Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you are unlikely to be protected if something goes wrong. Take 2 minutes to learn more

Market Analysis – August 11th

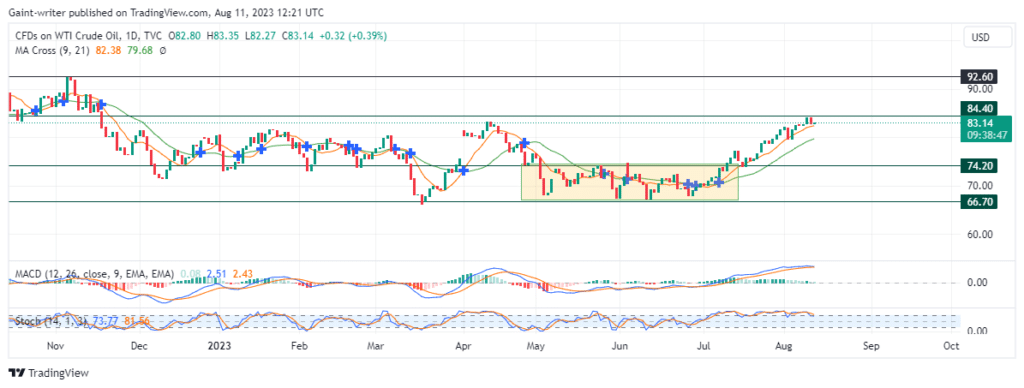

US Oil (WTI) continues to edge higher toward the 84.40 resistance level. The oil market has been favoring the bullish side since the previous month, with buyers displaying strong conviction.

Prior to the buyers gaining strength, the market emerged from a consolidation phase. US Oil (WTI) experienced a challenging period earlier when the price broke down below the key zone of 74.20. This led to a prolonged consolidation lasting for three months. However, buyers were able to regroup and gather momentum in July.

US Oil (WTI) Key Levels

Resistance Levels: 92.60, 84.40

Support Levels: 74.20, 66.70

US Oil (WTI) Long-Term Trend: Bullish

Presently, the buyers are making significant progress in their attempt to surpass the resistance at 84.40. During yesterday’s trading session, the bullish traders faced some setbacks. This was an illustration of the presence of selling pressure. In this scenario, buyers need to continue pushing forward, as this would indicate stronger momentum coming into the market.

On the other hand, sellers may attempt to regain control if buyers fail to break out. The MACD (Moving Average Convergence and Divergence) indicator’s signal line is approaching a critical stage. This indicates a potential opportunity for sellers to exert more influence. Additionally, the Stochastic Oscillator has been in overbought territory for an extended period. It also suggests that sellers are looking for an opportunity to retaliate.

US Oil (WTI) Short-Term Trend: Bullish

Examining the 4-hour chart, the bulls still require further upward momentum to achieve a breakout. Meanwhile, sellers are also maintaining their presence. Currently, buyers are heading toward the 84.40 market level, and a successful breakout is still plausible.

You can purchase Lucky Block – Guide, Tips & Insights | Learn 2 Trade here. Buy LBLOCK

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.