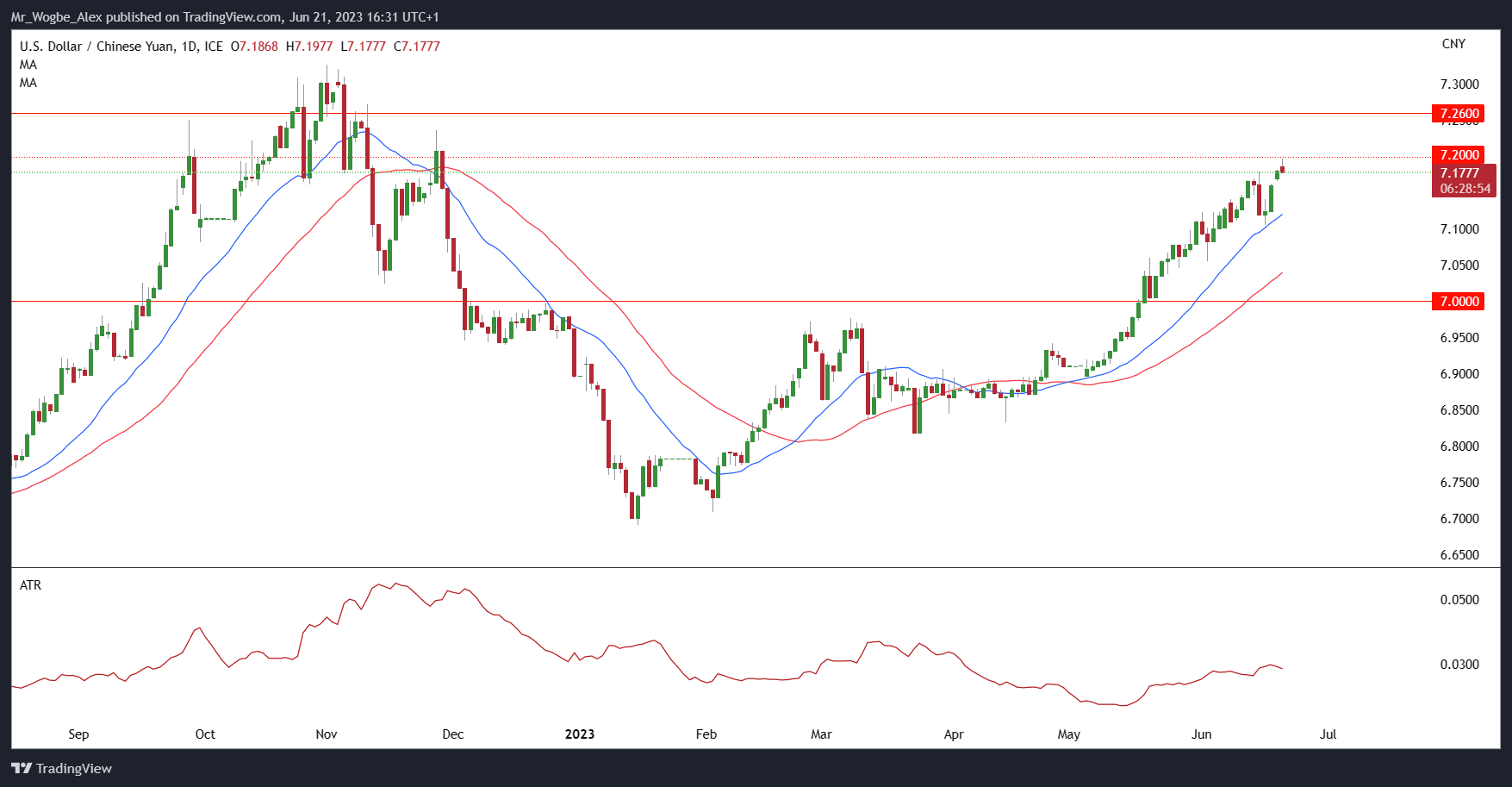

In the midst of fragile US-China relations, the exchange rate between the US dollar and the Chinese yuan (USD/CNY) encounters significant resistance at 7.2600. This resistance level follows a recent breach of the crucial 7.0000 mark by the pair. Despite the mixed performance of the US dollar, the bullish trend of USD/CNY remains supported by improving US-China interest rate differentials.

To bolster the economic recovery, the People’s Bank of China (PBoC) has taken a proactive step by easing benchmark borrowing rates. This move aims to encourage lending and provide support for the economy. While a single 10-basis point cut may not be sufficient to fully ignite economic activity, it serves as a promising indication of further actions to come.

The PBOC is also considering a reduction in the current reserve ratio requirement, which would inject additional capital into the system. The reserve ratio acts as a buffer by determining the minimum amount of commercial bank deposits required to be held with the central bank to meet potential increased withdrawals or external shocks.

USD/CNY Market Trends and Interest Rate Differentials

Despite fluctuations in the US dollar driven by inflation-sensitive news and data, the USD/CNY exchange rate has displayed a consistent upward trend since early February. Market struggles in pricing Federal Reserve rate hikes have contributed to a slowdown in US rate expectations.

However, the actual rates in China have declined, resulting in improved interest rate differentials between the two nations. This trend continues to support the bullish outlook for USD/CNY.

Outlook and Key Levels of Resistance

With USD/CNY currently testing the 7.2000 area following the breach of the significant 7.0000 mark, the next level of resistance stands at 7.2600. As US-China relations remain delicate and potential economic developments unfold, investors and market participants will closely monitor the exchange rate dynamics between the US dollar and the Chinese yuan.

You can purchase Lucky Block – Guide, Tips & Insights | Learn 2 Trade here. Buy LBLOCK

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.