Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you are unlikely to be protected if something goes wrong. Take 2 minutes to learn more

Market Analysis – September 8

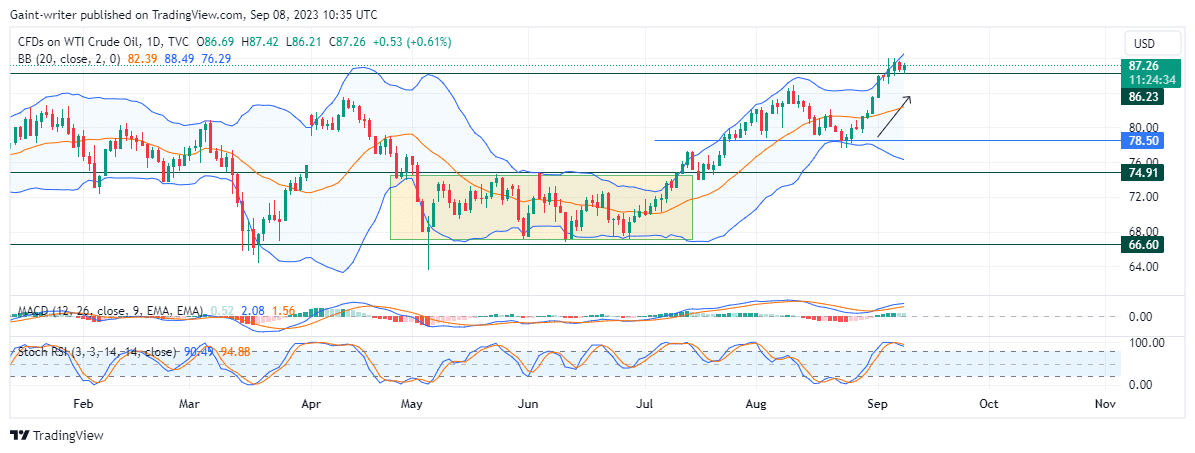

US Oil (WTI) slows down above the 86.230 market level. The US oil market has been on a bullish trend for the past few months due to the demand for crude oil. The buyers have continued to expand their domain as bullish sentiment increases. The crucial level of 86.230 has been successfully breached as we speak. At the moment, the bears are taking a breather above the 86.230 market level.

US Oil (WTI) Key Levels

Resistance Levels: 87.260, 78.500

Support Levels: 74.910, 66.600

US Oil (WTI) Long-Term Trend: Bullish

The

bullish tendency was stable for a while until the price broke through the 78.500 key zone in July. This was a significant breakout that signaled strong momentum in an upward direction. The buyers expanded more but failed to cross over the 86.230 resistance level in August. This level acted as a strong barrier that prevented further price appreciation. The market entered a consolidation phase, where the price fluctuated between 78.500 and 86.230 for several weeks.

I

The sellers regained confidence to drop the oil market to a crucial level of 78.500 in September. This was a sharp decline that indicated a possible reversal of the bullish trend. However, the buyers quickly reacted and pushed the price back up above 78.500. This showed that the buyers were still in control and had not given up on their bullish ambitions. The bulls have maintained steady momentum for the past few weeks until their recent breakout.

I

The

price is currently consolidating above the 86.230 market level. This shows that the buyers are still taking a breather before progressing. The stochastic oscillator shows price response after prices have broken above the 86.230 key level.

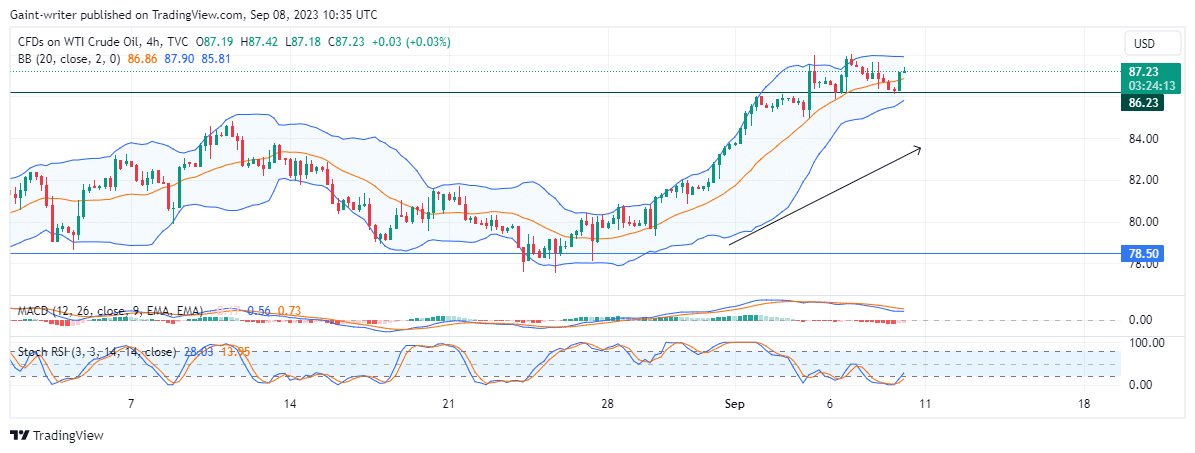

US Oil (WTI) Short-Term Trend: Bullish

The Stochastic Oscillator on the short time frame shows a bullish sentiment opening. The

Bulls, therefore, still aim to cause more expansion. If the price breaks higher, it could trigger a new wave of buying pressure and lead to higher highs. Failure to sustain above the 86.230 key zone could signal a weakness in the bullish trend and invite more sellers into the market.

I

You can purchase Lucky Block – Guide, Tips & Insights | Learn 2 Trade here. Buy LBLOCK

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results.

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- The Lowest Trading Costs

- 50% Welcome Bonus

- Award-winning 24 Hour Support

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus