US30 Analysis – December 9

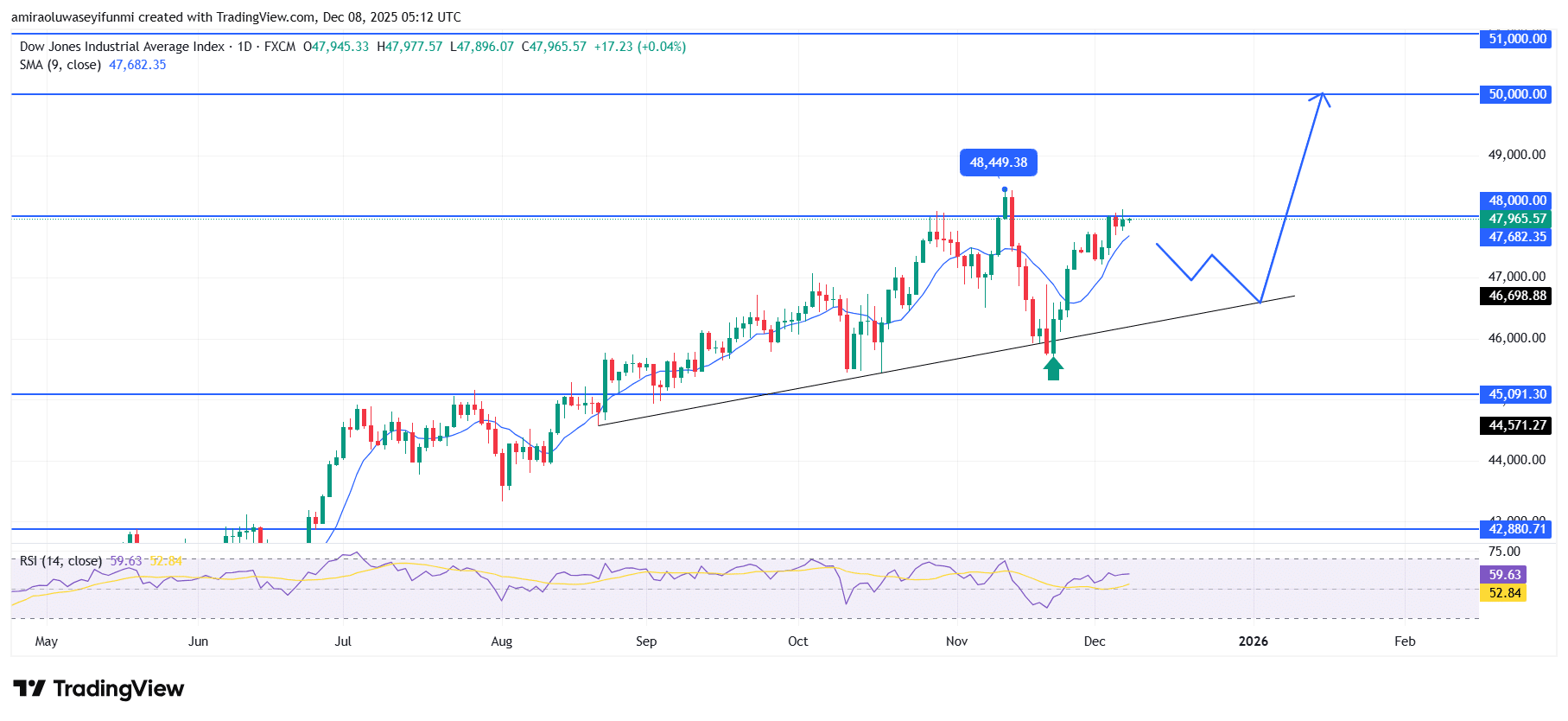

US30 upholds uptrend as momentum strength continues to support buyers. The index maintains a broadly upward stance on the daily timeframe, with price holding well above the short-term average around $47,680. Momentum remains stable, supported by an RSI reading comfortably above the midpoint, showing continued buyer commitment and a consistent upward rhythm. This alignment between moving-average support and steady momentum reinforces the prevailing appetite for risk assets.

US30 Key Levels

Resistance Levels: $48000, $50000, $51000

Support Levels: $45090, $42880, $41740

US30 Long-Term Trend: Bullish

Structurally, the index has reclaimed control of the $48,000 region after a clean rebound from the long-standing ascending trendline guiding price behaviour since late summer. The earlier lift from the $46,700 demand area confirms the strength of this structural support, while repeated higher-low formations highlight sustained accumulation. Price is currently pausing just beneath a minor resistance shelf, giving traders room to assess the strength of the next potential leg while the market remains positioned above key liquidity zones.

Looking ahead, US30 appears set to stretch toward the $50,000 region, a zone of both technical and psychological importance. A measured pullback into the $47,000–$47,200 range could provide a reset before buyers attempt to drive continuation. If the current order-flow dynamics remain steady, an extension toward the $51,000 resistance level becomes increasingly achievable as the market moves into early 2026.

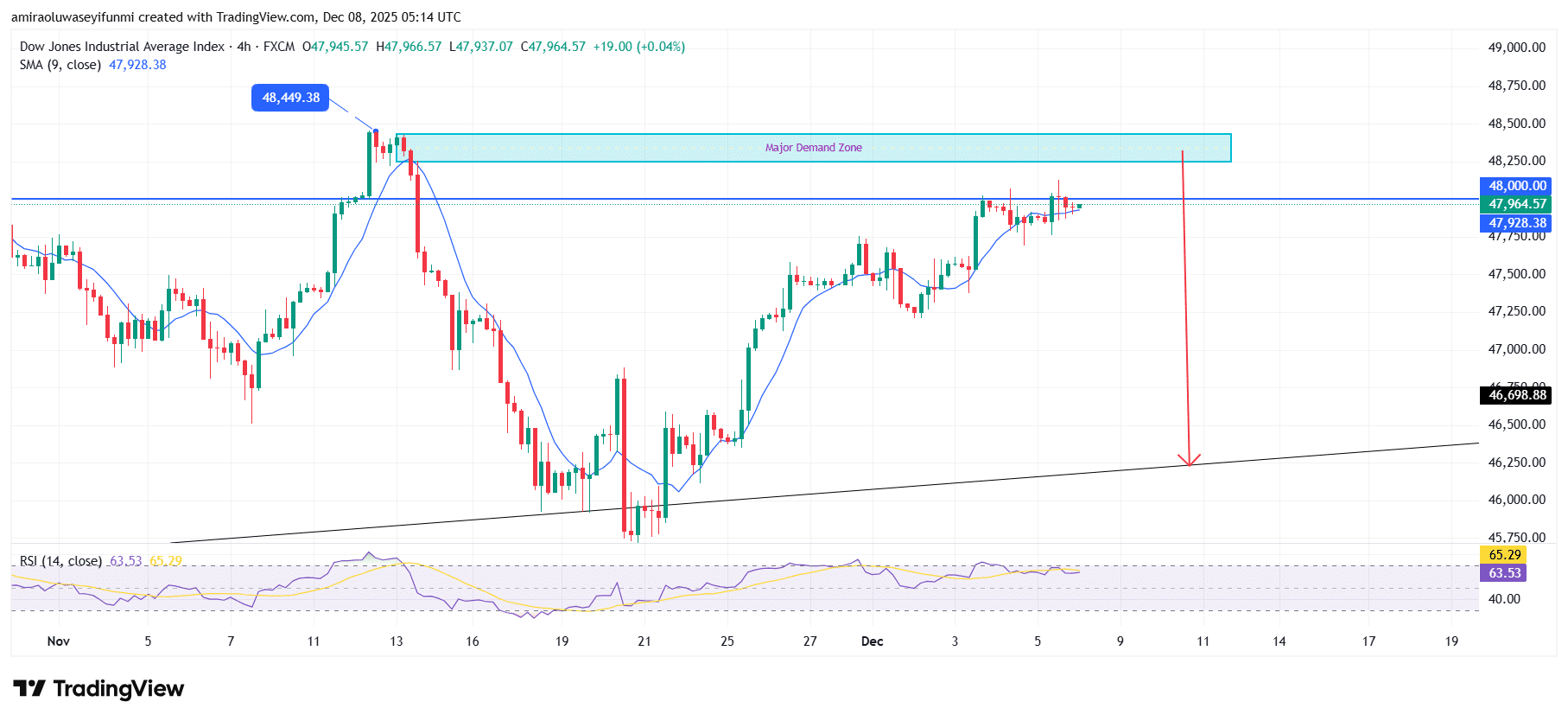

US30 Short-Term Trend: Bearish

US30 is beginning to show early signs of downside rotation on the four-hour chart as price struggles to maintain momentum near the $48,000 resistance area. Repeated rejection from the $48,200–$48,400 supply zone indicates fading buyer strength, even with RSI holding above midline levels. A break below the short-term SMA near $47,930 would confirm a shift toward corrective pressure and open the door for a deeper move lower. If downside continuation unfolds, price may slide toward the ascending trendline support around $46,700, a level closely watched by traders following forex signals.

Make money without lifting your fingers: Start using a world-class auto trading solution

How To Buy Lucky Block

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset, product, or event. We are not responsible for your investment results.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.