In a significant development, Bitcoin exchange reserves have dropped to their lowest levels since early 2021, according to recent data from CryptoQuant. Over the past month, a staggering 90,700 bitcoins have been withdrawn from major exchanges, signaling a potential shift in investor strategy towards long-term holding.

This trend, which has been observed over several years, aligns with significant events such as the approval of spot bitcoin ETFs and the anticipation of the bitcoin halving event.

In mid-2021, exchange reserves were approximately 2.8 million bitcoins, indicating a substantial decrease of about 900,000 coins since CryptoQuant began tracking this data.

This reduction in liquid supply suggests a growing preference for securing bitcoin in cold storage, away from the immediate reach of the market.

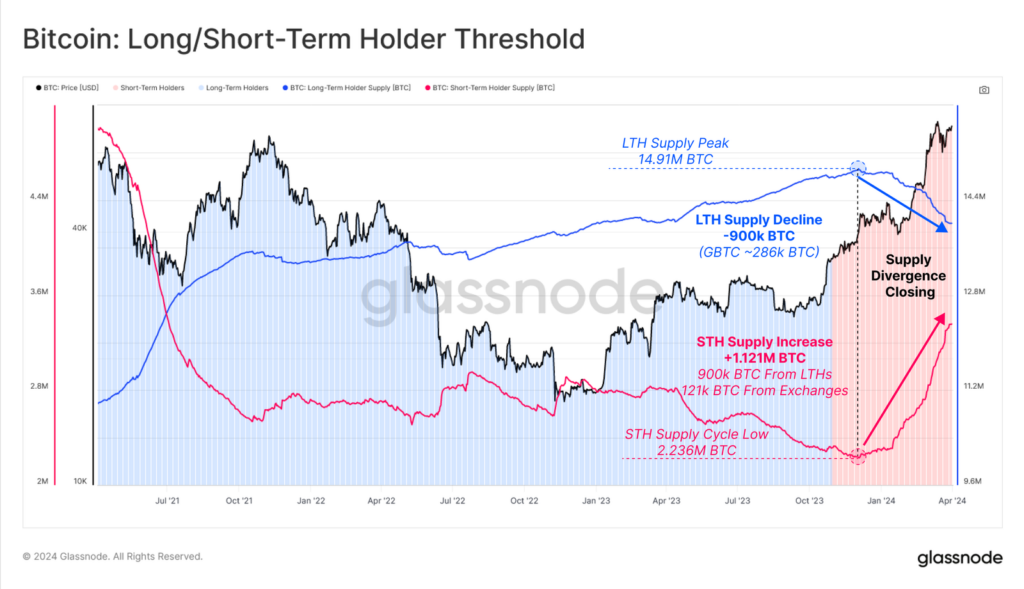

Glassnode’s latest report reveals a notable transition of Bitcoin from long-term holders to short-term holders. This movement is attributed to the narrowing gap between the supply held by these two groups.

As bitcoin prices rise and unrealized profits grow, long-term holders appear more inclined to sell their assets, contributing to an increase in short-term holder supply by roughly 1.121 million bitcoins.

U.S. Macro Factors Affecting Bitcoin in the Near Term

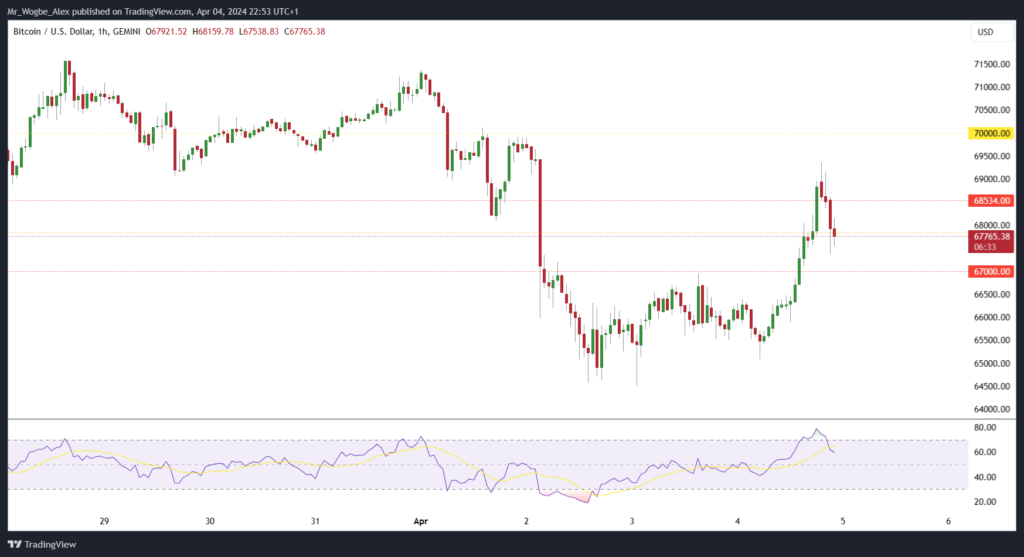

The macroeconomic landscape also plays a pivotal role in influencing bitcoin’s price. Bitcoin rose by 5.2% on Thursday, reaching a daily high of $69,360, yet it remains approximately 6% below its all-time high of $73,000 set in mid-March.

Analyst Neil Roarty from Stocklytics told The Block that robust economic indicators from the U.S. may be tempering bitcoin’s performance. He points out that the U.S. Federal Reserve’s current stance on interest rates, with no immediate plans to initiate a rate-cut cycle, could adversely affect bitcoin’s trajectory.

Roarty speculates that rate cuts might be essential for Bitcoin to achieve the projected $100,000 price target in 2024.

Want reliable crypto signals to capitalize on market swings? Join us on Telegram.

Interested In Getting The “Learn2Trade Experience?”Join Us Here

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.