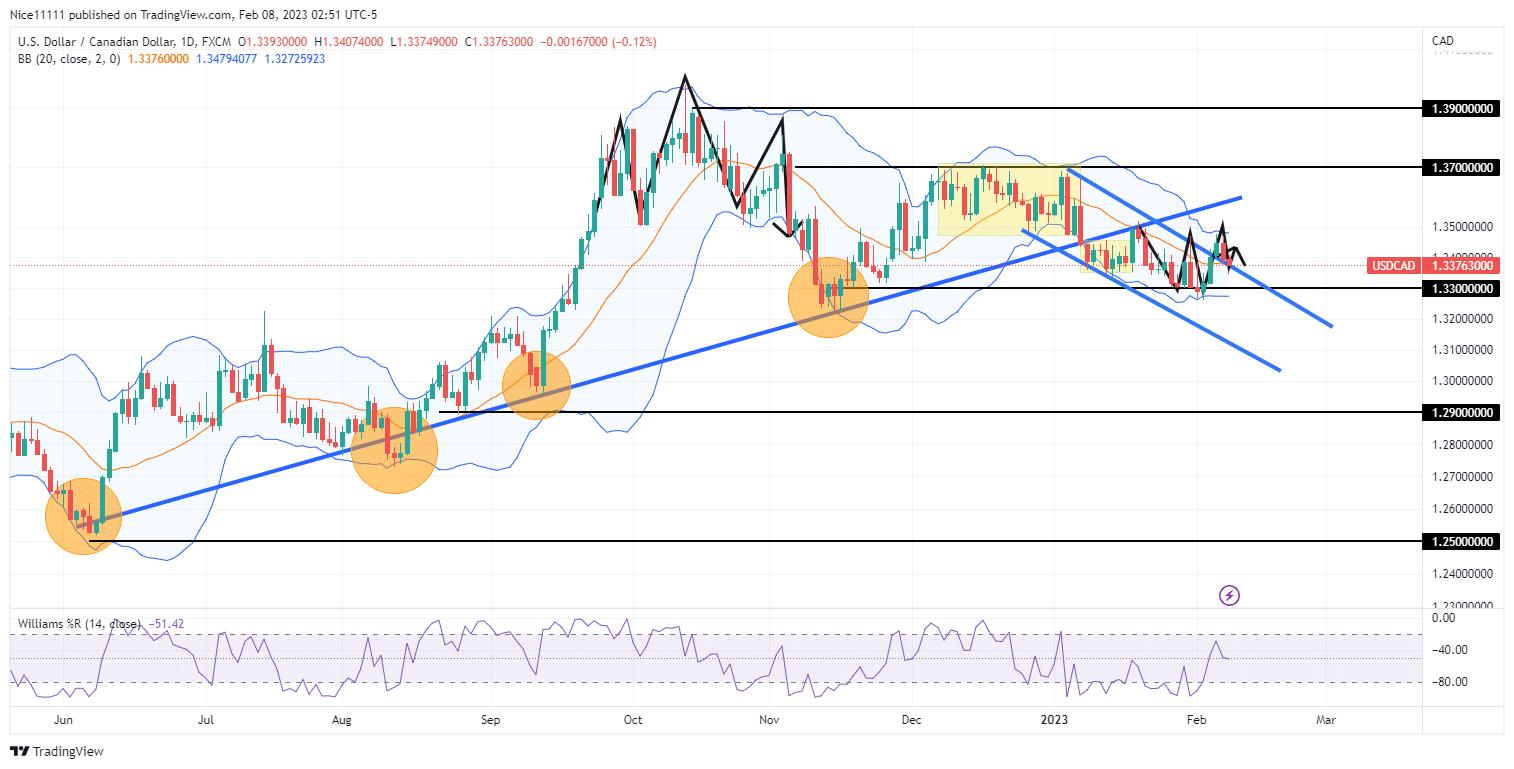

The USDCAD market ascended with the aid of the bullish trend line on the daily chart. The price ascended steadily till the market reached the peak price of the year at 1.390. The market has remained bearish since the formation of the head and shoulders pattern in October.

USDCAD Key Levels

Demand Levels: 1.330, 1.290, 1.250

Supply Levels: 1.370, 1.390, 1.400

USDCAD Long-term Trend: Bearish

USDCAD rose to the 1.390 supply level in October. The market posted a bearish structural shift after pressing on the upper band of the Bollinger. The resistance caused the price to plummet. The daily candles fell below the midline of the Bollinger Bands. A retracement back to the 1.390 supply level revealed the weakness of the buyers as the market failed to make a new high.

The bullish trendline was broken by the selling pressure. The price decline halted at the 1.330 demand zone. The new resistance trendline was able to keep the daily candles below it. The push above the bearish trendline seems to be a sign of a short-term bullish ride.

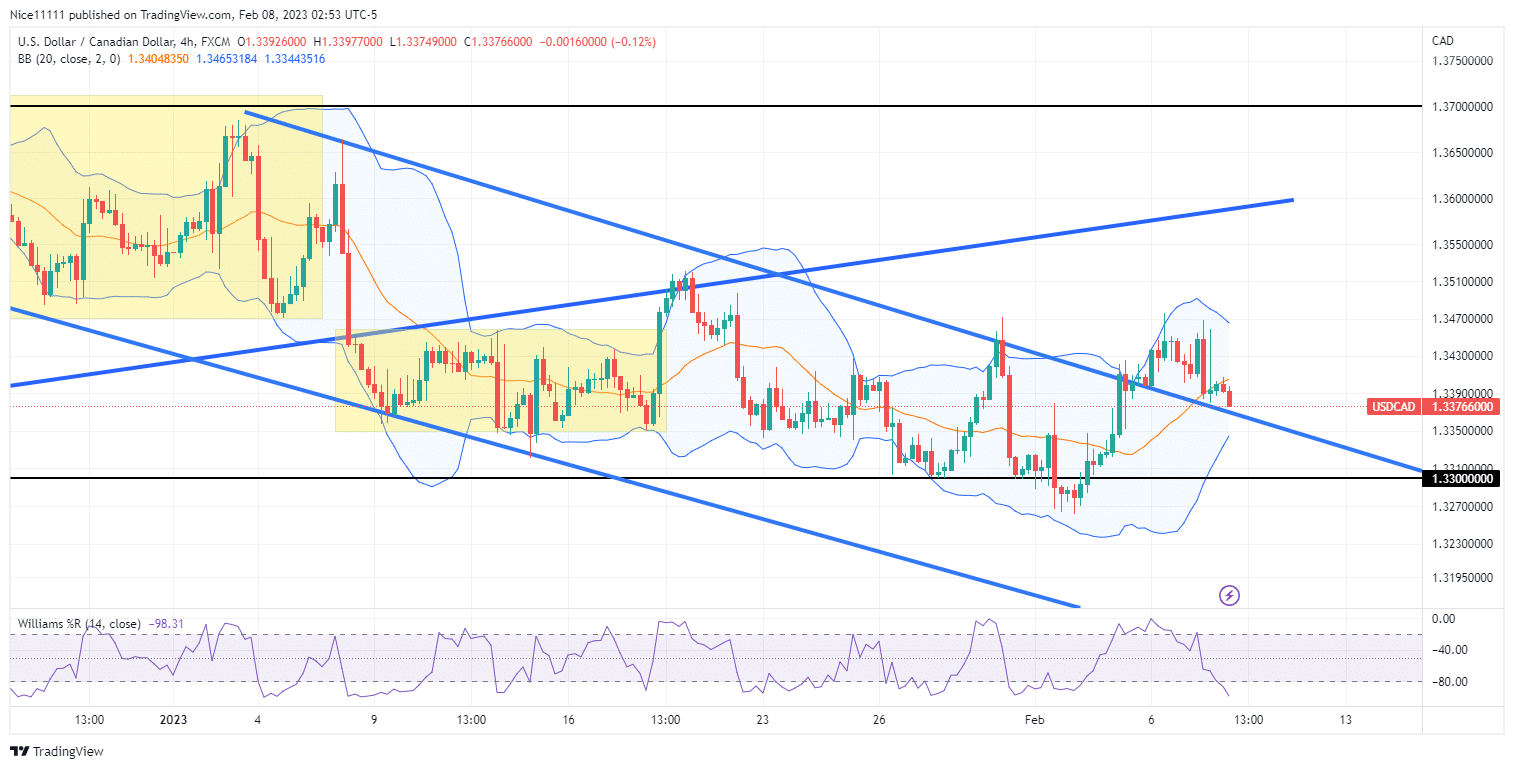

USDCAD Short-term Trend: Bullish

On the 4-hour chart, the market is oversold. The market is currently testing the downward-sloping trendline for support. The market is expected to crash to 1.290 if the bulls give way to the 1.330 support level.

Do you want to take your trading to the next level? Join the best platform for that here

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.