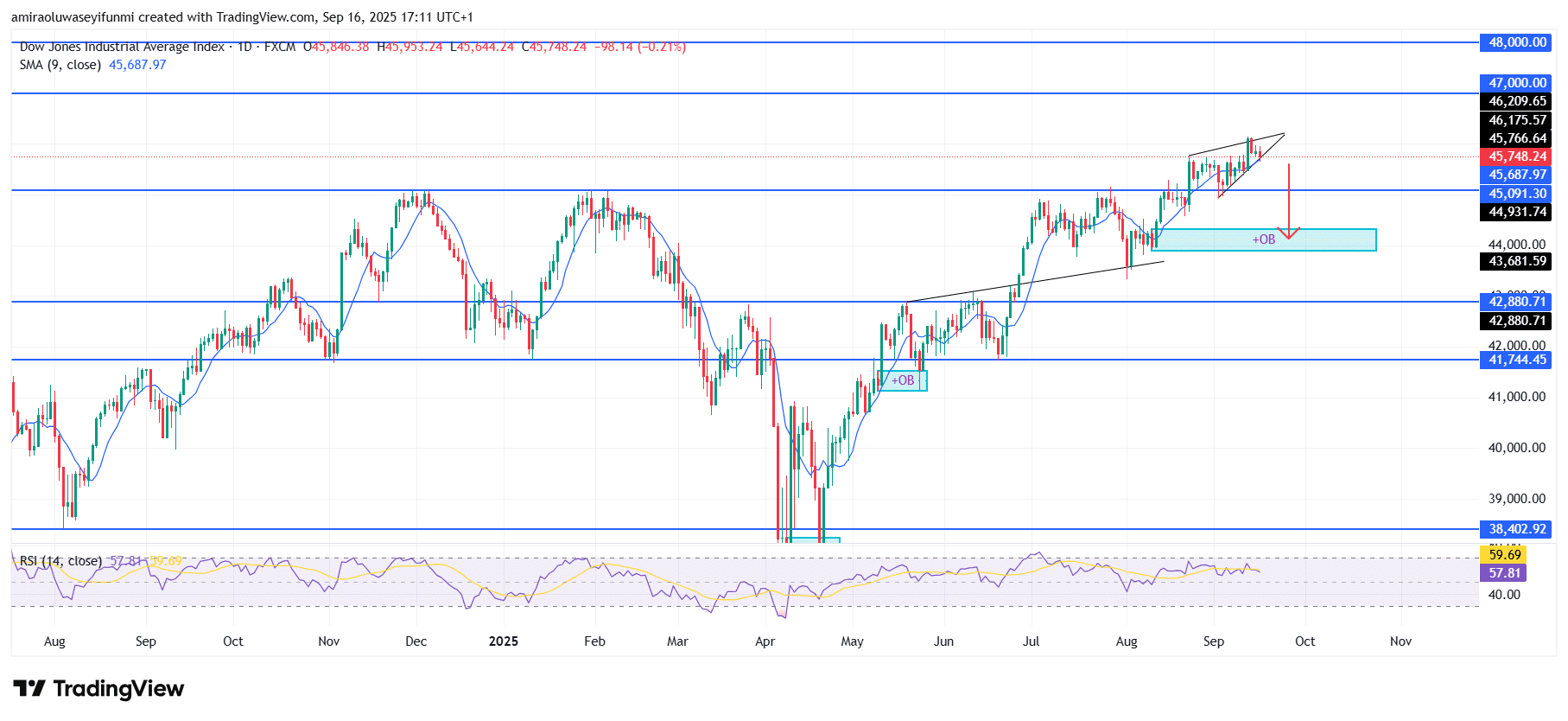

US30 Analysis – September 16

US30 faces a short-term correction amid broader uptrend resilience. The index recently showed signs of exhaustion after a sustained bullish rally, with price consolidating just below resistance at $46,210. The RSI, currently around 59, signals fading momentum but not yet an overbought condition. Meanwhile, the 9-day SMA at $45,688 offers immediate dynamic support, suggesting the market is in a transitional phase rather than a complete reversal. This setup supports the likelihood of a corrective pullback in the near term.

US30 Key Levels

Resistance Levels: $46,210, $47,000, $48,000

Support Levels: $42,880, $41,740, $38,400

US30 Long-Term Trend: Bullish

From a technical perspective, price action is forming a rising wedge pattern, a setup that often signals weakness after a sharp upward move. The rejection just below $46,210 underscores the presence of sellers at higher levels, while immediate downside pressure points toward support near $45,090. A break below this level could trigger a deeper decline into the demand zone between $44,930 and $43,680, where previous bullish reactions have occurred.

Looking ahead, the market is likely to retrace toward the $44,930–$43,680 zone before attempting a recovery. If buyers successfully defend this area, momentum could rebuild for another move toward the $46,210–$47,000 resistance range. However, failure to hold $43,680 would shift focus to the next significant support at $42,880, deepening the correction. Overall, while the short-term view leans bearish, the broader trend remains aligned with a potential continuation toward $47,000 and even $48,000.

US30 Short-Term Trend: Bearish

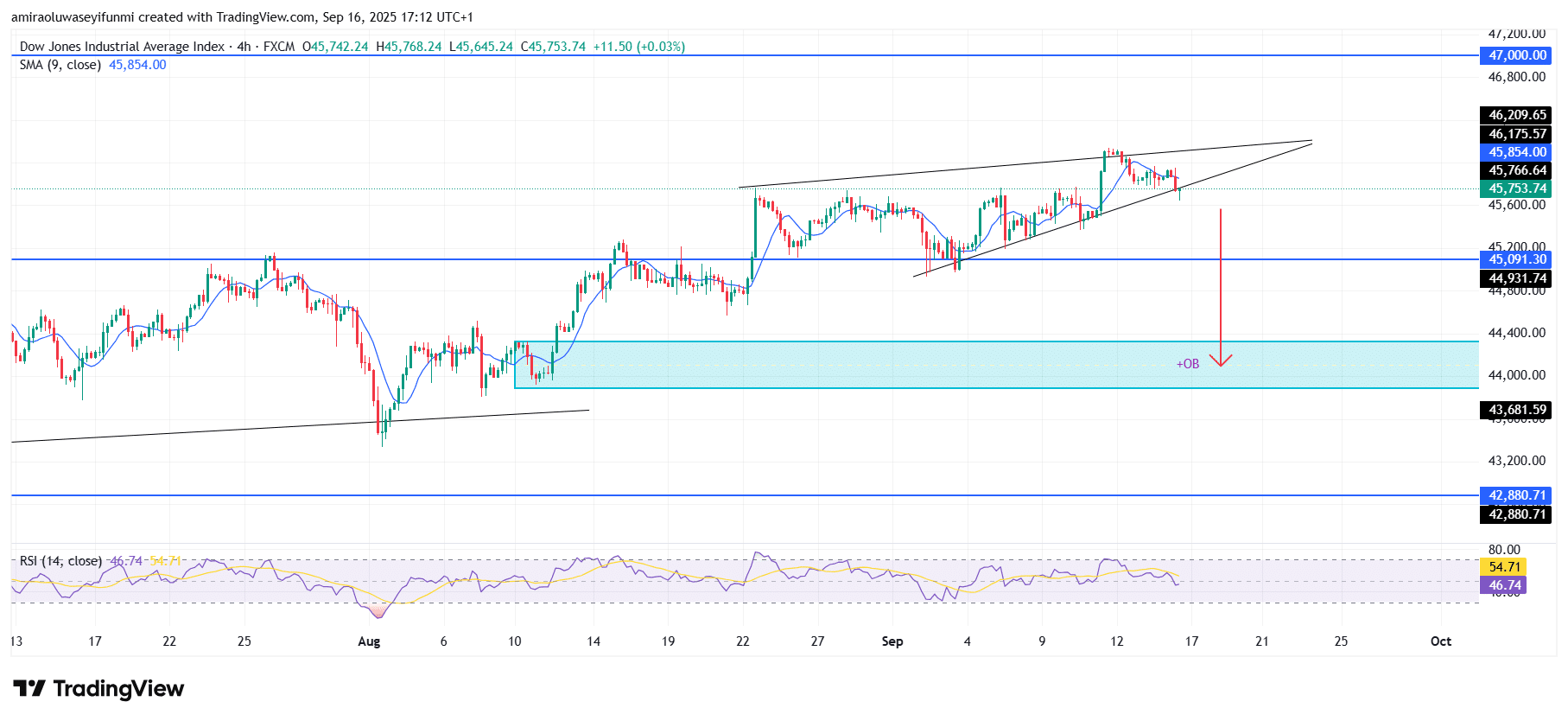

US30 shows weakness on the four-hour chart as price continues to form a rising wedge near $45,770. The RSI has turned lower from mid-levels, confirming waning bullish momentum.

Immediate support lies at $45,090, and a break below this level could expose the demand zone between $44,930 and $43,680. As long as price remains capped below $46,210, the short-term bias favors continued downside. Traders can use forex signals to monitor potential entries and exits during this corrective phase.

Make money without lifting your fingers: Start using a world-class auto trading solution

How To Buy Lucky Block – Guide, Tips & Insights | Learn 2 Trade

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset, product, or event. We are not responsible for your investment results.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.