In a notable development within the cryptocurrency investment realm, U.S. spot Bitcoin Exchange-Traded Funds (ETFs) are witnessing a noteworthy shift in net inflows, reflecting a cautious sentiment among investors amid Bitcoin’s recent retracement from its peak.

On Thursday, the net inflows for these ETFs plunged to a monthly low of $132.5 million, primarily due to a substantial $257.1 million outflow from the Grayscale Bitcoin Trust (GBTC).

[1/4] Bitcoin ETF Flow – 14 March 2024

All data in. $132m net inflow for the day. Strong result, but much weaker than earlier in the week. Blackrock has $345m of inflow, GBTC $257m outflow, while other providers had much lower flow. pic.twitter.com/8tl2H3BTNY

— BitMEX Research (@BitMEXResearch) March 15, 2024

However, despite this downturn, the cumulative net inflows since the inception of spot Bitcoin ETF trading on January 11 have surged to nearly $12 billion, equivalent to over 211,000 bitcoins, according to The Block.

Leading the pack, BlackRock’s IBIT ETF continued its dominance, garnering an additional $345.4 million in inflows, according to data from The Block’s Data Dashboard. VanEck’s HODL ETF followed with $13.8 million in inflows, benefiting from a temporary fee waiver. In a surprising turn, Fidelity’s FBTC ETF, typically a strong performer, witnessed its inflows dip to $13.7 million, the lowest since its launch.

The increasing interest in Bitcoin ETFs is evident, with Cetera Financial Group recently endorsing several ETFs, including BlackRock’s IBIT and Fidelity’s FBTC, for client investment portfolios. Matt Fries, Cetera’s Head of Investment Products, emphasized the firm’s strategic approach to integrating these innovative investment vehicles.

"As expected, we are prudently embracing bitcoin ETFs.”

Financial advisory firms now issuing press releases regarding use of btc ETFs.

In other words, attempting to use btc ETFs as point of differentiation/competitive advantage.

Things getting wild.

Cetera w/ $475bil AUA. pic.twitter.com/VvTcaVczPJ— Nate Geraci (@NateGeraci) March 14, 2024

Nate Geraci, President of the ETF Store, highlighted the growing excitement around Bitcoin ETFs, noting that financial advisory firms are leveraging them as a competitive edge.

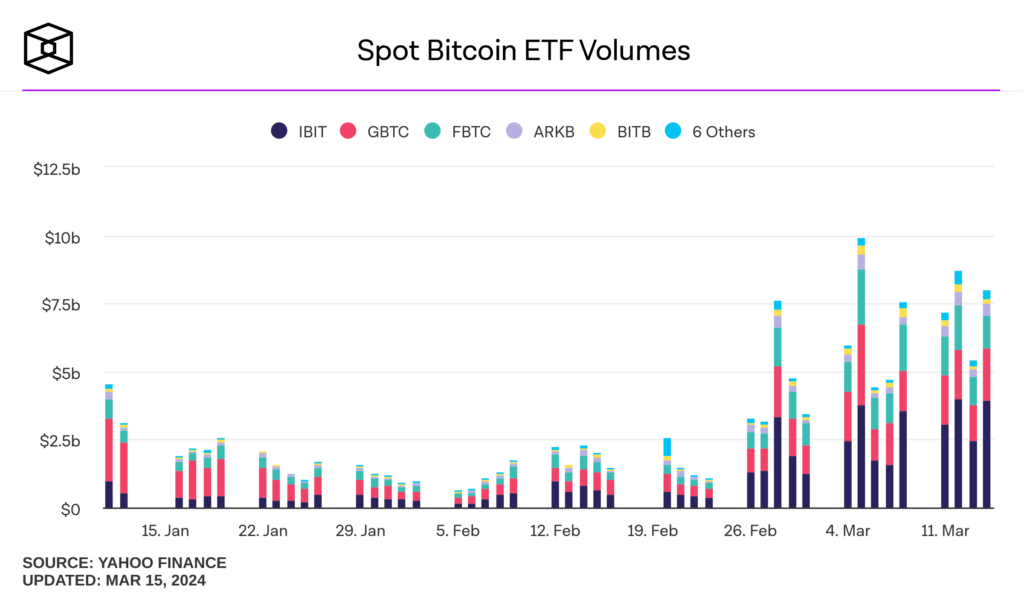

In terms of trading volume, the spot Bitcoin ETFs recorded their third-largest day, with a combined volume of $7.98 billion. BlackRock’s IBIT led with $3.92 billion, followed by Grayscale’s GBTC and Fidelity’s FBTC. Notably, IBIT is nearing a 50% market share by volume, underscoring its growing prominence.

Bitcoin ETFs Shine in March Despite Current Dip in Inflows

The trading activity for Bitcoin ETFs has surged this month, outpacing the volumes of January and February combined. Bloomberg’s ETF analyst Eric Balchunas shared that March’s halfway mark has already seen a staggering $65 billion in volume, setting a new precedent for the sector.

Here's monthly volume for the ten btc ETFs. March is only half over but has already smashed the numbers from Feb and Jan w/ $65b. pic.twitter.com/UpZ6pFgQgt

— Eric Balchunas (@EricBalchunas) March 14, 2024

With the cumulative trading volume for all spot Bitcoin ETFs standing at $135.9 billion, it’s evident that these instruments are carving out a significant niche in the investment world, offering both opportunities and challenges as the market continues to evolve.

Want reliable crypto signals to capitalize on market swings? Join us on Telegram.

Interested In Getting The “Learn2Trade Experience?”Join Us Here

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.