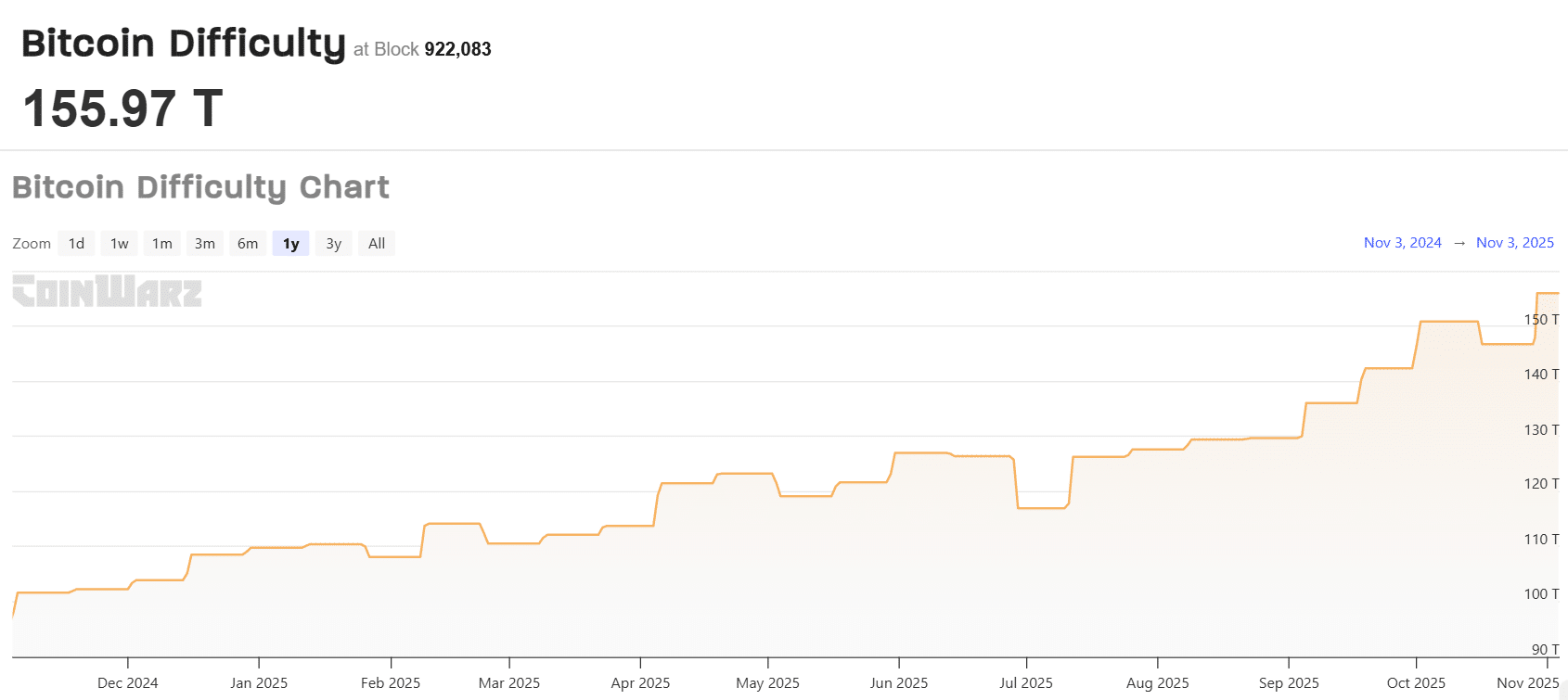

When Bitcoin’s network hit record levels on October 29—with mining difficulty reaching 155.9 trillion and hash rate crossing 1.1 zetta-hashes per second—many people wondered what these numbers actually mean.

If you’re holding Bitcoin or thinking about mining, understanding mining difficulty helps you make smarter decisions about the network’s health and your potential profits.

Think of mining difficulty as Bitcoin’s automatic speed control. It keeps the whole system running at the right pace, no matter how many miners join or leave the network. Without it, Bitcoin would fall apart pretty quickly.

How Bitcoin Keeps Its Timing Perfect

Bitcoin needs to release new blocks roughly every ten minutes. These blocks contain all the recent transactions people make across the network.

But here’s the problem: what happens when thousands of new mining machines suddenly come online? They’d solve puzzles way faster and create blocks in maybe two or three minutes instead of ten.

That’s where the adjustment mechanism comes in. Every 2,016 blocks (about two weeks), Bitcoin checks whether blocks are coming too fast or too slow.

If miners are crushing through blocks in eight minutes on average, the network cranks up the difficulty. If they’re taking twelve minutes, it gets easier. This self-correcting system has kept Bitcoin stable for over 15 years.

The math behind this involves miners guessing numbers that produce specific hash outputs through the SHA-256 algorithm. A hash is basically a long string of characters that looks random but comes from specific data.

The network sets a target number, and miners need to find a hash below that target. Lower targets mean more guesses required, which means higher difficulty.

Why Mining Difficulty Matters for Your Portfolio

Mining difficulty directly affects three things you should care about:

- Network security: When difficulty rises, it means more computing power is protecting Bitcoin. An attacker would need to control an insane amount of hardware to mess with the blockchain. At current difficulty levels, that’s basically impossible for any single entity. This protects your coins from double-spending attacks and other manipulation.

- Miner economics: Higher difficulty means miners need more electricity and better equipment to earn the same rewards. In 2025, many older mining rigs simply can’t compete anymore. This pushes mining toward efficient operations in places with cheap power. For you as a holder, this matters because miner behavior affects selling pressure on Bitcoin’s price.

- BTC supply: Bitcoin’s whole value proposition includes a fixed supply schedule. The difficulty adjustment makes sure new coins enter circulation at the expected rate, regardless of how many miners are competing. This predictability builds trust in Bitcoin as a store of value.

Let’s look at a real example. In 2021, China banned crypto mining and roughly half the global hash rate disappeared within weeks. The difficulty dropped 28 percent—the biggest decline ever.

Despite this, the network kept functioning. Blocks still came every ten minutes on average. Remaining miners picked up the slack, and within months, new Bitcoin mining operations opened in other countries. The system adapted.

What Current Trends Tell Us

Right now in November 2025, we’re seeing difficulty at all-time highs.

This tells us several things about what’s happening in the mining world.

- First, professional operations dominate. Small miners using a couple machines in their garage can’t really compete anymore unless they have incredibly cheap electricity. Most successful miners today either run large facilities or join mining pools where they share resources and split rewards.

- Next, mining has spread globally. After the China ban, operations expanded in the United States, Kazakhstan, Canada, and other regions. This geographic distribution actually makes Bitcoin stronger because it’s harder for any single government to disrupt the network.

- Lastly, equipment keeps improving. New mining machines are more efficient, squeezing more hashes from each watt of electricity. But as these efficient machines spread, difficulty rises to match, creating an ongoing arms race.

If you’re considering mining, run the numbers carefully. Calculate your electricity costs, equipment expenses, and expected difficulty increases. Most profitable miners today operate at massive scale with access to cheap power, often from renewable sources like hydroelectric or stranded natural gas.

For traders and holders, watching difficulty trends gives you insight into miner stress levels. When difficulty jumps but Bitcoin’s price stays flat, miners face tighter margins.

Some might sell coins to cover costs, potentially affecting short-term price action. Tools like Blockchain.com and mempool.space let you track these metrics in real-time.

The bottom line? Mining difficulty is the mechanism that keeps Bitcoin secure, predictable, and decentralized. Whether you’re mining, trading, or holding, understanding how difficulty works helps you read the network’s health and make better decisions in this market.

Interested In Trading The Market With A Trustworthy Partner? Try Eightcap Today.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.