Market Analysis – December 10

The landscape of North American currency markets is experiencing a seismic shift. The USD/CAD pair, once characterized by tight correlation to oil prices and synchronized central bank moves, is in sharp decline, marking a forceful rejection of previous highs and signalling a potent shift in macroeconomic fundamentals.

The prevailing downtrend is driven by a powerful decoupling of monetary policy expectations. While a dovish U.S. Federal Reserve appears poised to initiate interest rate cuts amidst a cooling domestic economy, the Bank of Canada, guided by recent resilient GDP data and sticky inflation, has adopted a surprisingly steadfast stance.

As interest rate differentials narrow in the Canadian Dollar’s favour, the “Loonie” is gaining significant strength. The market is now positioning for a more hawkish Bank of Canada relative to the U.S. Federal Reserve, setting the stage for what could be a sustained period of Canadian dollar dominance.

USD/CAD Key Levels

Demand Levels: 1.3800, 1.3700, 1.3600

Supply Levels: 1.40000, 1.41000, 1.42000

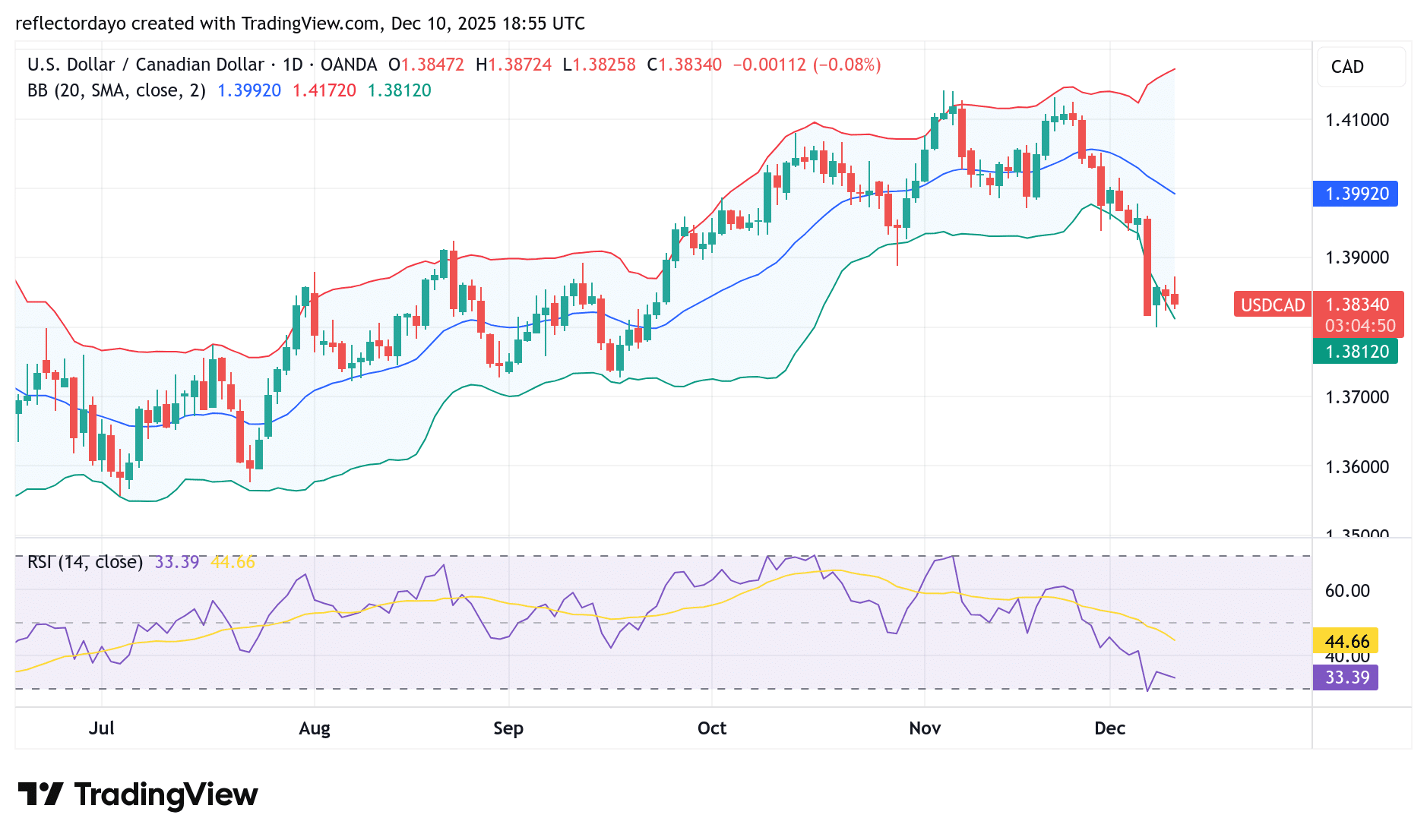

USD/CAD Bear Market Finds Support at 1.38000

The bearish breakdown anticipated in our last analysis of the USD/CAD pair certainly materialized, pushing the price significantly lower. However, expectations for a rebound at the 1.3900 price level did not hold true. The downward momentum carried the pair further, stalling decisively as it approached the 1.38000 support zone.

As the market closed last week, price action consolidated near the 1.38000 psychological and technical support level. Persistent downside attempts have been met with strong rejection at this floor, suggesting an exhaustion of immediate bearish pressure.

The current technical indicators support a potential near-term reversal:

Oversold Conditions: Both the Bollinger Bands and the Relative Strength Index (RSI) are flashing clear oversold signals, indicating that the recent pace of selling may be unsustainable.

Rebound Potential: These oversold readings often precede a bullish correction or rebound as investors reassess the market bias.

The USD/CAD pair is now at a critical juncture. While the fundamental bias remains tilted toward CAD strength in the medium term, the immediate technical picture suggests we may witness a bullish recovery in the short term, provided the 1.38000 support holds firm.

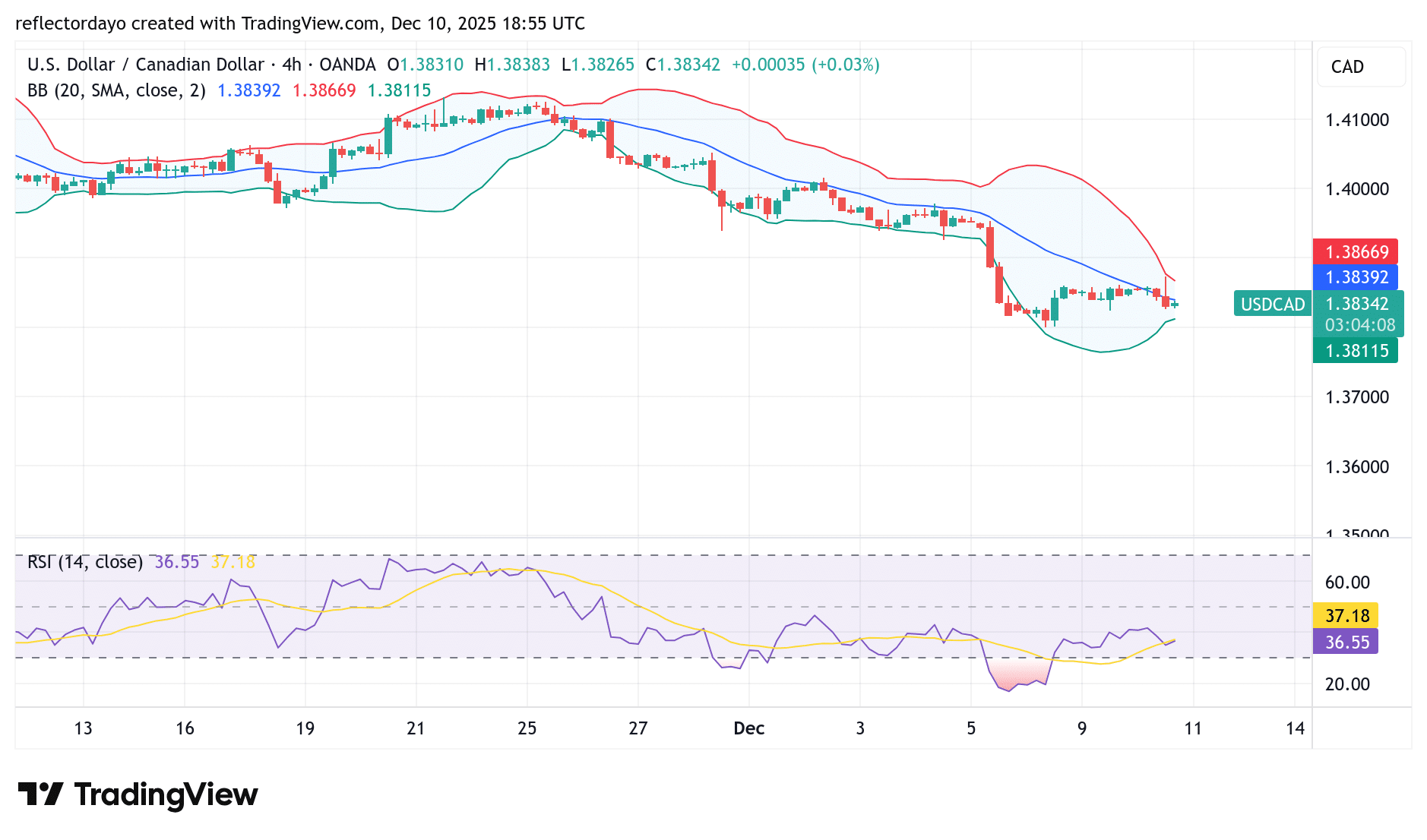

USD/CAD Short-Term Trend: Bullish Bias Emerges

Analysis of the smaller timeframes reveals the early stages of a significant volatility squeeze developing within the USD/CAD pair. We are observing the once wide-banded Bollinger Bands converging tightly around a horizontally moving price channel.

This technical consolidation sends a clear message to traders and investors: the market is coiling, preparing for a potential sharp directional move.

The current technical setup suggests an imminent short-term bullish reversal. The combination of price consolidation near key support and contracting volatility increases the probability of an upward breakout. If bullish momentum takes hold, we anticipate a potential surge in price targeting the 1.4000 price level as the immediate technical objective.

Make money without lifting your fingers: Start using a world-class auto trading solution.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.