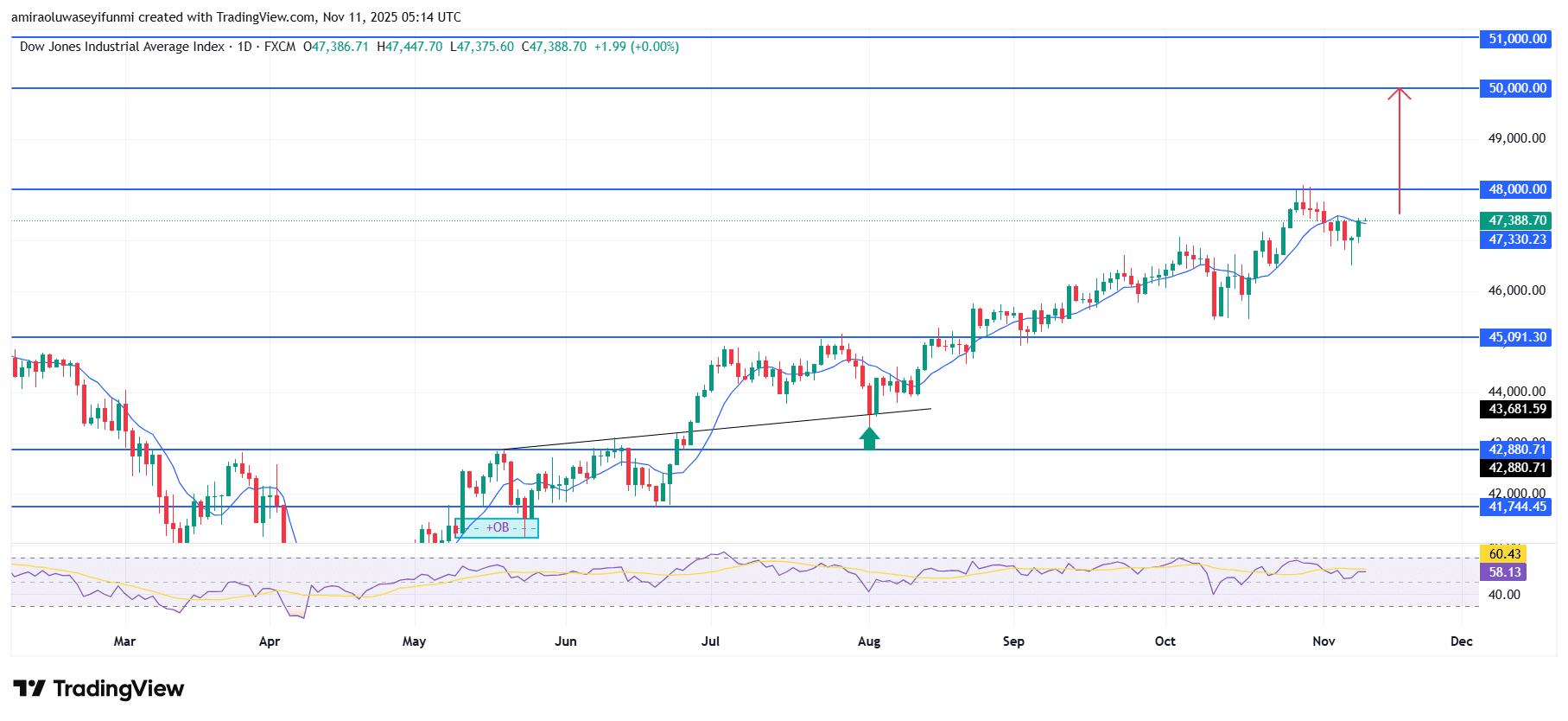

US30 Analysis – November 11

US30 extends bullish drive aiming toward fresh yearly peaks. The US30 Index continues to exhibit a firm upward trajectory, maintaining its stance above the short-term moving average and aligning with the broader tone of market optimism. The Relative Strength Index (RSI) remains around 58, positioned above the neutral midpoint, indicating sustained accumulation and consistent buying pressure without signs of exhaustion. This technical setup reflects enduring investor confidence and reinforces the market’s resilience in the medium term.

US30 Key Levels

Resistance Levels: $48000, $50000, $51000

Support Levels: $45090, $42880, $41740

US30 Long-Term Trend: Bullish

From a structural perspective, price action has stabilized above the $47,300 level after rebounding from earlier corrective dips. The previous breakout beyond the $45,100 threshold in mid-October confirmed a higher low, signaling the continuation of the bullish framework. Candlestick formations reveal steady accumulation, while the recent retest around $47,330 underscores the sustained control of buyers. As long as the index remains anchored above this zone, the prevailing upward outlook is expected to hold.

Looking ahead, the $48,000 resistance level stands as a pivotal barrier to watch, marking a key threshold for further advancement. A decisive breakout and close above this region could open the path toward the $50,000 psychological level, with an extended target near $51,000 if bullish momentum endures. Market sentiment continues to lean toward the upside, supported by robust technical alignment and steady capital inflows into risk assets. Traders can monitor forex signals to refine entry and exit strategies in anticipation of these potential upward movements.

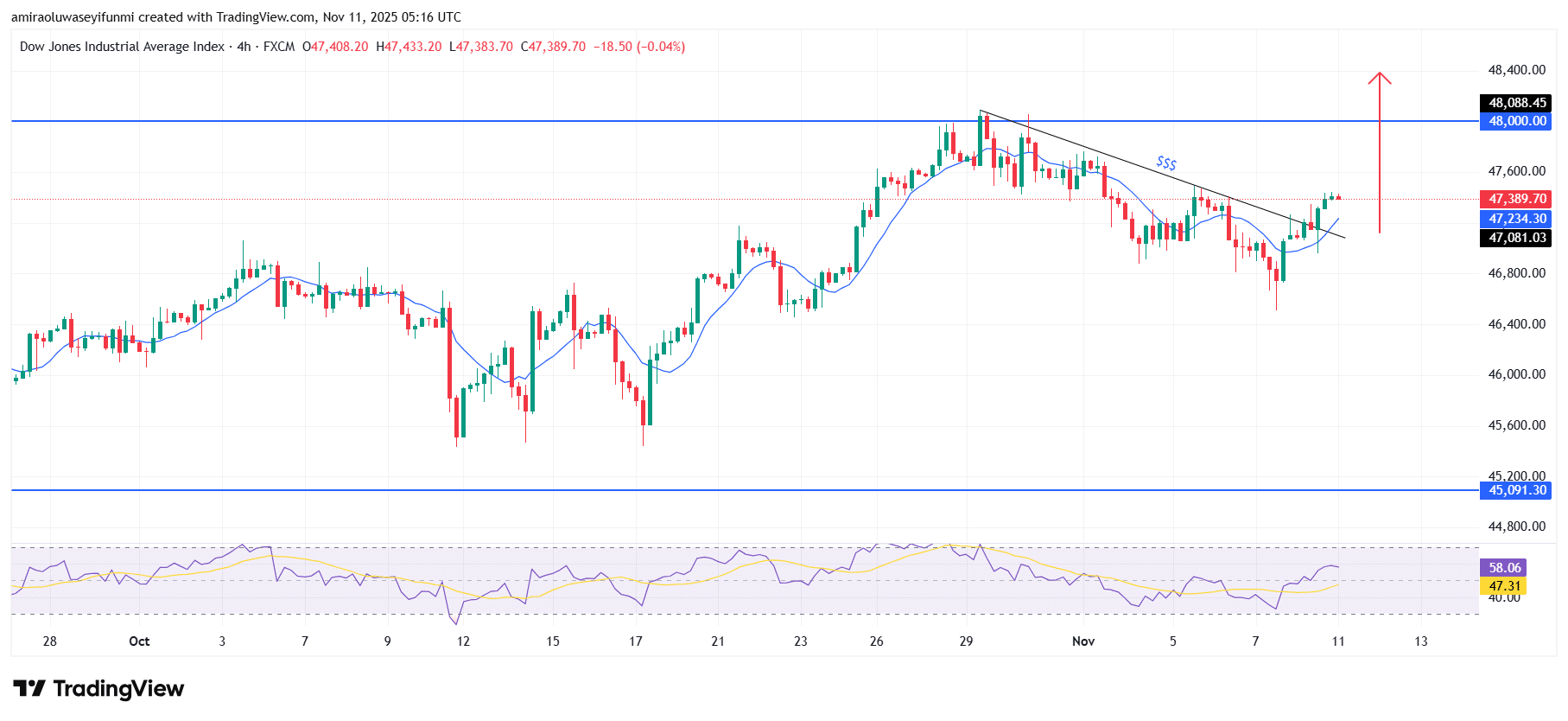

US30 Short-Term Trend: Bullish

US30 maintains a bullish stance on the four-hour chart as price breaks above the descending trendline, confirming renewed upward momentum. The index trades comfortably above the 9-period moving average, highlighting short-term buyer dominance.

RSI remains steady around 58, reflecting continued strength without approaching overbought territory. A sustained move above the $47,600 zone could accelerate price action toward the $48,000–$48,100 resistance area.

Make money without lifting your fingers: Start using a world-class auto trading solution

How To Buy Lucky Block

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset, product, or event. We are not responsible for your investment results.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.