US30 Analysis – June 17

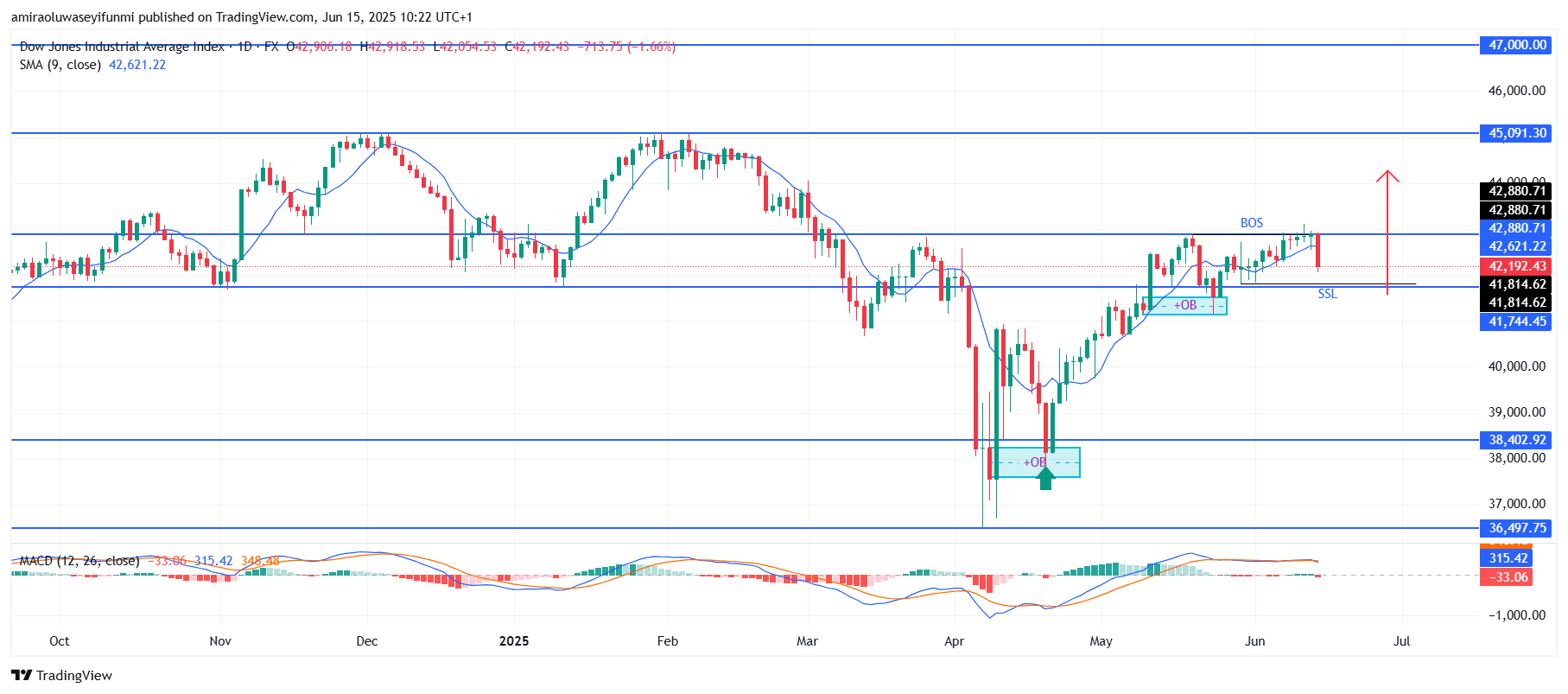

US30 is setting up for further upward movement as a bullish structure continues to form. The index maintains a bullish outlook, trading above the 9-day Simple Moving Average (SMA), currently positioned around $42,620. Supporting this bias, the MACD remains in positive territory, with its signal line flattening but still above the zero level, indicating consolidation within a broader uptrend. Despite a recent pullback, market sentiment stays positive, fueled by higher lows and consistent closes above key dynamic support levels.

US30 Key Levels

Resistance Levels: $42,880, $45,100, $47,000

Support Levels: $41,740, $40,000, $38,400, $36,500

US30 Long-Term Trend: Bullish

From a technical perspective, the price recently broke structure (BOS) near $42,880 and retraced to retest the demand zone between $41,810 and $41,740. This pullback, accompanied by a sweep of the short-term swing low, reflects a typical liquidity grab that often precedes bullish continuation. The previous strong reaction around the $38,400 order block triggered a decisive rally, further confirming the prevailing higher timeframe bullish trend. The strong rejection from lower levels signals that buyers are actively defending key support areas, keeping the order flow aligned with the bullish narrative.

Going forward, US30 is positioned to continue its ascent toward the next significant resistance at $42,880, with $47,000 as the extended target if bullish momentum gains traction. Reclaiming the $42,880 level on strong volume would offer additional confirmation of the bullish scenario. Should the price experience deeper retracement, the $41,740 level remains a key invalidation point—holding above it preserves the bullish market structure. This scenario offers insight for traders using forex signals to monitor price behavior at key inflection points.

US30 Short-Term Trend: Bullish

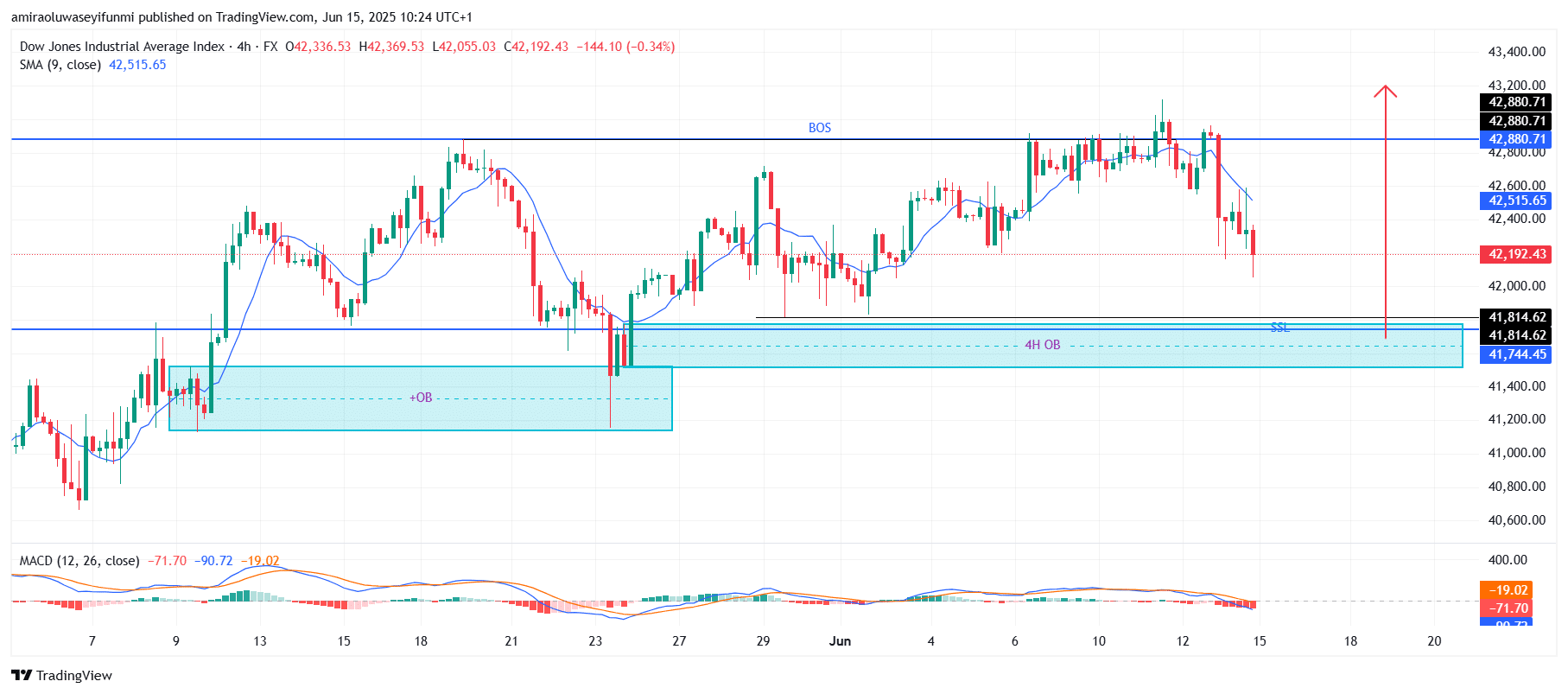

US30 is nearing a 4H demand zone between $41,740 and $41,810, an area that previously sparked bullish momentum. The recent dip below the 9-period SMA indicates short-term weakness.

While the MACD remains bearish, the histogram is beginning to show signs of declining negative momentum, hinting at a possible reversal. If the price finds support within the demand zone, a bullish bounce toward the $42,880 resistance level is anticipated.

Make money without lifting your fingers: Start using a world-class auto trading solution

How To Buy Lucky Block – Guide, Tips & Insights | Learn 2 Trade

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset, product, or event. We are not responsible for your investment results.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.