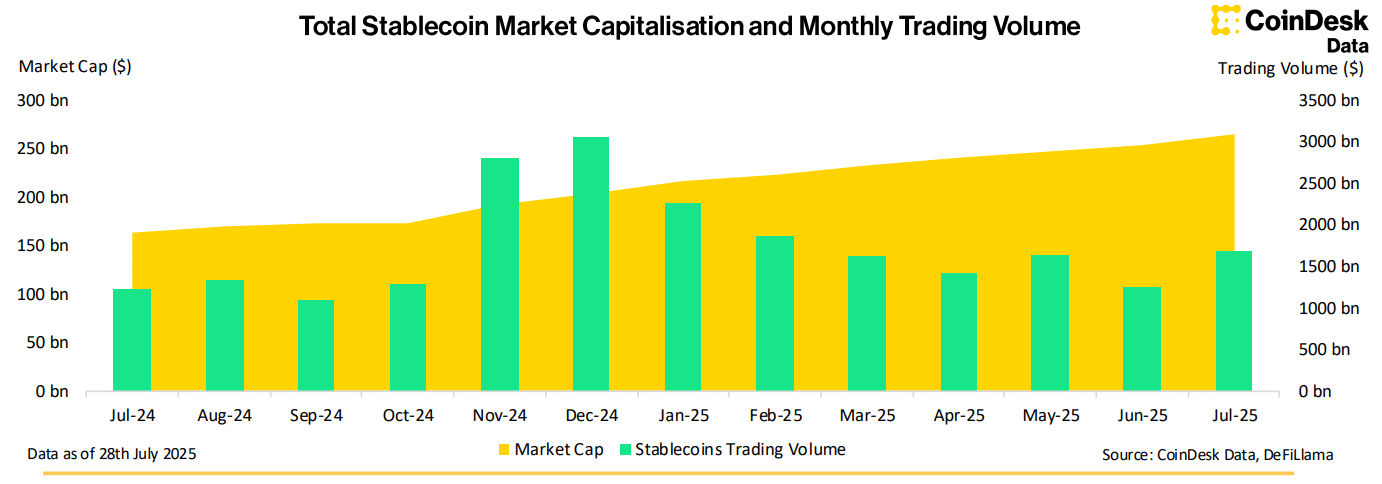

The stablecoin sector reached an unprecedented milestone in July 2025, with total market capitalization climbing 4.87% to $261 billion, according to the latest CoinDesk report.

This marks the 22nd consecutive month of growth for the stablecoin ecosystem, signaling sustained institutional confidence despite broader market volatility.

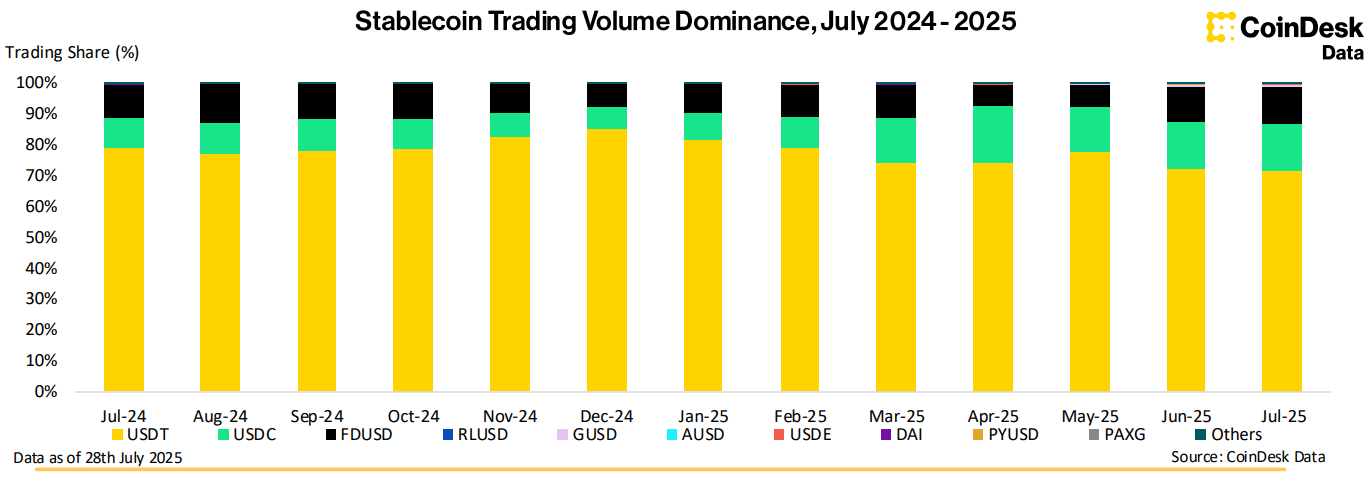

Market dynamics reveal shifting preferences among major stablecoin protocols. For context, Tether (USDT) maintains dominance with $164 billion in market cap, though its relative share declined slightly to 61.8%.

Meanwhile, USD Coin (USDC) expanded 3.78% to $63.6 billion, while Ethena’s USDe experienced explosive 43.5% growth to reach $7.6 billion.

Yield-Driven Migration Reshapes Stablecoin Preferences

The most significant development involves Sky Protocol’s USDS overtaking DAI in market capitalization, reaching $4.87 billion. This shift stems from USDS offering competitive yields between 4.5% and 7% APY, substantially higher than DAI’s 2% returns.

The yield differential has triggered notable liquidity migration, with DAI’s centralized exchange volumes dropping from $100 million to $40 million monthly.

Falcon Finance’s USDf emerged as another growth leader, surging 121% to $1.07 billion and securing tenth place among stablecoins. The protocol’s yield-generating mechanisms and roadmap for gold redemptions attracted significant capital inflows.

Network Dominance and Regulatory Developments

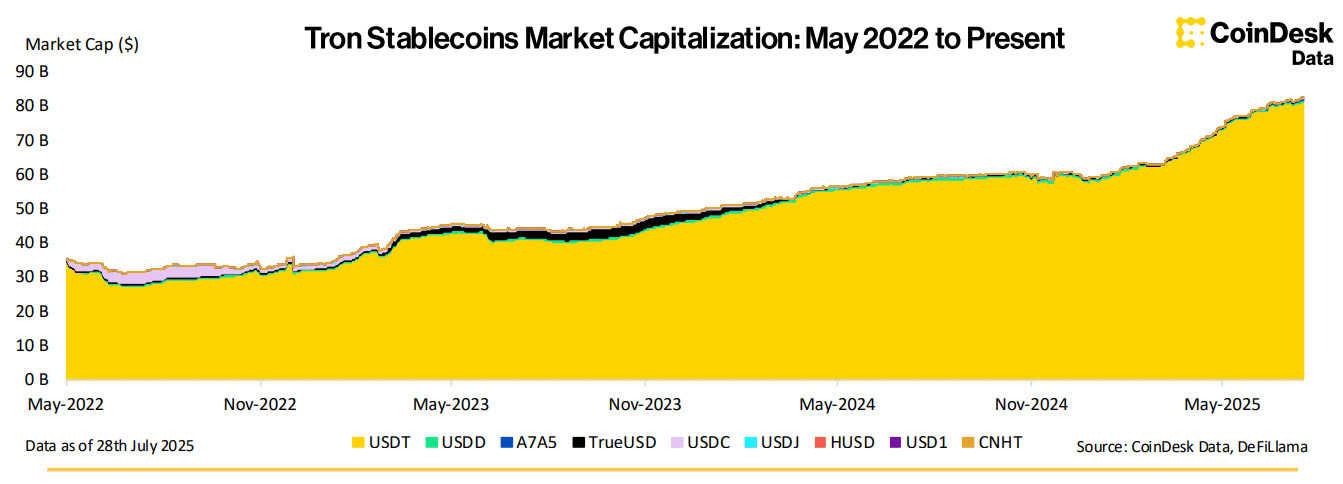

The Tron blockchain solidified its position as a stablecoin hub, hosting over 50% of USDT’s circulating supply for the first time since August 2024. The total stablecoin market cap on Tron reached $81.9 billion, with new entrants like A7A5, a ruble-pegged stablecoin, contributing $467 million since its June launch.

Trading activity across centralized exchanges hit $1.68 trillion, driven by corporate treasury adoptions of digital assets. However, USDT’s trading dominance decreased to 71.3%, with USDC and FDUSD capturing 15.1% and 12.0% market shares, respectively.

The sustained growth trajectory suggests stablecoins are becoming essential infrastructure for digital finance, with yield optimization increasingly driving user preferences across protocols.

Interested In Trading The Market With A Trustworthy Partner? Try Eightcap Today.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.