Market Analysis – April 14

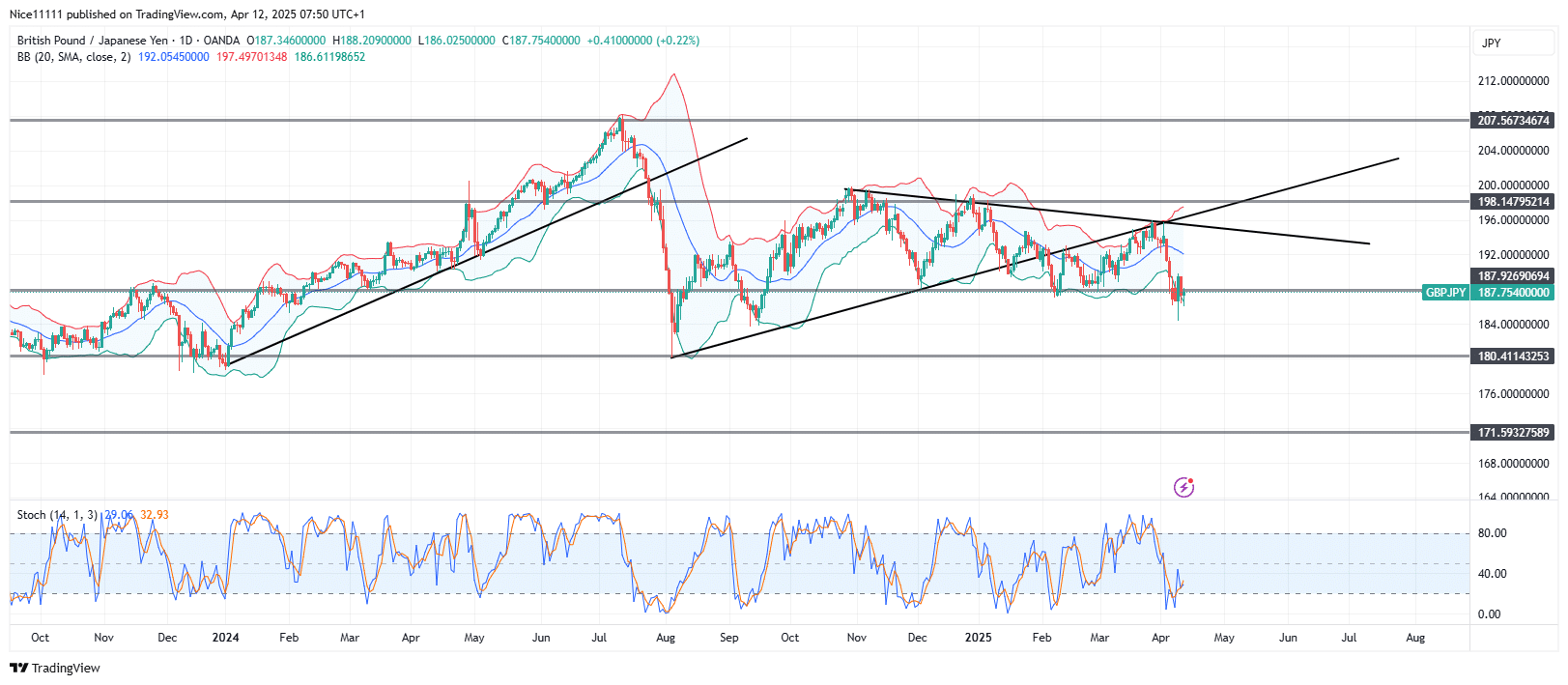

The GBPJPY pair had been riding high on the back of a bullish trendline, with the price action forming a series of three rising valleys that steadily pushed the market upwards. This upward trajectory ultimately led to the resistance zone at 198.00. However, the bullish momentum was short-lived, as the market’s structure soon unravelled. This upward movement was short-lived, and the market’s vulnerability became apparent as the price action faltered.

GBPJPY Key Levels

Demand Levels: 188.0, 180.0, 172.0

Supply Levels: 198.0, 207.0, 210.0

Supply Levels: 198.0, 207.0, 210.0

GBPJPY Long-term trend: Bearish

In February, the price broke through the bullish trendline, dashing hopes of a bullish continuation. This significant development marked a shift in market sentiment, as the bears began to dominate the market. The breakdown of the trendline was a clear indication that the bullish momentum had weakened, paving the way for a potential decline.

.

Following the breakout, the price pulled back to a bearish confluence zone, which consisted of a bearish resistance trendline and a previously broken bullish support trendline. The market reached this confluence zone in March, already bearish, which further fueled the selloff. The combination of these technical factors reinforced the bearish outlook, setting the stage for a potential continuation of the downtrend.

GBPJPY Short-term trend: Bearish

GBPJPY Short-term trend: Bearish

The price has recently broken through the support level of 188.0. Although it pulled back and surged above this level, caution is advised. It’s essential to wait for a second break of structure to the upside to confirm a potential reversal, as the erratic price spike upward may resume its bearish motion.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

9.8

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

9

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

9

Learn to Trade

Never Miss A Trade Again

step 1

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

step 2

Get Alerts

Immediate alerts to your email and mobile phone.

step 3

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.

GBPJPY Short-term trend: Bearish

GBPJPY Short-term trend: Bearish