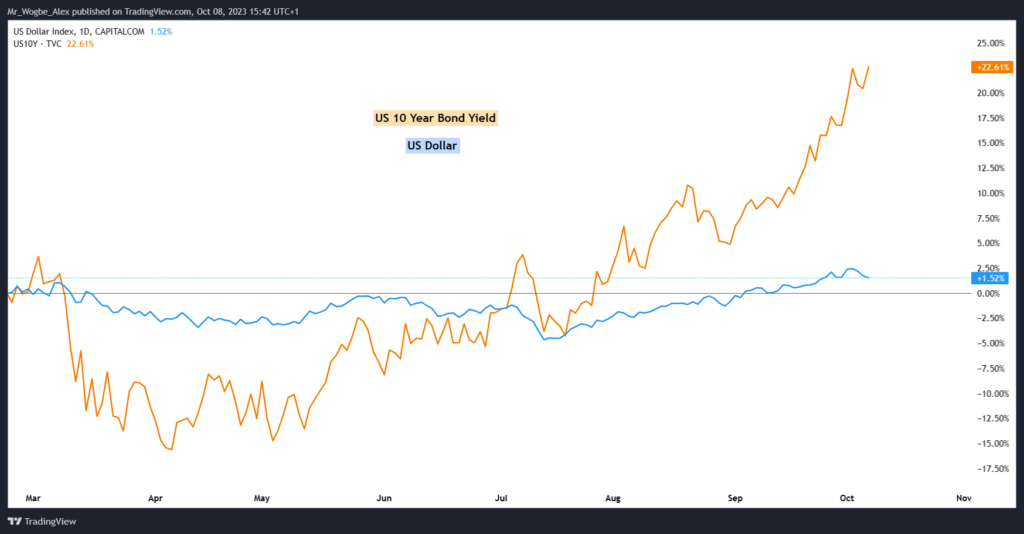

The US dollar embarked on an impressive winning streak during the third quarter of 2023, surging for a remarkable eleven consecutive weeks. Such a resilient performance had not been witnessed since the heydays of Q3 2014.

The primary catalyst behind this remarkable rally can be attributed to the surge in long-term Treasury yields. These yields are a barometer of the market’s anticipation of an eventual hike in the Federal Funds Rate, signifying the Federal Reserve’s intention to tighten its monetary policy for an extended period.

But as we delve into the final quarter of the year, the million-dollar question arises: will this dollar rally sustain its momentum?

US Dollar Price Action in Q4 to Be Determined by Inflation

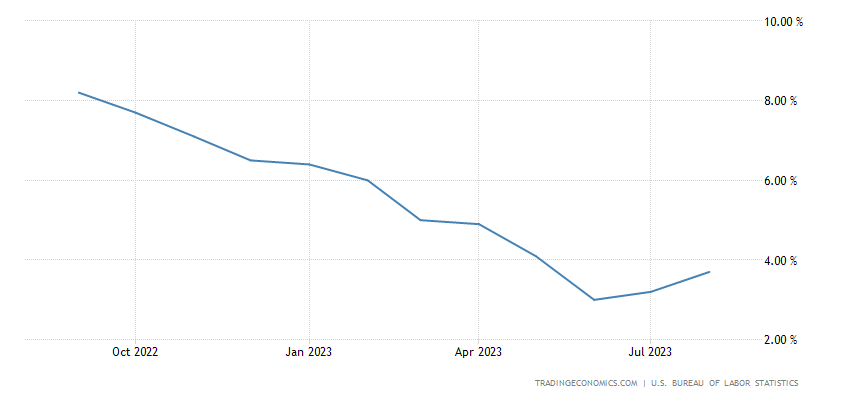

One of the pivotal determinants that will sway the Fed’s decisions and consequently influence the trajectory of the greenback is inflation. Inflation gauges the evolving prices of goods and services over time.

The Federal Reserve has set a target inflation rate of 2%, aspiring to maintain a balanced and stable price escalation. Should inflation spiral out of control or, conversely, dwindle to alarming levels, it could spell trouble for both the economy and consumers alike.

Within the realm of inflation metrics, the Fed keeps a watchful eye on ‘shelter’ expenses, encompassing rent and housing costs. Shelter constitutes the largest chunk of the Consumer Price Index (CPI), the principal yardstick for measuring inflation in the United States. Nevertheless, there exists a lag between alterations in rent prices and their ripple effect on the CPI shelter component.

Meanwhile, it’s crucial to understand that the monetary policy decisions made by the Fed are not solely contingent on inflation dynamics. The central bank factors in an array of variables, including the oscillations in oil prices and labor market conditions. Consequently, a cautious and comprehensive approach by the Fed could continue to lend support to the US dollar throughout the fourth quarter.

Interested In Becoming A Learn2Trade Affiliate? Join Us Here

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.