US30 Analysis – May 6

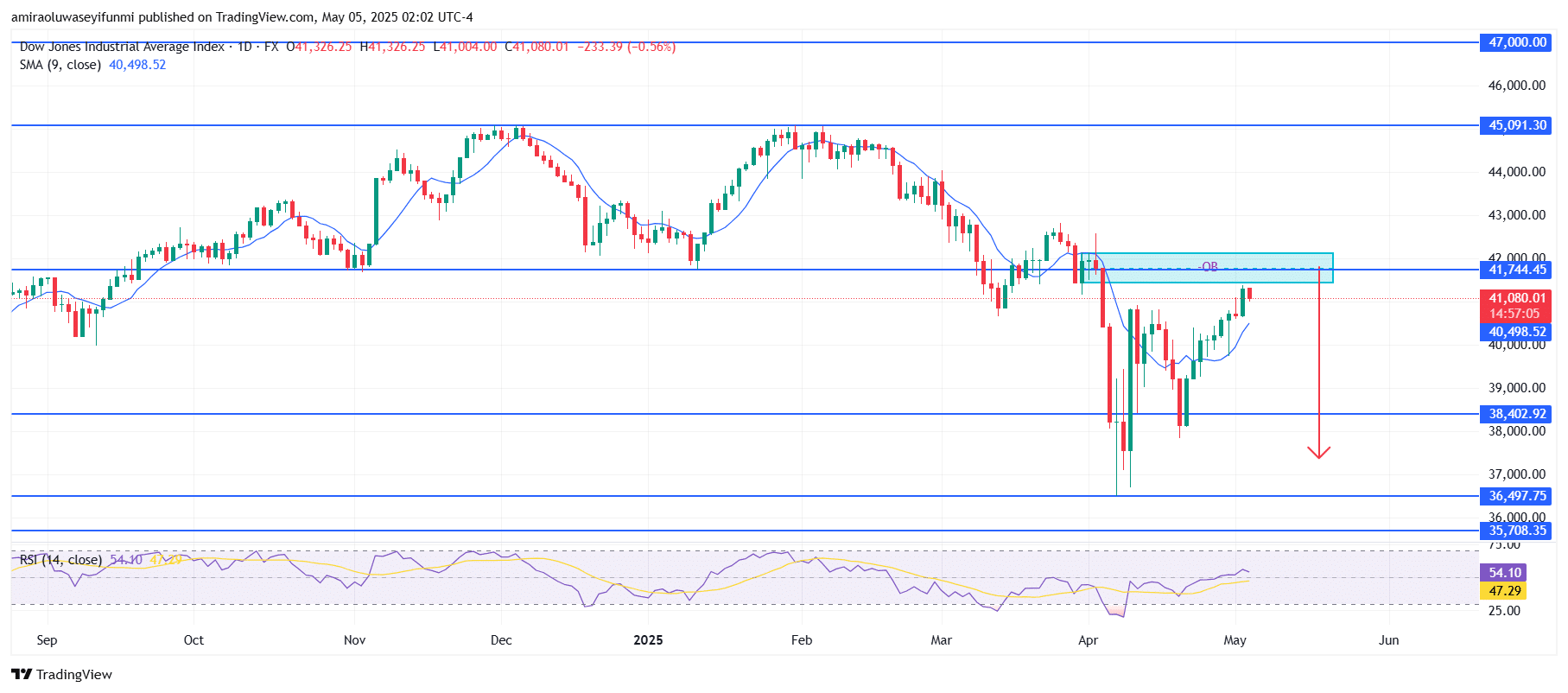

US30 faces strong resistance at a crucial price zone. Technical indicators for the Dow Jones Industrial Average suggest potential upcoming weakness. After attempting to break above the $41,750 level, the price has failed to maintain momentum above this barrier. The 9-day simple moving average, positioned near $40,500, continues to trend upward, but the rally is beginning to lose strength just below the resistance. With the RSI around 54—neutral but leaning toward overbought—there is increasing evidence that sellers may soon gain control.

US30 Key Levels

Resistance Levels: $41,740, $45,100, $47,000

Support Levels: $38,400, $36,500, $35,710

US30 Long-Term Trend: Bearish

On the long-term chart, the supply zone between $41,750 and $42,000 has once again halted upward movement following a sharp recovery. Candlesticks in this range display long upper wicks and signs of indecision, highlighting the market’s struggle to push higher. A significant drop in April after touching this same zone further confirms it as a critical area of selling interest. Additionally, the most recent high remains below the peak from March, supporting the prevailing downtrend structure.

If the $41,750–$42,000 resistance holds firm, the next downside targets are $38,400, with a break below that level opening the way to $36,500 and potentially $35,710. This bearish outlook remains intact as long as the price stays under $42,000. A sustained move above this level would invalidate the current near-term bearish bias.

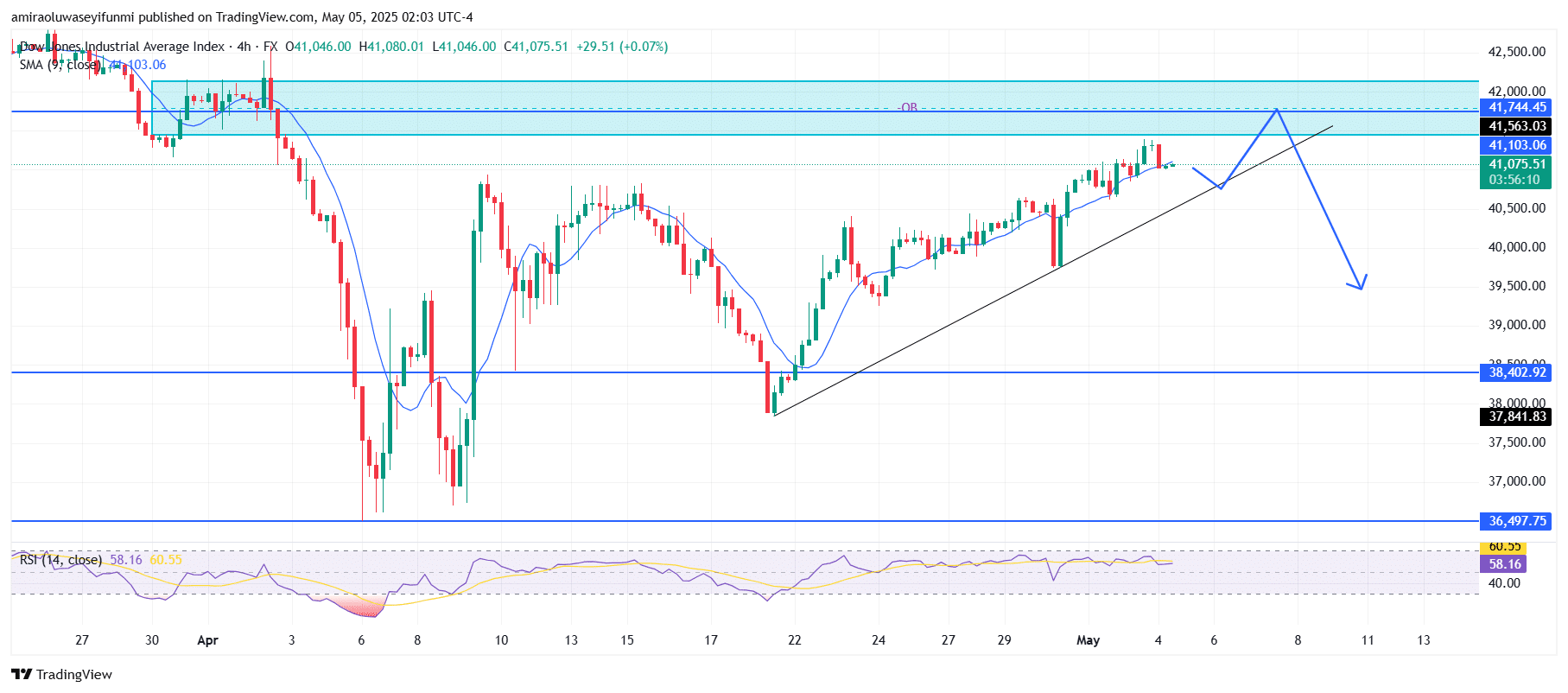

US30 Short-Term Trend: Bearish

In the short term, US30 is once again struggling within the $41,560–$41,750 resistance band, an area that has proven difficult in the past. Despite an ascending trendline, momentum appears to be weakening, with the RSI stalling around 58. A breakdown below the trendline would suggest a shift toward increased selling pressure. If the price is rejected again at the current resistance zone, support around $38,400 is likely to be tested in the coming sessions. This scenario is also reflected in recent forex signals indicating heightened bearish momentum.

Make money without lifting your fingers: Start using a world-class auto trading solution

How To Buy Lucky Block – Guide, Tips & Insights | Learn 2 Trade

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset, product, or event. We are not responsible for your investment results.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.