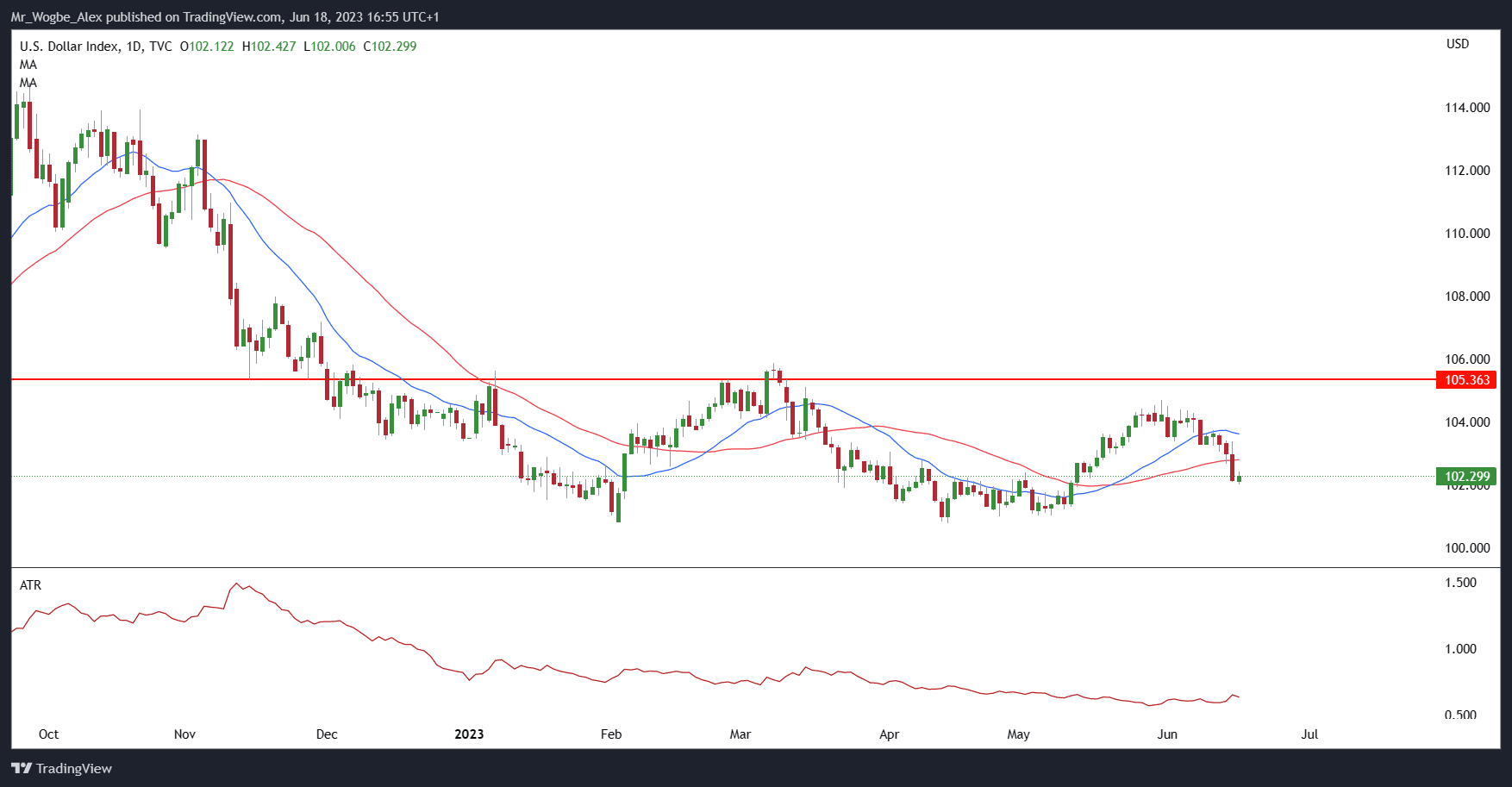

The US dollar index, known as the DXY index, has encountered significant challenges as it falls below a crucial support level, signaling a disconnect between the market and the US Federal Reserve’s hawkish stance on monetary policy.

During its recent meeting, the Federal Reserve opted to maintain interest rates at their current levels. However, they surprised the market with a more hawkish approach by projecting two additional rate hikes for 2023. This decision reflects the Fed’s concerns over the sluggish decline in inflation. Additionally, factors such as the economy’s resilience to tightening financial conditions, the recent increase in the US debt ceiling, and reduced risks in the banking sector may have influenced the Fed’s more assertive guidance.

Differing Perspectives: Fed vs. Market

While the Fed’s dot plot indicates the likelihood of two more rate hikes by the end of the year, the market remains skeptical, pricing in less than a 100% chance of a single rate hike in 2023 and even anticipating potential rate cuts as early as next year. Fed Chair Powell, however, emphasized that a rate cut would only occur once inflation had meaningfully and significantly decreased, which could take a couple of years.

The market’s dovish pricing is rooted in the belief that the Fed’s inflation forecasts have consistently underestimated realized inflation. Moreover, indicators such as producer price inflation and import prices already suggest a softening in economic activity. While Fed officials have raised their economic growth projections for 2023 and anticipate a slower decline in inflation, they still expect the core PCE price index to ease from the current 4.7% to 3.9% by the end of 2023, compared to the 3.6% on-year figure observed in March.

Is the US Dollar Index Heading to 101.50?

Last Friday, the US dollar index plunged to a 4-week low of around 102.00 before recovering mildly to 102.3. Dollar traders will be on the lookout to see how DXY starts the week in a few hours. That said, we could be looking at a possible bearish continuation towards the 101.50 low.

You can purchase Lucky Block – Guide, Tips & Insights | Learn 2 Trade here. Buy LBLOCK

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.