US30 Analysis – June 24

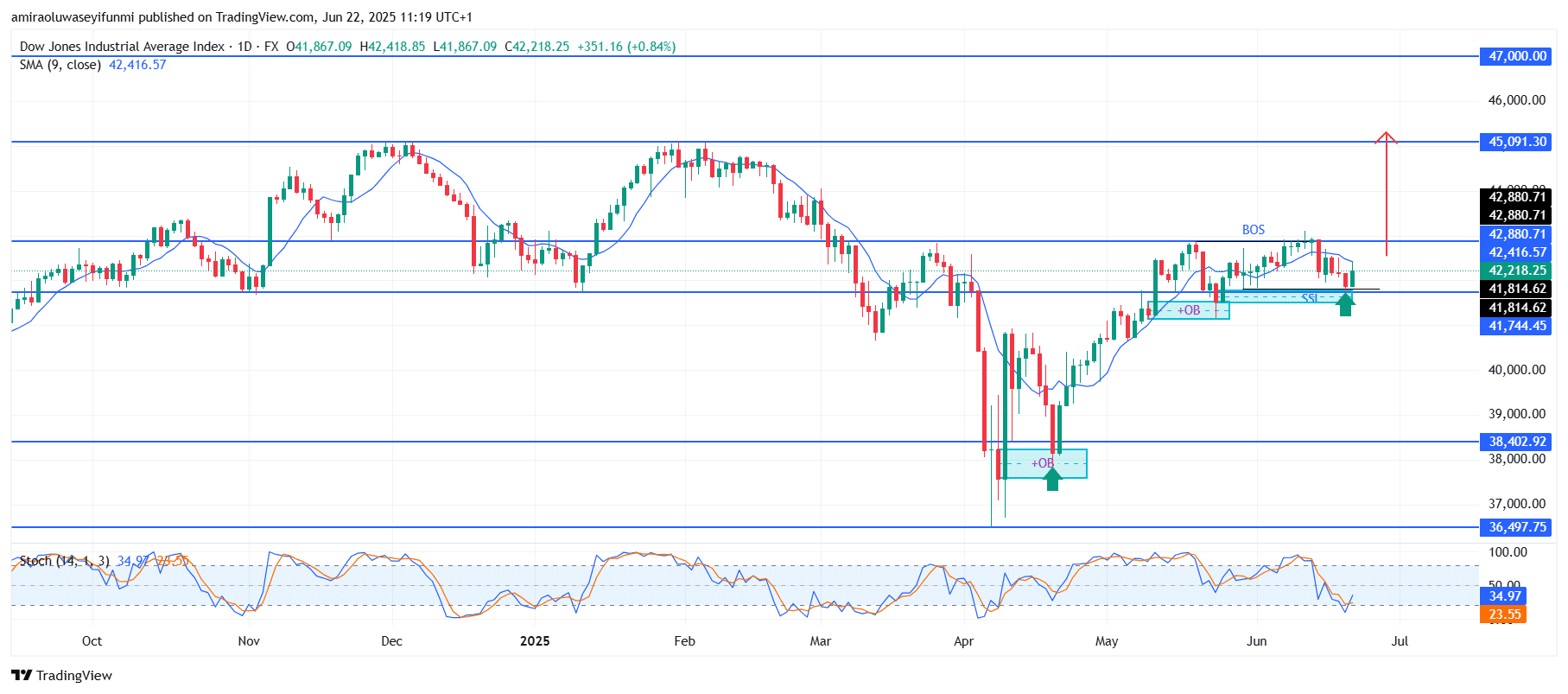

US30 is seeking renewed momentum after reclaiming key support levels. The index has regained a bullish posture following a rebound from the $41,740 demand zone, aligning positively with both the 9-day Simple Moving Average (SMA) and the Stochastic Oscillator. The SMA at $42,420 now acts as dynamic support, with the price trading slightly above it—an indication of renewed buyer interest. The Stochastic Oscillator, which previously dipped into oversold territory near 23, is curving upwards toward 35, suggesting a possible shift in momentum favoring the bulls. This confluence of indicators supports a technically driven resumption of upward movement.

US30 Key Levels

Resistance Levels: $42,880, $45,100, $47,000

Support Levels: $41,740, $40,000, $38,400, $36,500

US30 Long-Term Trend: Bullish

Recently, the price executed a clean sweep of the short-term liquidity pool just below $41,810 before sharply rejecting that zone, validating it as an order block region. This move respects the bullish break-of-structure (BOS) established in May, reinforcing the prevailing bullish trend. Additionally, the latest candle formation reveals a clear bullish engulfing setup near the demand area, highlighting strong institutional interest and a likely transition from distribution to accumulation. This behavior affirms the intention to push higher, with $42,880 as the immediate resistance.

Looking ahead, as long as the price holds above the $41,740 support level, US30 remains positioned to move toward the next major resistance at $45,100. If this level is broken with notable volume and momentum, it could pave the way for a retest of the all-time high near $47,000. In the short to medium term, a pullback toward $42,200 may offer a strategic re-entry opportunity for buyers aiming to capitalize on the broader bullish continuation.

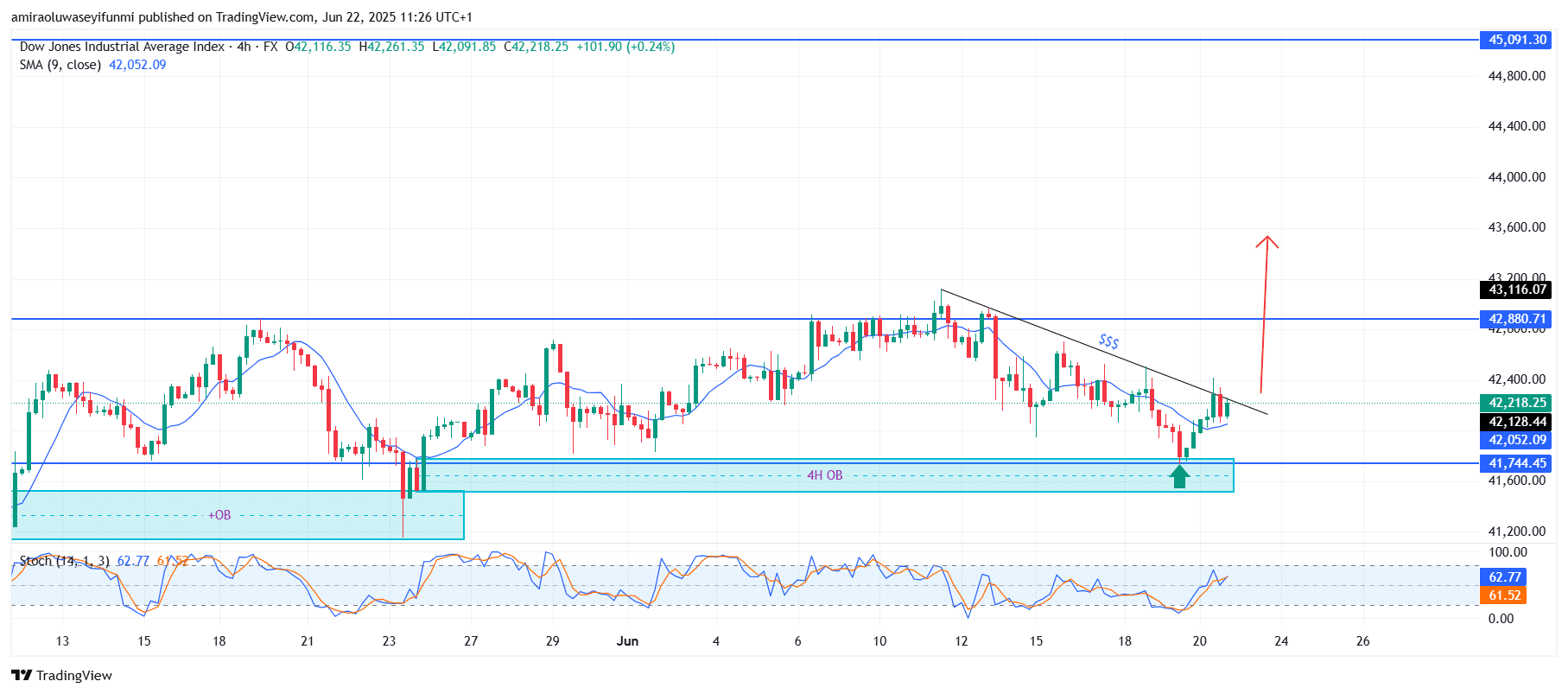

US30 Short-Term Trend: Bullish

US30 is displaying bullish momentum after a strong rebound from the 4H order block zone around 41,740. The price has broken above the descending trendline and is now trading above the 9-period SMA, indicating a potential structural shift. The Stochastic Oscillator is now crossing above the 60 level, reinforcing the bullish outlook. If buyers maintain control, the next target is around the 42,880 resistance zone, making this a key area to monitor for informed forex signals.

Make money without lifting your fingers: Start using a world-class auto trading solution

How To Buy Lucky Block – Guide, Tips & Insights | Learn 2 Trade

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset, product, or event. We are not responsible for your investment results.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.