US30 Analysis – August 5

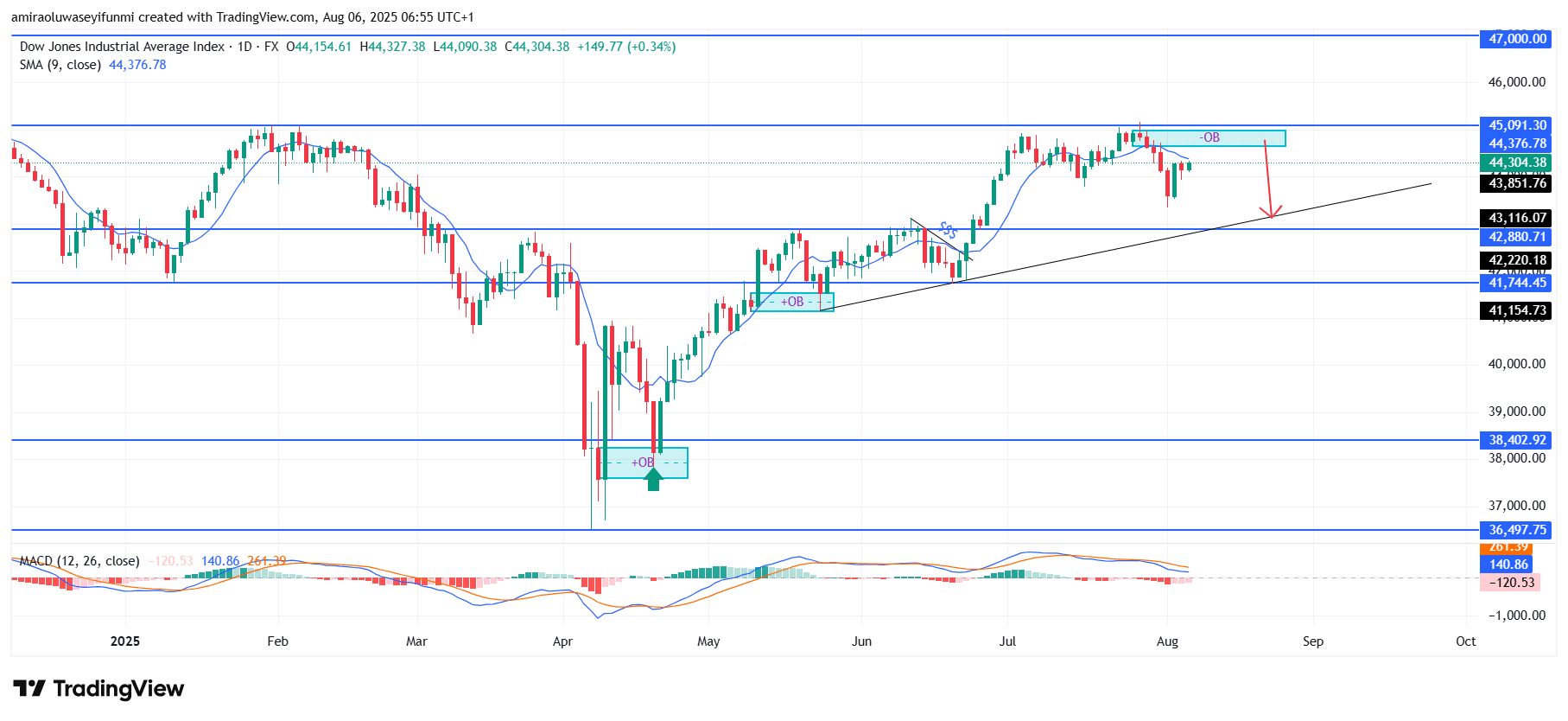

US30 is showing clear signs of resistance rejection amid a growing vulnerability along the trendline. The index has recently exhibited weakening bullish momentum, with price action struggling to break above the $45,100 resistance zone.

The MACD (Moving Average Convergence Divergence) histogram reflects a decline in bullish volume, while the signal line tilts downward, pointing to a potential shift in short-term sentiment. Price is also trading below the 9-day Simple Moving Average (SMA), which could act as dynamic resistance in the upcoming sessions. These developments suggest that bullish control is losing strength, raising the likelihood of corrective price action.

US30 Key Levels

Resistance Levels: $45,100, $47,000, $48,000

Support Levels: $42,880, $41,740, $38,400

US30 Long-Term Trend: Bearish

Structurally, the price faced firm rejection within a bearish order block between $44,800 and $45,100, which has functioned as a distribution zone. While earlier bullish order blocks at lower levels fueled upward rallies, this rejection zone aligns with a supply region. The response from this area suggests institutional profit-taking or a shift toward risk-off sentiment near previous highs. The inability to set a new high, combined with weakening MACD momentum, strengthens the case for a bearish continuation.

Given this confluence, the index appears set for a retracement toward lower support levels. The first target lies near the trendline support, followed closely by the horizontal demand zone at $42,880. A decisive break below these supports could lead to a deeper move toward the next structural pivot at $41,740. Unless price reclaims and closes above $45,100 with strong volume, US30 is likely to maintain its short-term bearish direction. Traders following forex signals may also find these levels significant for assessing broader market sentiment.

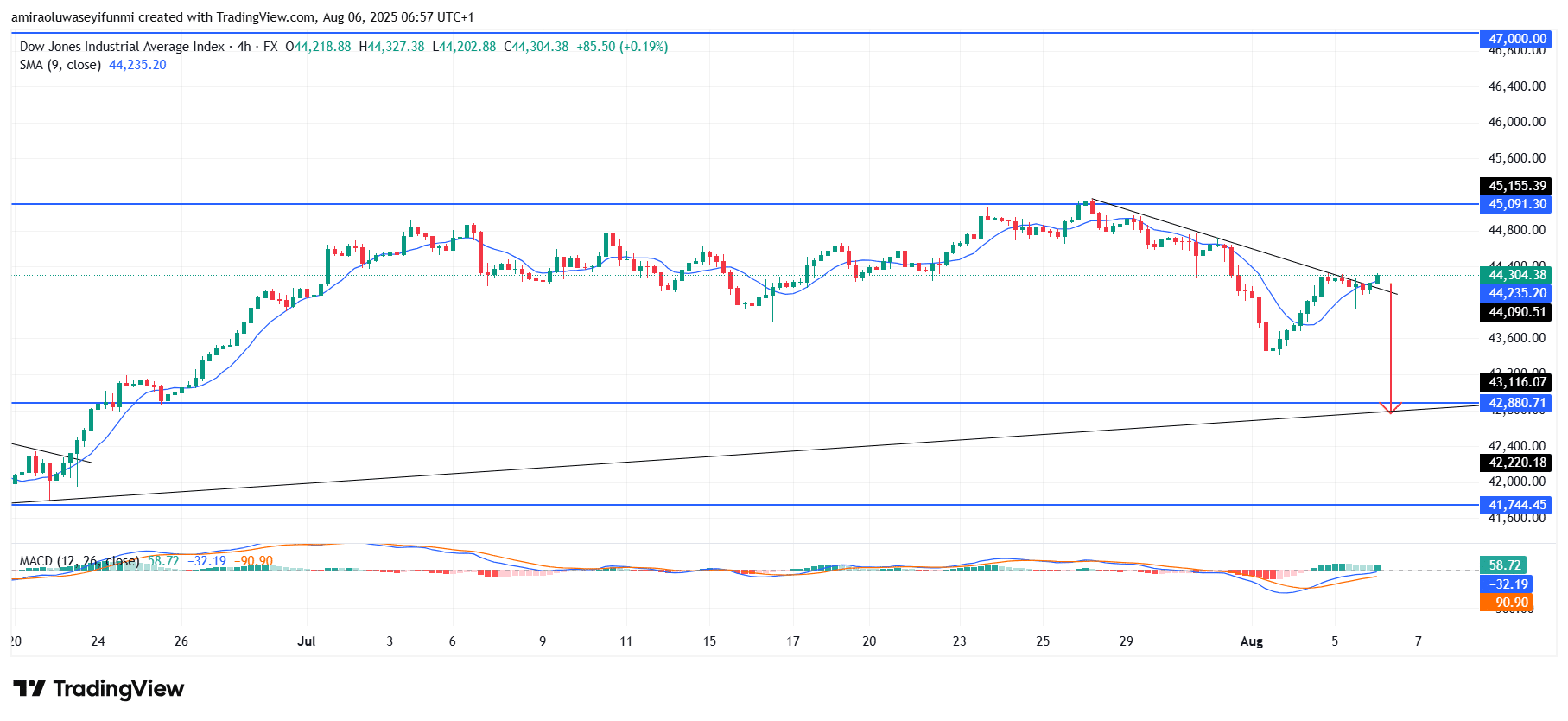

US30 Short-Term Trend: Bearish

In the short term, US30 continues to face resistance at the descending trendline, failing to break higher. Price remains below the 9-period SMA, indicating sustained downside momentum.

The MACD stays in bearish territory despite recent minor gains. A further breakdown could send the index toward the $42,880 support zone in the near term.

Make money without lifting your fingers: Start using a world-class auto trading solution

How To Buy Lucky Block – Guide, Tips & Insights | Learn 2 Trade

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset, product, or event. We are not responsible for your investment results.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.