The USD/JPY exchange rate is poised for significant movements this week as the Federal Reserve and the Bank of Japan prepare for their respective monetary policy meetings. Market participants eagerly await clues regarding the direction of interest rates and inflation in the world’s two largest economies.

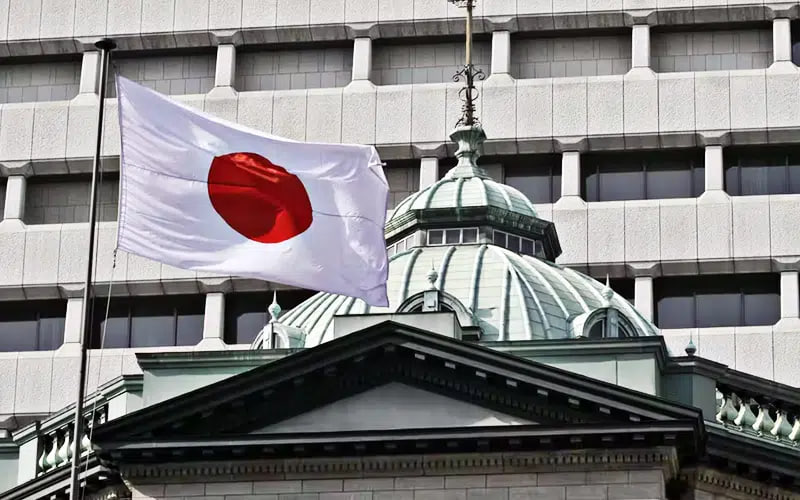

The Bank of Japan (BoJ) is set to convene today, with expectations leaning toward the maintenance of the -0.10% negative interest rate policy. Nevertheless, the market is vigilant, as the BoJ may surprise by adjusting its yield curve control program, which targets long-term bond yields around 1.0%. Should the BoJ allow bond yields to edge above this level, it could signal a subtle shift towards policy normalization, bolstering the yen.

On Wednesday, November 1, the Federal Reserve will take center stage. No alteration in the federal funds rate is anticipated after the four rate hikes earlier this year, bringing rates to a range of 5.25% to 5.50%. Attention will pivot to Fed Chair Jerome Powell’s press conference, where he will outline the monetary policy outlook.

If Powell hints at another rate hike in the near term, the dollar could surge against the yen as investors anticipate a higher terminal rate for the Fed’s tightening cycle. The robust U.S. economy and inflation surpassing the Fed’s 2% target make this scenario a possibility.

Conversely, if Powell adopts a more cautious tone, suggesting that the Fed has completed its rate hikes, the dollar may cede ground to the yen. Some Fed officials argue that the bond market is already tightening financial conditions by raising yields, potentially reducing the need for further policy action.

USD/JPY Traders: Brace for Impact

In any case, traders should prepare for turbulence in the USD/JPY pair next week, as both central banks hold the potential to spring market-altering surprises. Stay tuned for the latest developments and be ready to adapt to the shifting landscape of the currency market.

Interested in becoming a Learn2Trade Affiliate? Join us here

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.