Market Analysis – August 25

US oil (WTI) looks for more bullish momentum. The market needs more attention from bullish participants to expand its momentum. The buyers have been attempting to regain the previously lost bullish pace in the market. Although US oil experienced a significant dip earlier this week, the bulls need to strengthen their position in the market.

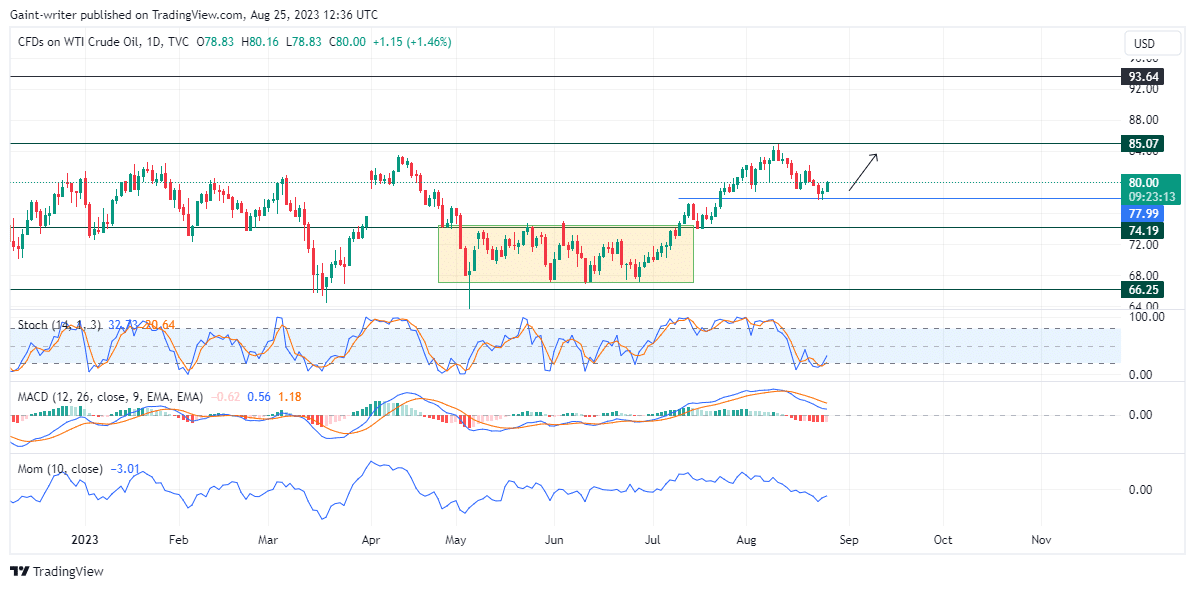

US Oil (WTI) Market Levels

Resistance levels: 93.640, 85.070

Support levels: 74.190, 66.250

US Oil (WTI) Long-Term Trend: Bullish

Technically, the significant zone at 85.070 has not been broken this year, highlighting the importance of this key level. In April, the bulls attempted but were unable to sustain the upward movement, resulting in a fall.

Subsequently, the bears pushed the price below the market level of 74.190. However, the buyers managed to escape through a period of market consolidation. Since then, the bulls have been expanding their influence. This month, market activity has revolved around the 85.070 level. The buyers have not been able to achieve a breakthrough yet.

The US oil market has reacted to the 77.990 level, indicating the willingness of buyers to push forward. To achieve a breakthrough, the bulls need to accumulate more strength.

The Stochastic Oscillator has indicated an overbought region. This suggests that buyers could potentially expand their presence as the trade progresses. Although the bullish momentum has declined, as shown by the Momentum indicator, the bulls are expected to strengthen their position.

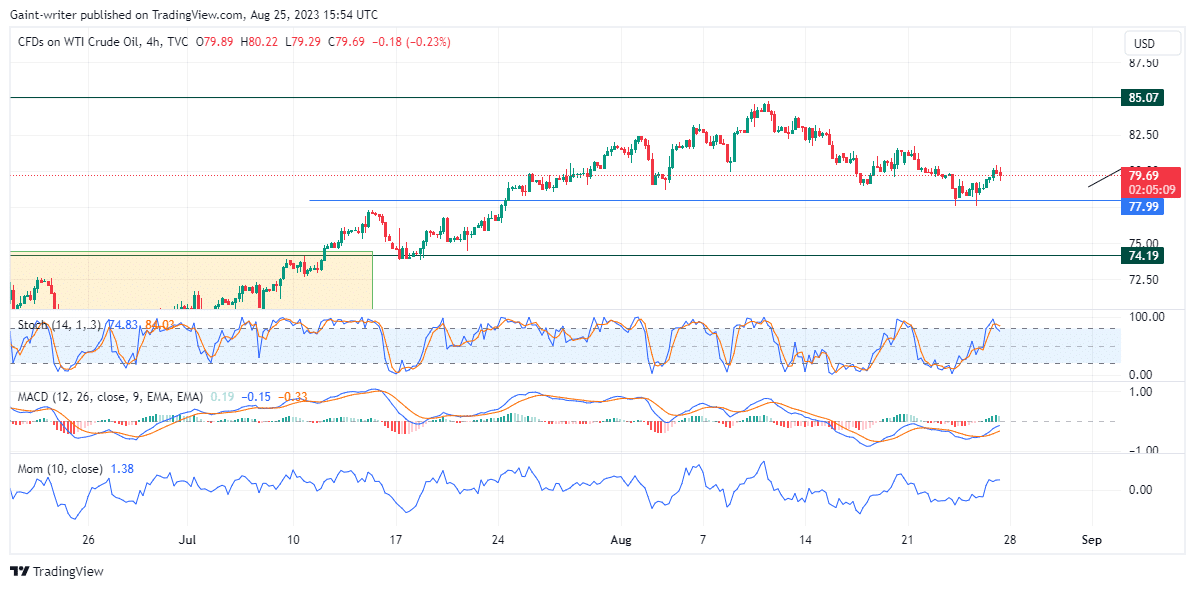

US Oil (WTI) Short-Term Trend: Bullish

Currently, the market is positioned to continue its bullish trend. As the trade unfolds next week, the buyers will need to increase their pace to solidify the bullish momentum.

You can purchase Lucky Block – Guide, Tips & Insights | Learn 2 Trade here. Buy LBLOCK

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

9.8

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

9

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

9

Learn to Trade

Never Miss A Trade Again

step 1

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

step 2

Get Alerts

Immediate alerts to your email and mobile phone.

step 3

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.