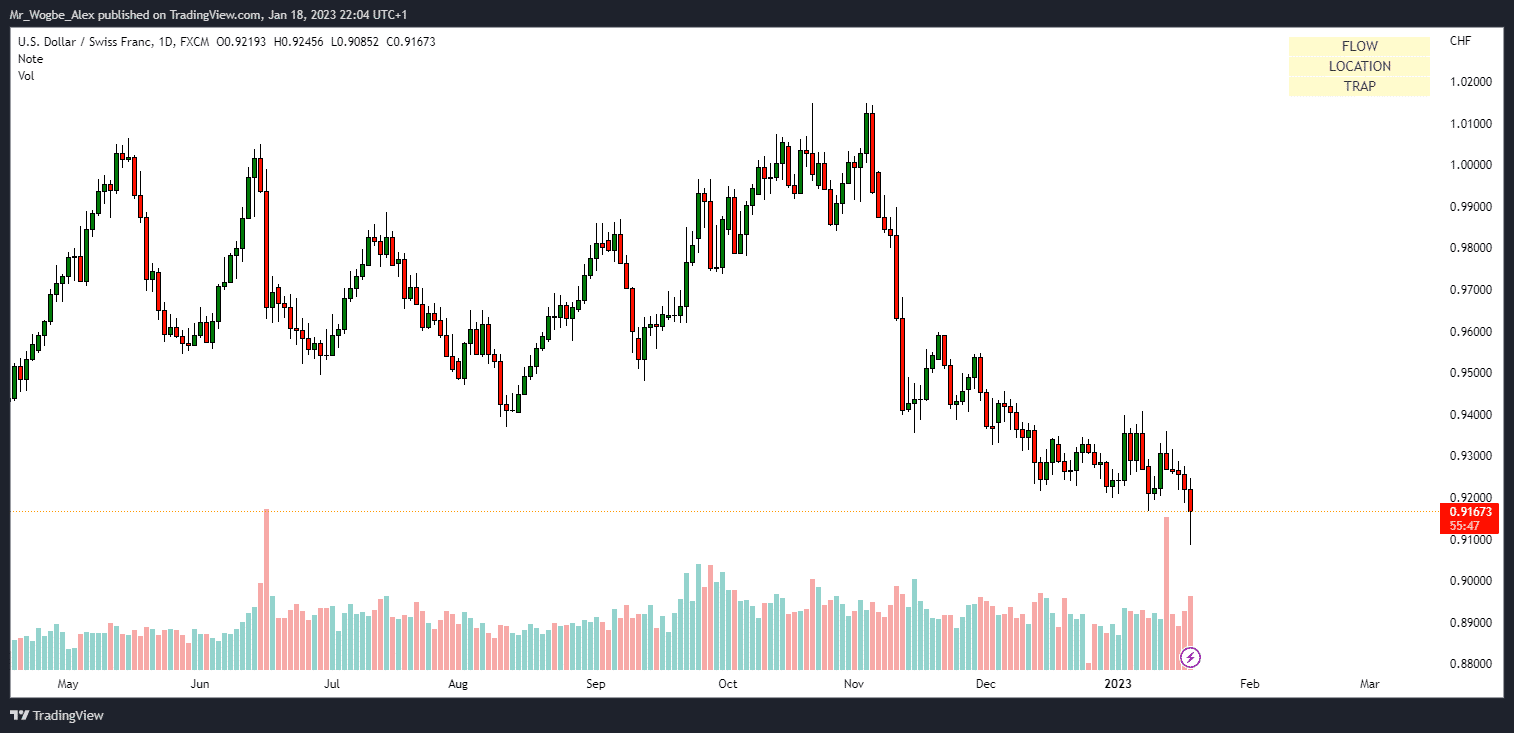

On Wednesday, the USD/CHF fell by about 100 pips after cutting some losses during the previous hour, although it has rebounded halfway at the time of writing. The pair hit its lowest point since November 2021 at 0.9084 before recovering and moving back above 0.9166.

The US dollar was weaker, while the Swiss franc was stronger due to falling European and US government bond yields. The US 10-year yield plummeted to 3.38%, the lowest level since September, and the Swiss 10-year bond yield decreased to 1.05%, the lowest level since early December.

USD/CHF Decline Fueled By US Economic Data

After data revealed a slowdown in inflation and some “not so bad” activity numbers, demand for European bonds increased. This was especially true after a media report on Tuesday that stated policymakers at the European Central Bank (ECB) were beginning to consider a slower pace of interest rate increases after the February meeting.

The euro fell as a result of expectations for a less hawkish ECB, and it is still a hindrance. The EUR/CHF exchange rate has dropped significantly, reversing from six-month highs near 1.0100 to values under 0.9900.

The publication of economic data on Wednesday made USD/CHF even more volatile. While Retail Sales and Industrial Production decreased more than expected, inflation data came in below estimates.

Dollar Weak Across Board

In other news, the USD/CAD is heading in the direction of 1.3400 as the US Dollar pares back some of its recent losses that came as a result of the publication of US economic data. Despite the dollar’s decline, which was supported by Canadian data, the pair maintained its daily highs.

On Wednesday, Canada’s inflation data fell short of forecasts. The Industrial Product Price Index (IPPI) fell 1.1% from one month to the next, less than the market consensus decrease of 0.3%. It increased by 7.6% from the same time last year. In December, the Raw Materials Price Index (RMPI) declined 3.1% vs. forecasts for a 1.3% decline.

You can purchase Lucky Block – Guide, Tips & Insights | Learn 2 Trade here. Buy LBLOCK

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.