The United States has emerged as the world’s second-largest market for crypto adoption, according to Chainalysis’s 2025 Geography of Cryptocurrency Report.

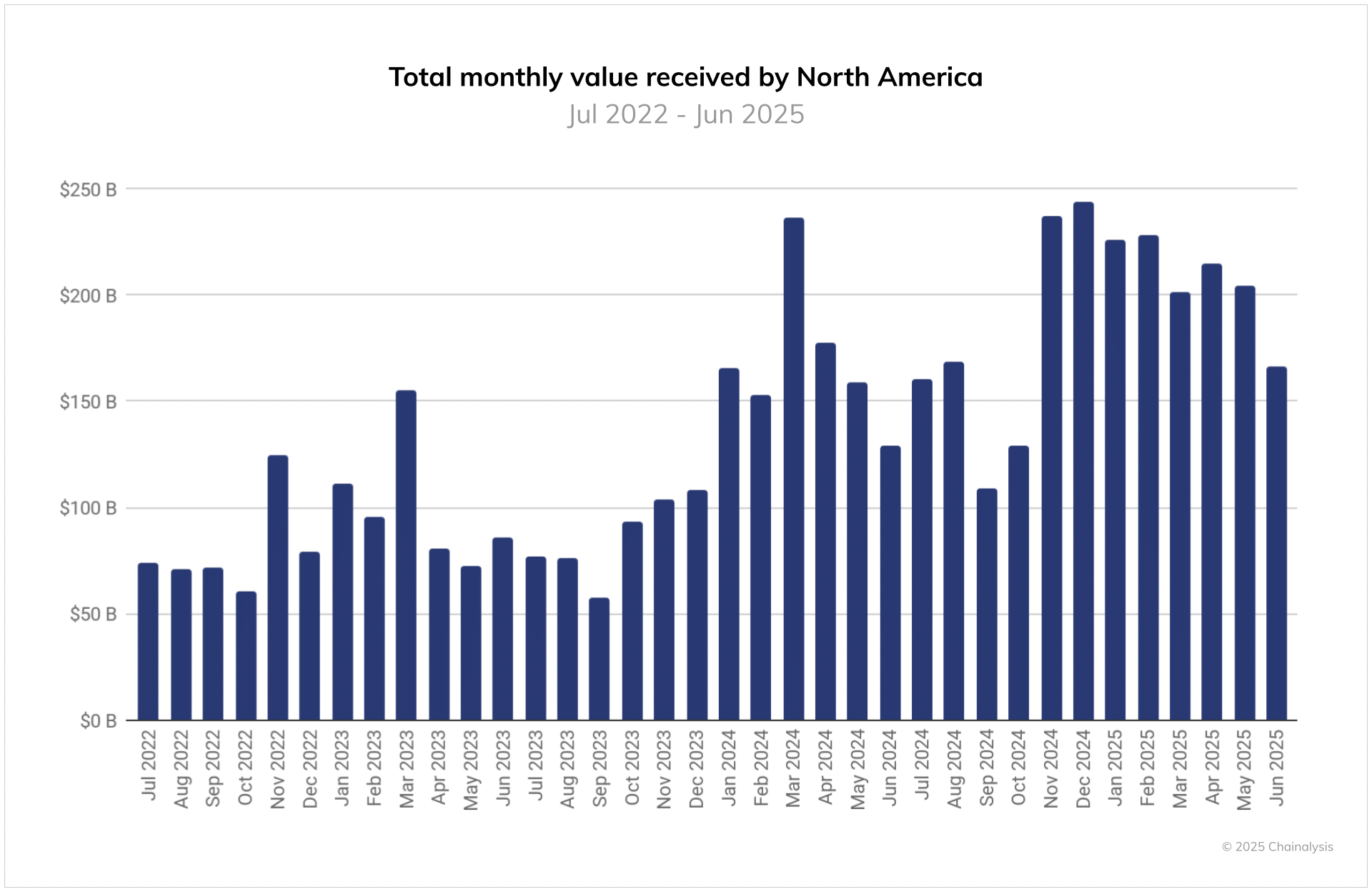

North America now accounts for 26% of all global cryptocurrency transaction activity, with the region processing $2.3 trillion in digital asset value between July 2024 and June 2025.

December 2024 marked a pivotal moment when North America received $244 billion in cryptocurrency transactions in a single month.

This surge coincided with Donald Trump’s presidential election victory, which sparked optimistic market sentiment about clearer regulatory frameworks and crypto-friendly policies ahead.

Institutional Money Drives Market Volatility

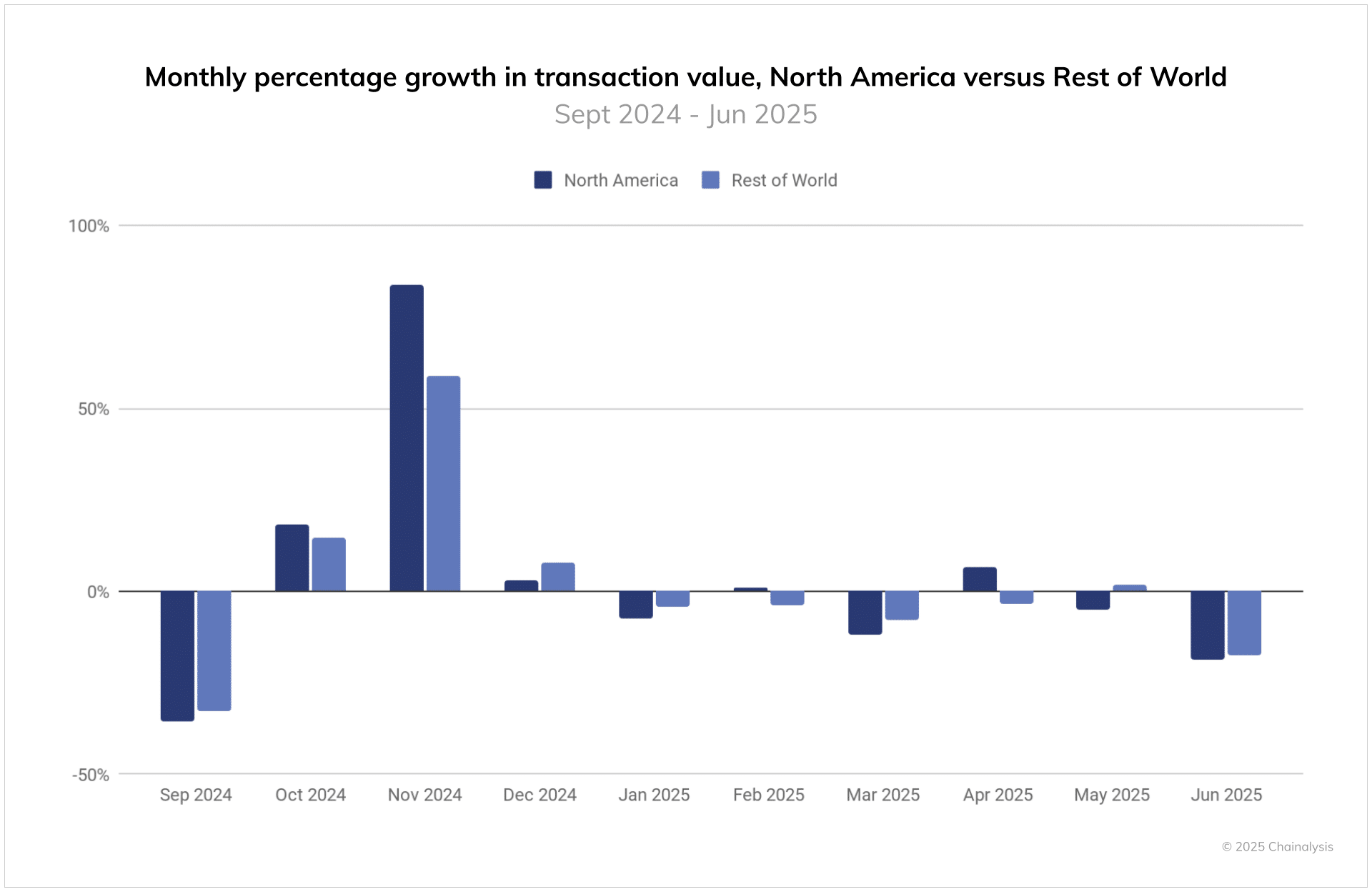

North American markets show significantly more price swings than other regions. Monthly transaction growth rates varied dramatically from a 35% decline in September 2024 to an 84% spike in November.

This volatility stems from heavy institutional participation and active trading strategies that respond quickly to market catalysts.

The data reveals stark differences in market structure. While North America focuses on institutional investment, other regions rely more on utility-based transactions and remittances.

North America dominates high-value transfers, handling 45% of all transactions exceeding $10 million compared to Europe’s 34%.

ETFs and Tokenized Assets Fuel Growth

Bitcoin ETFs have become major growth drivers, reaching $179.5 billion in global assets under management by mid-July 2025.

US-listed products control over $120 billion of this total, giving American investors easy exposure without direct cryptocurrency ownership.

Tokenized US Treasury funds also experienced remarkable expansion. These assets grew from $2 billion in August 2024 to over $7 billion by August 2025.

The growth reflects investor demand for regulated, yield-bearing digital assets that serve as collateral in DeFi protocols.

Regulatory Changes Open New Opportunities for Crypto Adoption

The regulatory environment has shifted dramatically under the current administration. The SEC dropped numerous enforcement actions while other agencies revoked restrictive guidance.

President Trump’s Working Group on Digital Asset Markets aims to make America the “crypto capital of the world.”

The GENIUS Act, signed in July 2025, established clear stablecoin regulations. This framework protects the US dollar’s global dominance while enabling innovation in digital payments.

With continued regulatory support and rising institutional demand, the US appears positioned to potentially claim the top spot in global crypto adoption rankings.

Interested In Trading The Market With A Trustworthy Partner? Try Eightcap Today.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.