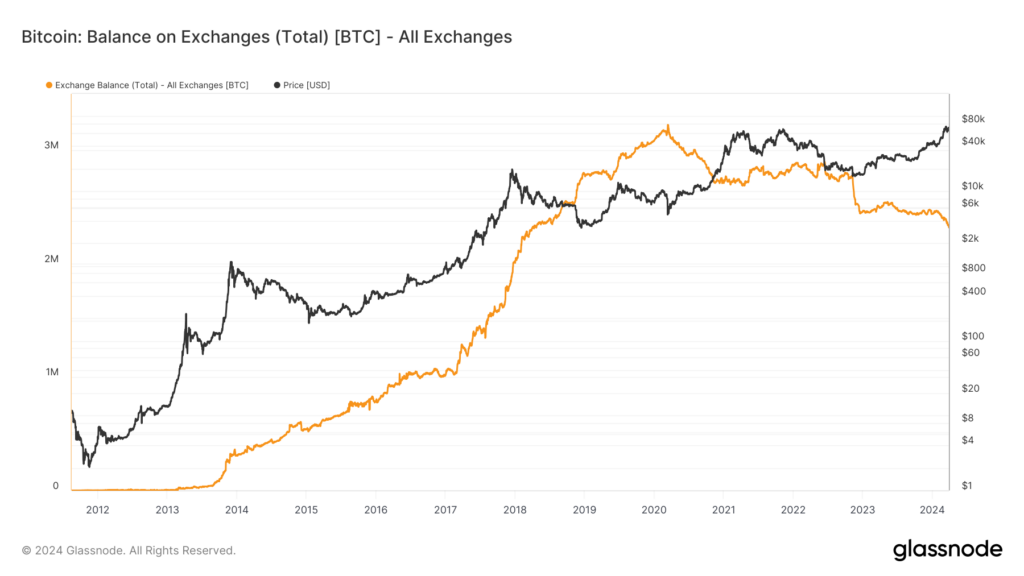

Bitcoin, the leading cryptocurrency, has experienced a monumental shift in recent weeks, with nearly $10 billion in Bitcoin withdrawn from exchanges since the introduction of spot exchange-traded funds (ETFs) in the United States. This development signifies a significant change in the landscape of cryptocurrency trading and ownership.

Cointelegraph reports that over 136,000 BTC have been removed from exchanges since January 11, indicating a strong bullish sentiment among investors. This move suggests that holders are transferring their assets to private wallets, showcasing long-term confidence in Bitcoin’s value.

Bitcoin Balance on Coinbase Plunge to 2018 Low

The launch of U.S. spot Bitcoin ETFs, operational for less than three months, has already resulted in approximately $9.5 billion worth of BTC being withdrawn from major trading platforms. As of March 28, the balance of Bitcoin on Coinbase, one of the largest exchanges, dropped to its lowest level since April 2018, with a combined total of over 2,320,458 BTC.

The pace of withdrawals shows no signs of slowing down. On March 27 alone, more than 22,000 BTC, valued at $1.54 billion, were withdrawn, making it the third-largest daily amount in 2024. This outflow coincided with a record transfer of USD Coin (USDC) to Coinbase, hinting at potential upcoming buying pressure.

🚨 Largest #USDC Inflow EVER (!!)

$1.4B USDC just moved into Coinbase. Is strong buying pressure incoming?https://t.co/hdXKZ4CBGH pic.twitter.com/HwZRHtuyor

— Maartunn (@JA_Maartun) March 29, 2024

Analysts are closely monitoring the long-term effects of ETFs on Bitcoin’s supply and price. Predictions indicate a significant supply squeeze could occur within the next six to twelve months, as demand may soon surpass the available Bitcoin for sale. The upcoming block subsidy halving event in mid-April will further intensify this, as the rate of new BTC entering the market will halve, exacerbating the scarcity of the cryptocurrency.

This news report highlights the current state of Bitcoin’s market dynamics, reflecting a robust bullish outlook fueled by strategic financial products and a landmark event in Bitcoin’s history. The anticipation of a supply-demand imbalance presents a compelling narrative for both investors and observers of the cryptocurrency space.

Want reliable crypto signals to capitalize on market swings? Join us on Telegram.

Interested In Getting The “Learn2Trade Experience?”Join Us Here

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.