Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you are unlikely to be protected if something goes wrong. Take 2 minutes to learn more

With Bitcoin resuming its northward movement, the crypto market seems to be bubbling back to life. On this week’s list of trending coins, Bitcoin has taken its rightful place as king among other trending assets. Let’s take a closer look at the market below.

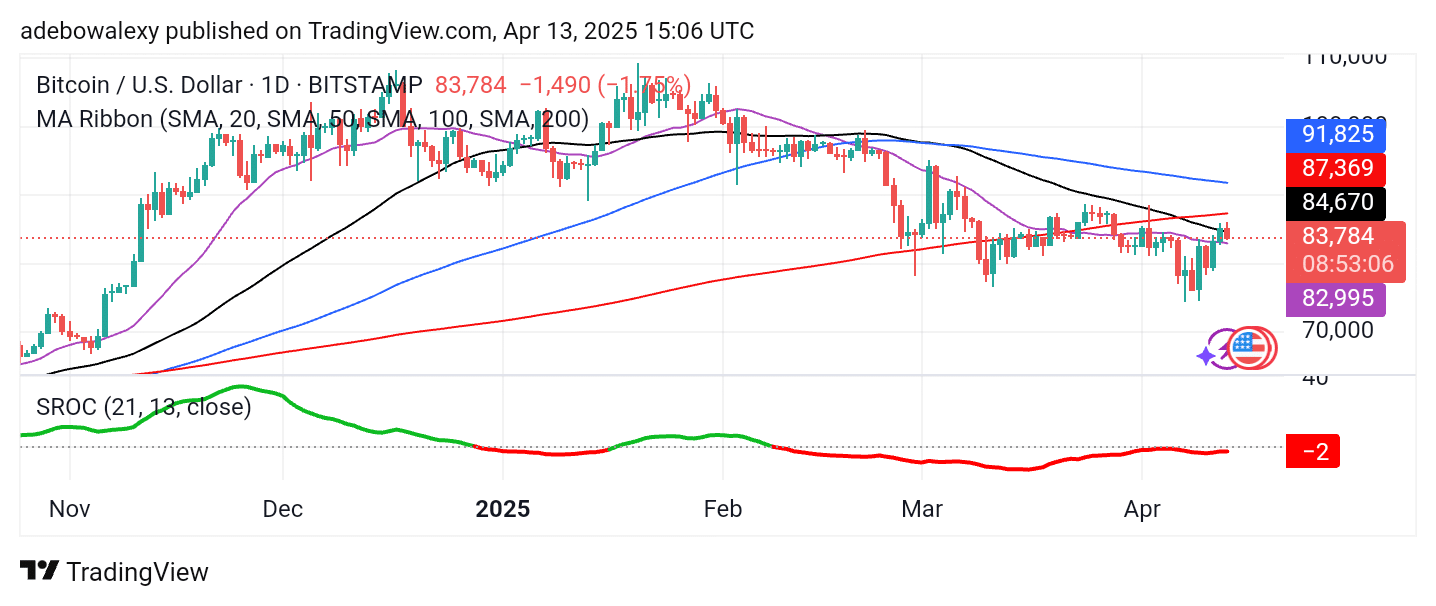

Bitcoin (BTC)

Major Bias: Bearish

As mentioned earlier, Bitcoin tops this week’s list of trending cryptocurrencies. At the time of writing, the coin has seen a 1.09% price increase over the past 24 hours and a 1.54% gain over the past 7 days. Also, It currently holds a market capitalization of $1.67T and a trading volume of $27.47B.

On the price chart, price action is on a steep upward trajectory. Although there have been a few pauses along the way, the upward momentum has continued. The last two price candles have breached two out of four Moving Average (MA) lines. However, the latest candle shows a slight downward retracement below the 50-day MA line. The Stochastic Rate of Change (SROC) line is trending slightly upward but remains below the equilibrium level. Since price action has started rising through the MA curves, traders can remain bullish toward the $90,000 price level.

Current Price: $83,784

Market Capitalization: $1.67T

Trading Volume: $27.47B

7-Day Gain/Loss: +1.54%

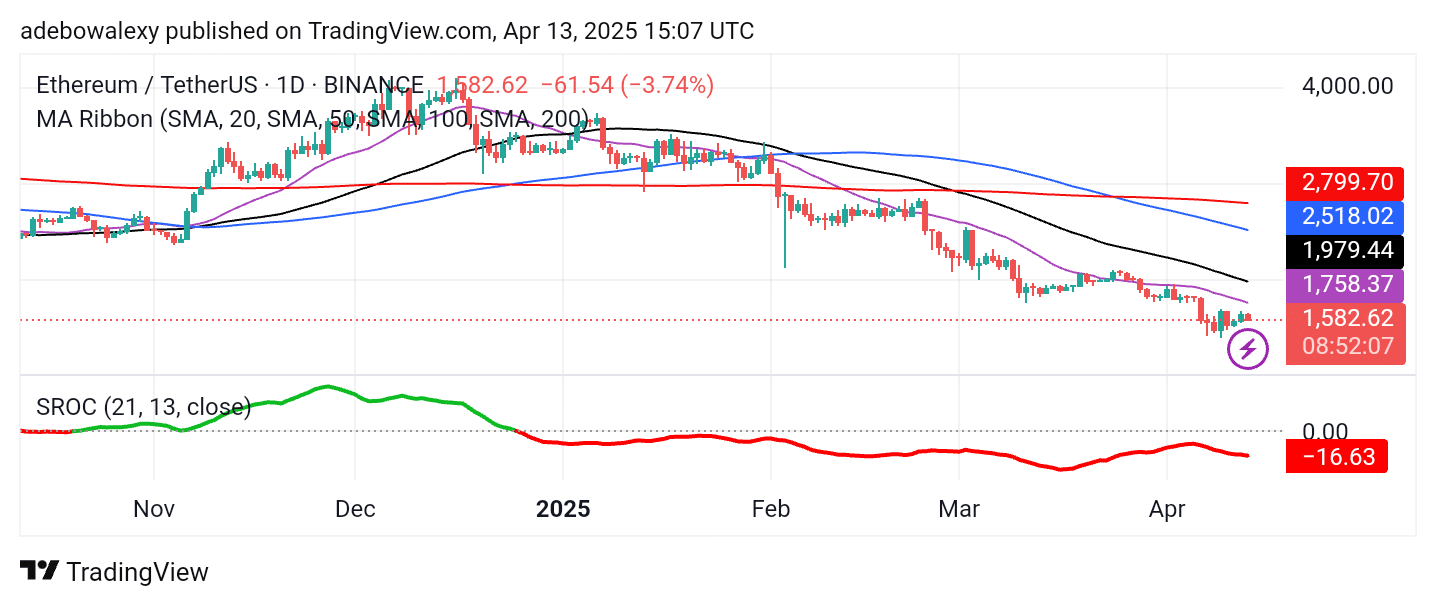

Ethereum (ETH)

Major Bias: Bearish

Ethereum takes the second spot on this week’s trending coins list. The token has recorded a 4.33% price drop in the past 24 hours and a 10.45% decline over the past 7 days. As of now, it boasts a market capitalization of $191.21B and a trading volume of $12.35B.

Meanwhile, the most recent price candle is red, indicating a moderate downward retracement. Price action remains below all MA lines on the chart. The SROC lines are trending below the 0.00 level and show a slight downward slope. Additionally, the indicator line is red, suggesting ongoing bearish momentum and a possible decline toward the $1,500 level.

Current Price: $1,583

Market Capitalization: $191.21B

Trading Volume: $12.35B

7-Day Gain/Loss: –10.45%

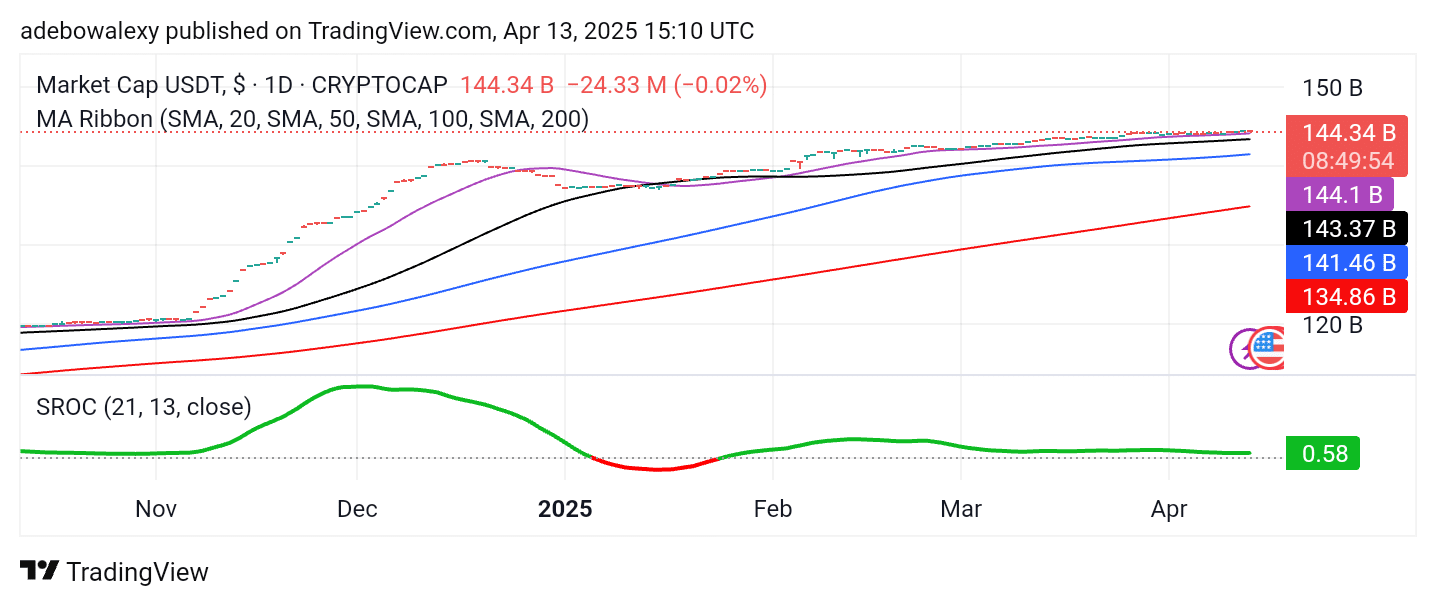

Tether (USDT)

Major Bias: Bullish

Surprisingly yet confidently, Tether makes its way into this week’s list of trending coins. The token appears to have gained enough market traction to secure the third spot. It has shown no price movement over the past 24 hours or the past 7 days, which is expected for a stablecoin. Still, it boasts a market cap of $144.34B and a trading volume of $54.99B.

On the price chart, the token can be seen moving steadily through all MA lines. Albeit, given that USDT is a stablecoin, its price candles appear very small. Nevertheless, the market is expanding, and the growing market cap reflects continued demand and use.

Current Price: $0.9960

Market Capitalization: $144.34B

Trading Volume: $54.99B

7-Day Gain/Loss: 0.00%

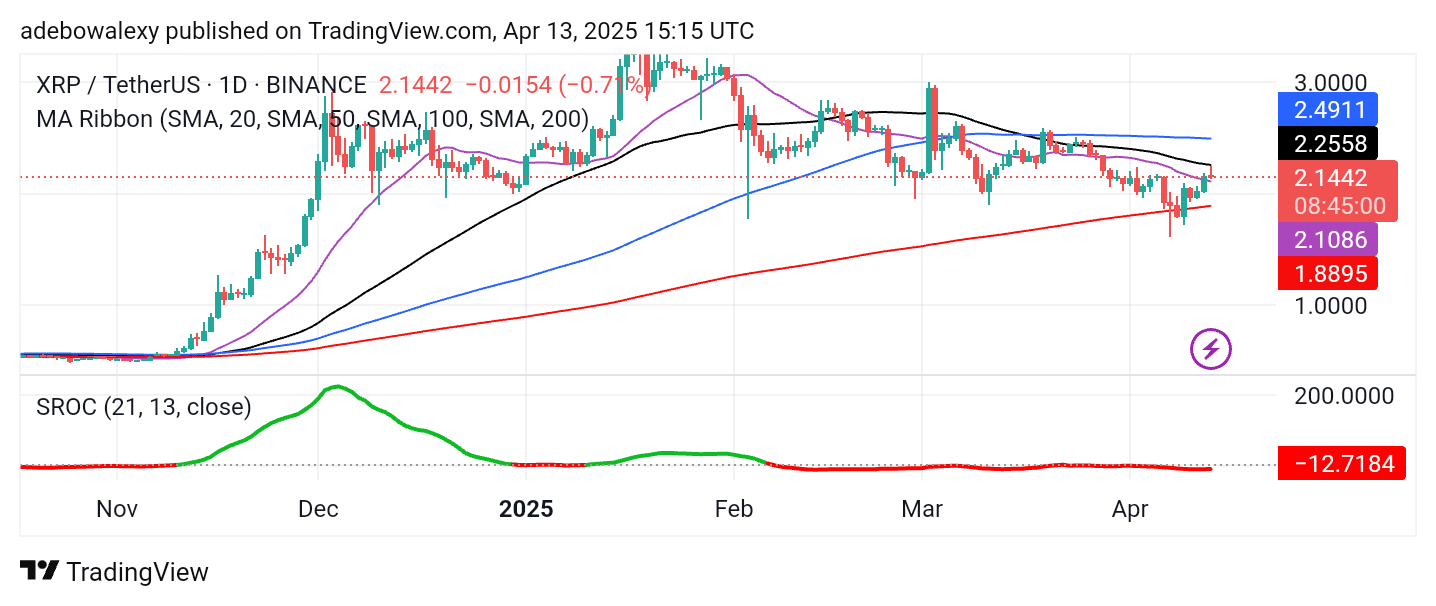

XRP

Major Bias: Bearish

In fourth position is the XRP token, which has experienced a 0.63% price decline over the past 24 hours. Over the last 7 days, it has gained 2.55%. The token currently has a market capitalization of $125.01B and a trading volume of $3.88B.

XRP is currently hovering just above the 20-day MA line. The last price candle is red and compressed, suggesting that bearish pressure is at play. At the same time, the SROC indicator lines are trending sideways below the equilibrium level. Despite the bearish signals, traders may still hope for a continued upward retracement toward the $2.50 price level.

Current Price: $2.144

Market Capitalization: $125.01B

Trading Volume: $3.88B

7-Day Gain/Loss: +2.55%

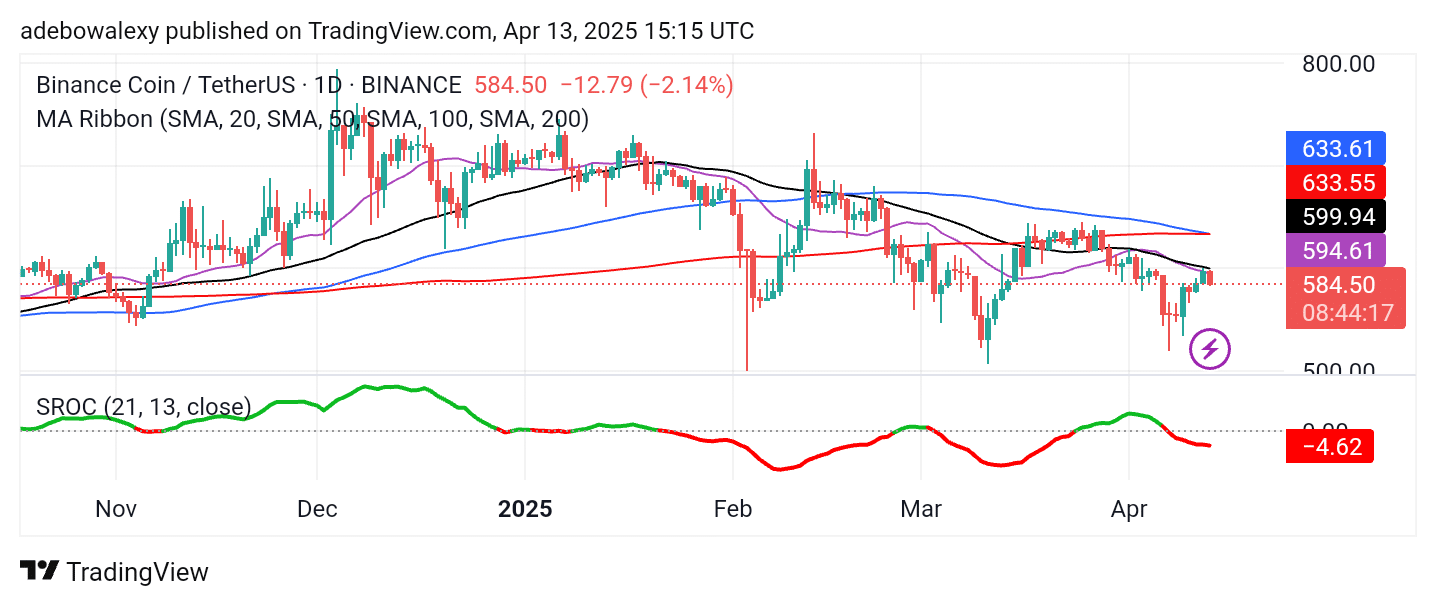

BNB (Binance Coin)

Major Bias: Bearish

Rounding out the list is BNB, which has seen a 2.45% price decline over the past 24 hours, but a slight 0.29% gain over the last 7 days. The token currently has a market capitalization of $83.27B and a trading volume of $1.28B.

BNB’s price action has reversed downward after testing resistance at the 20-day MA line. Also, the most recent price candle reflects a moderate drop, keeping the token trading below the MA lines. In addition, the SROC indicator has fallen below the equilibrium level. While the terminal end of the indicator is now trending sideways, the convergence of the 100- and 200-day MA lines poses resistance that could challenge any upward movement.

Current Price: $584.50

Market Capitalization: $83.27B

Trading Volume: $1.28B

7-Day Gain/Loss: +0.29%

Do you want to take your trading to the next level? Join the best platform for that here.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.