Global crypto adoption has reached new heights in 2025, with India maintaining its top position for the sixth consecutive year. The latest Chainalysis report reveals significant shifts in how people worldwide use cryptocurrency.

India dominates across all categories, ranking first in retail transactions, centralized services, DeFi protocols, and institutional activity.

The United States follows in second place, benefiting from regulatory clarity and the approval of spot Bitcoin ETFs.

Pakistan, Vietnam, and Brazil round out the top five countries, per the Chainalysis report.

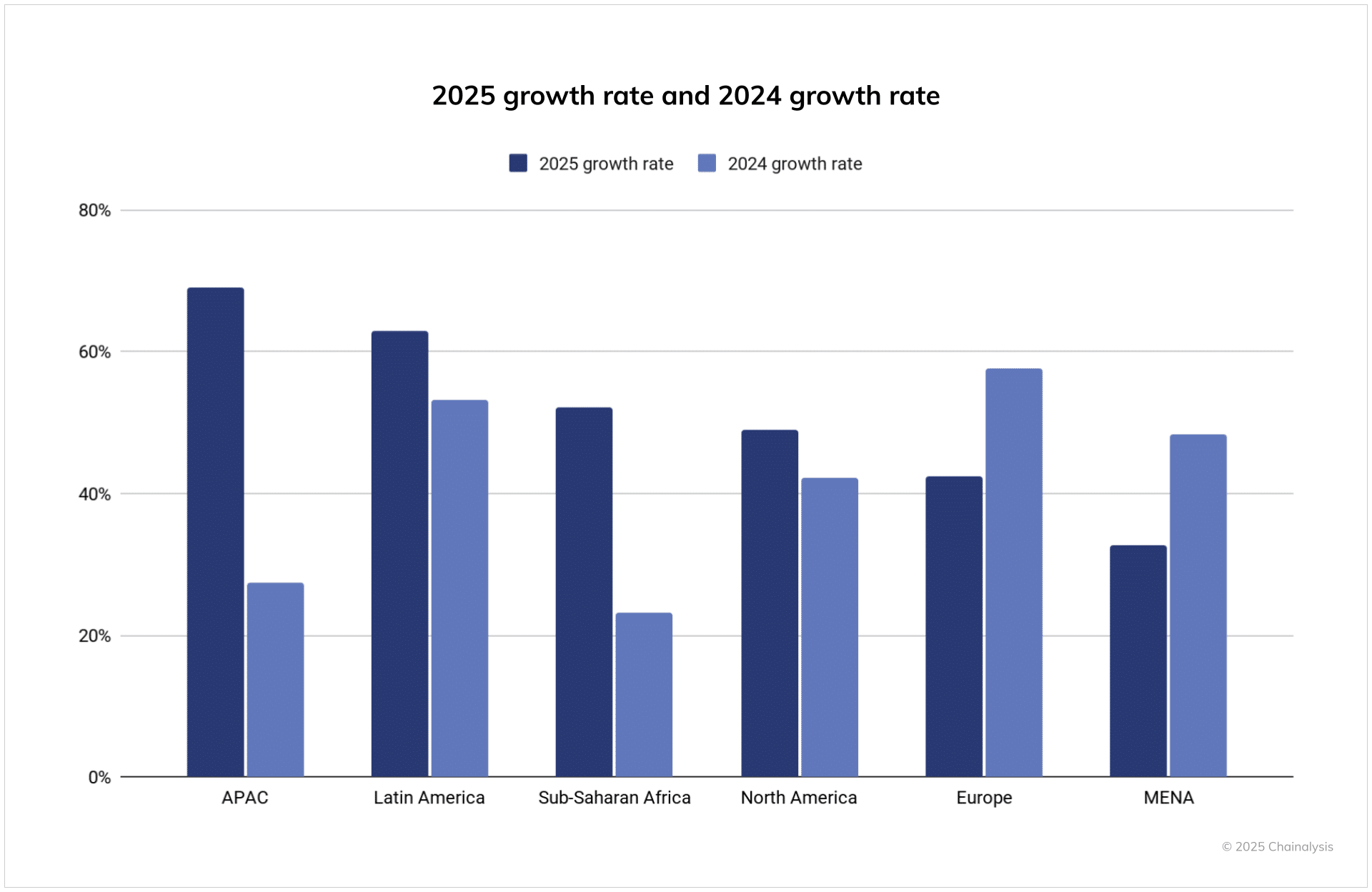

Meanwhile, the Asia-Pacific region leads growth with a massive 69% increase in transaction volume over the past year.

Total crypto activity in APAC jumped from $1.4 trillion to $2.36 trillion. Latin America wasn’t far behind with 63% growth, while Sub-Saharan Africa saw 52% expansion.

These numbers show crypto’s shift toward emerging markets where practical utility drives adoption. People use digital currencies for remittances, payments, and protecting wealth from inflation.

Eastern Europe Dominates Per-Capita Rankings in Global Crypto Adoption

When adjusted for population size, a different picture emerges. Ukraine, Moldova, and Georgia top the per capita adoption rankings. Economic uncertainty and distrust in traditional banks push Eastern Europeans toward cryptocurrency alternatives.

This trend highlights crypto’s role as a financial lifeline in unstable regions. Countries facing inflation, banking restrictions, or conflict rely heavily on digital assets for cross-border transactions and wealth preservation.

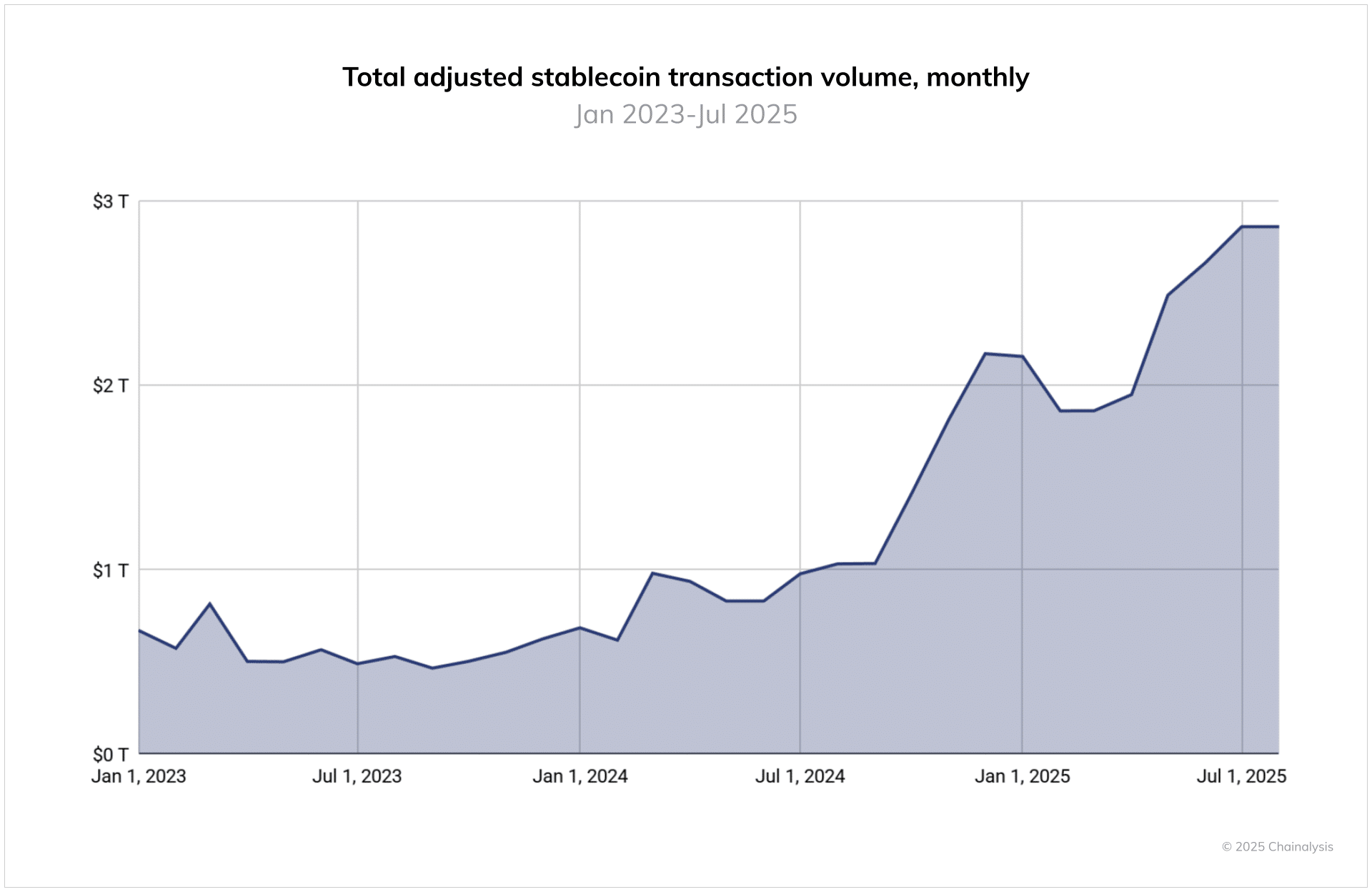

Stablecoins Drive Real-World Usage

According to the Chainalysis report, stablecoin adoption continues accelerating globally. USDT processed over $1 trillion monthly, while USDC handled between $1.24 trillion and $3.29 trillion per month.

Smaller stablecoins like EURC showed explosive 89% month-over-month growth.

Major payment companies now integrate stablecoins. Stripe, Mastercard, and Visa launched products enabling users to spend digital dollars through traditional payment rails.

Traditional banks like Citi and Bank of America announced plans to explore their own stablecoin offerings.

Bitcoin remains the primary entry point for new users, accounting for over $4.6 trillion in fiat purchases during the study period. The US leads fiat on-ramping with $4.2 trillion in volume, followed by South Korea with $1 trillion.

This data confirms crypto adoption spans all income levels globally, signaling mainstream acceptance rather than niche speculation.

Interested In Trading The Market With A Trustworthy Partner? Try Eightcap Today.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.