US30 Analysis – December 16

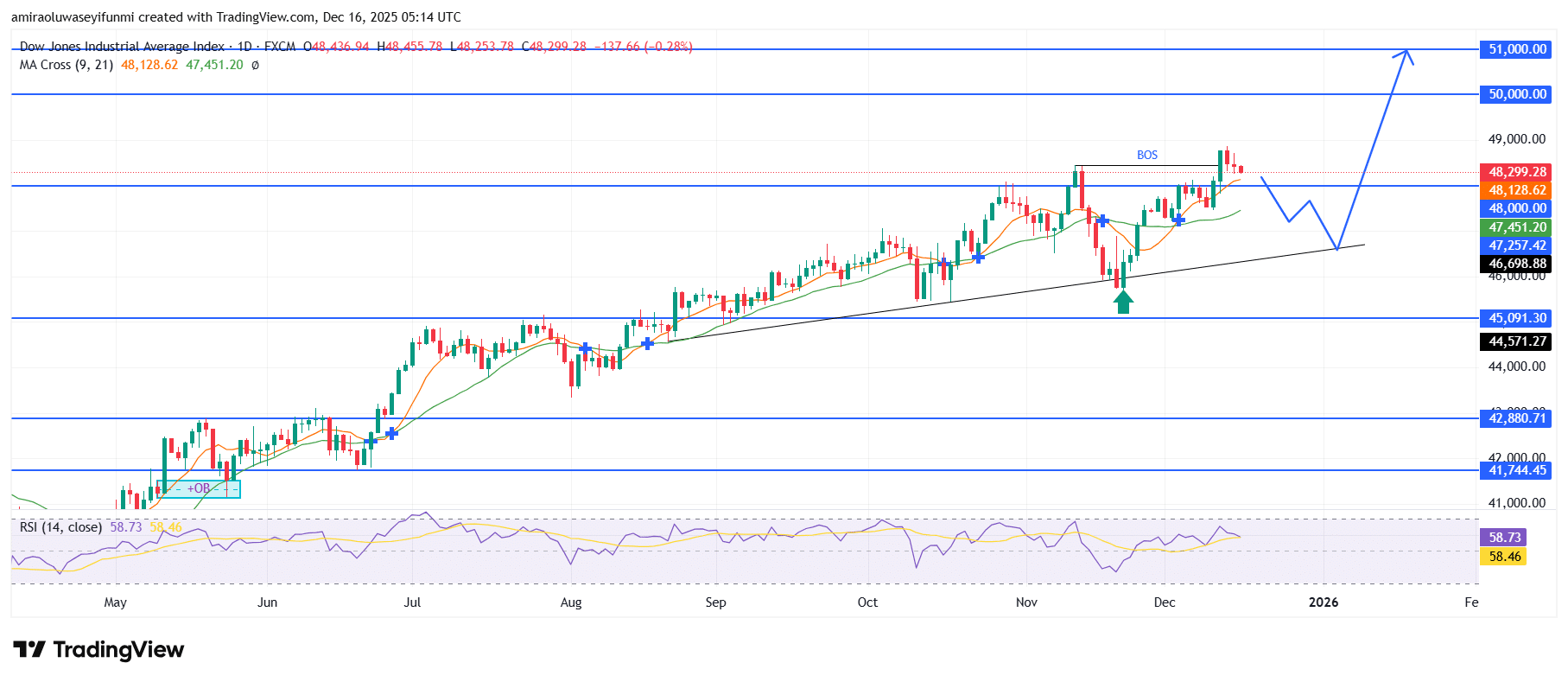

US30 sustains upward bias as trend conditions remain constructive. US30 remains positioned within a favourable upward phase, with price holding steadily above the rising 9-day and 21-day moving averages near $48,130 and $47,450. The positive slope and clear separation of these averages above broader trend support levels underline sustained bullish commitment and trend resilience. Momentum readings remain balanced yet constructive, with the RSI hovering around 59, signalling underlying strength without immediate signs of exhaustion.

US30 Key Levels

Resistance Levels: $48000, $50000, $51000

Support Levels: $45090, $42880, $41740

US30 Long-Term Trend: Bullish

From a technical perspective, the index continues to defend a sequence of higher swing lows aligned with the ascending support base originating near $45,090, preserving the integrity of the broader bullish structure. The successful break and hold above the former ceiling in the $48,000–$48,100 zone, followed by consolidation above this area, suggest acceptance at higher valuation levels rather than rejection. Shallow pullbacks into the $47,450–$47,500 region have consistently attracted buying interest, reinforcing the presence of dip-led demand.

Looking ahead, sustained trade above $48,000 keeps the route open toward the $50,000 psychological level, with additional upside potential extending into the $50,800–$51,000 region if momentum continues to strengthen. Any corrective movement is likely to remain contained within the $47,500 to $46,700 band, where structural and historical demand converge. Overall, price behaviour continues to favour trend continuation, with short-term setbacks viewed as corrective pauses within a dominant bullish phase, supported by broader forex signals.

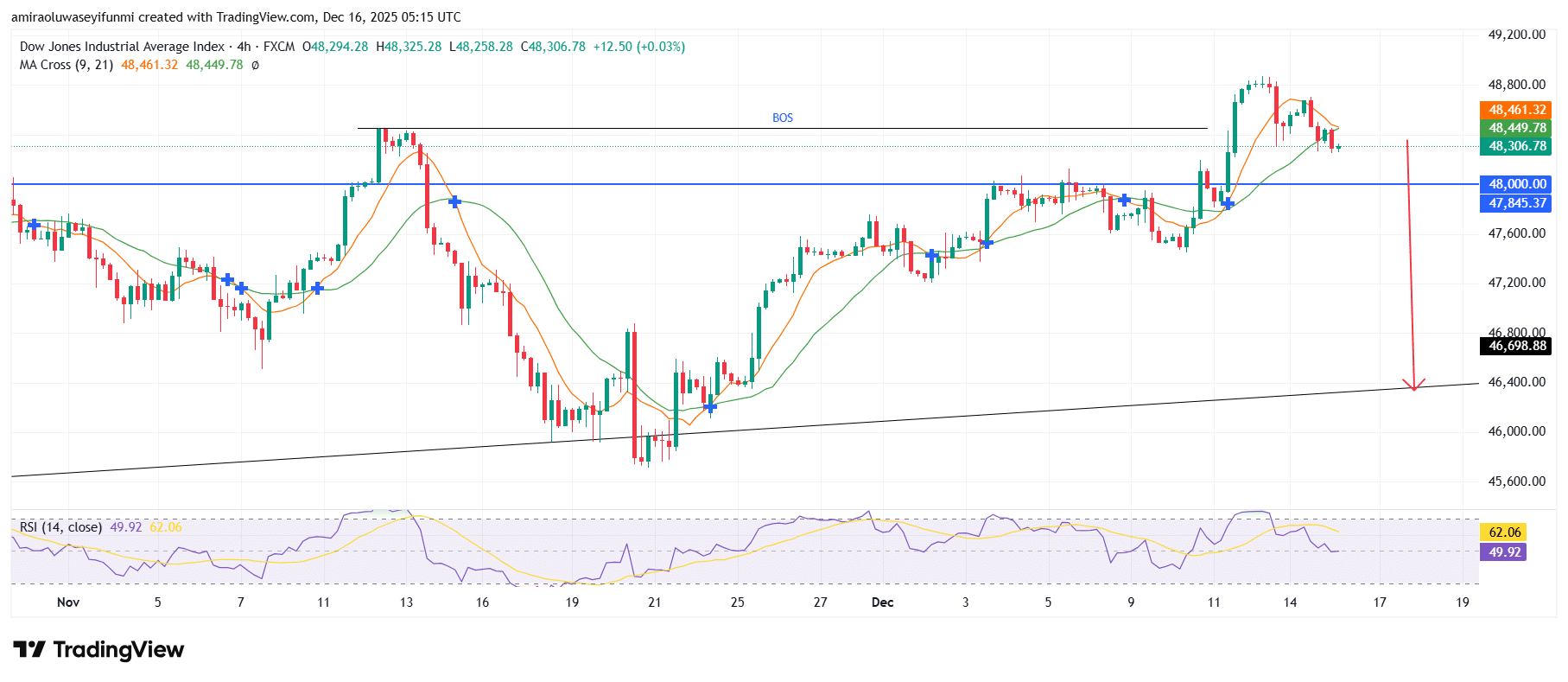

US30 Short-Term Trend: Bearish

US30 is showing early signs of bearish rotation on the four-hour chart as price struggles to maintain acceptance above the $48,300–$48,400 region. Short-term moving averages are flattening and beginning to turn lower, indicating fading upside momentum following the recent advance.

Price action has failed to sustain gains above prior structure near $48,000, increasing the probability of a deeper corrective phase. A downside extension toward the ascending trendline around $46,700–$46,400 remains technically favoured if selling pressure intensifies.

Make money without lifting your fingers: Start using a world-class auto trading solution

How To Buy Lucky Block

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset, product, or event. We are not responsible for your investment results.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.