In a notable market development, the US dollar has seen a weakening trend today. This decline is attributed to the recently released data on US inflation for the month of September, which revealed a slight moderation. Consequently, market expectations for further interest rate hikes by the Federal Reserve have eased.

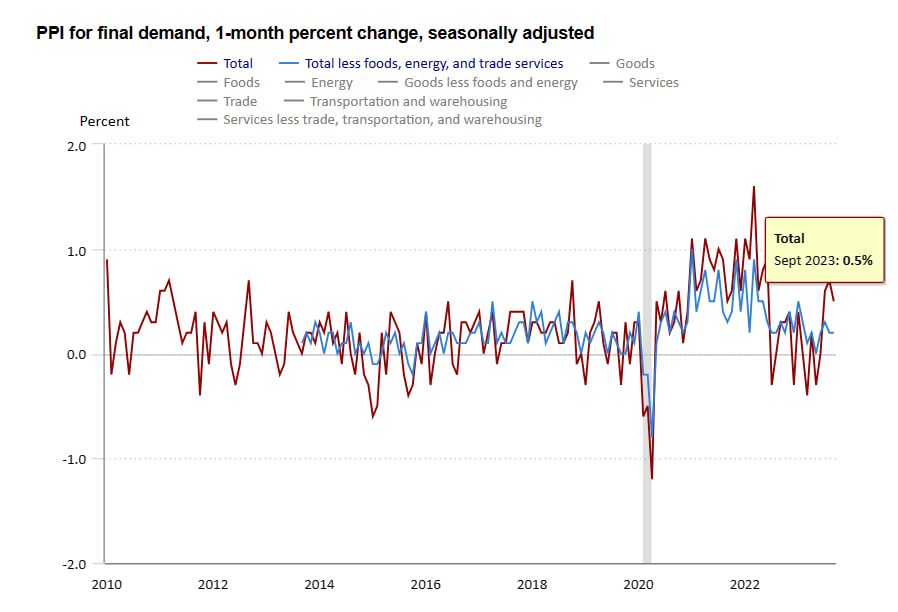

According to the latest Producer Price Index (PPI) report, wholesale-level inflation ticked up by 0.5% last month, surpassing the expected 0.3% increase. However, it’s essential to note that the Core PPI, a figure that excludes volatile items like food and energy, increased by a more modest 0.2%, aligning with August’s statistics. On an annual basis, PPI displayed a 2.2% increase, while Core PPI slowed down slightly from 2.9% to 2.8%.

The softer inflation figures have had a direct impact on the dollar index, a measure of the dollar’s performance against six other key currencies. The index plummeted to a two-week low, settling at 105.559, as the euro surged to its highest level since September 25th at $1.0634.

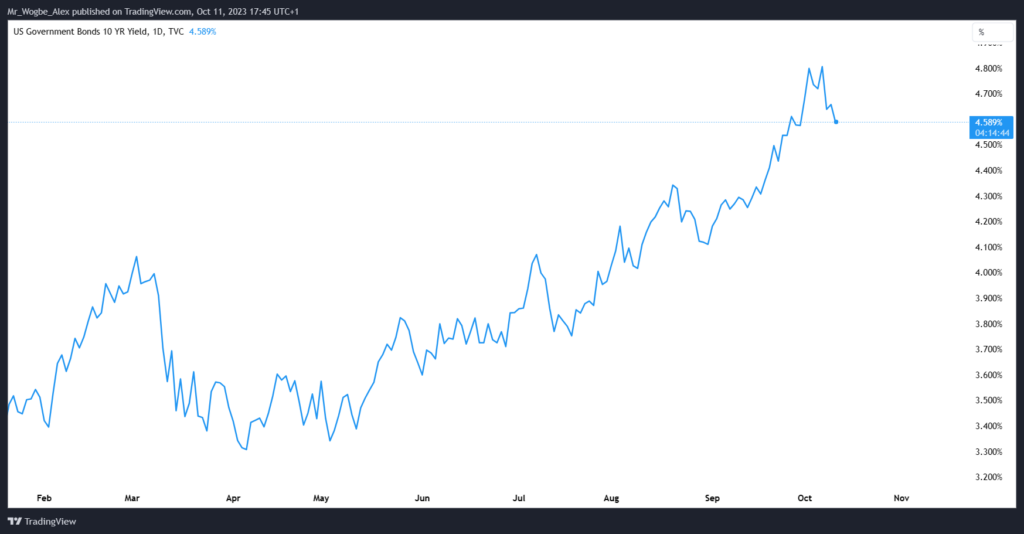

Treasury Yields Drop Weighs on the Dollar

Further compounding the dollar’s woes is the drop in Treasury yields, which reflect market sentiment regarding future Federal Reserve policies. The benchmark 10-year Treasury bond yield witnessed a significant drop of 1.42%, resting at 4.589%. This sharp fall follows the 16-year high of 4.887% achieved last Friday, in response to a robust jobs report.

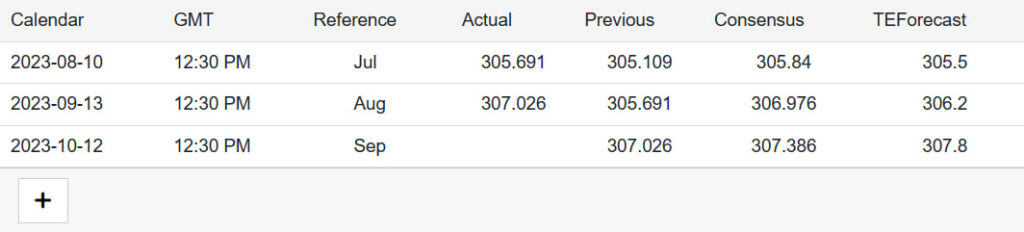

Market enthusiasts are now eagerly anticipating the release of the minutes from the most recent Federal Reserve meeting later today. Additionally, the Consumer Price Index (CPI) report, scheduled for Thursday, is expected to provide further insight into the outlook for interest rates.

It’s worth noting that the Federal Reserve has already raised rates three times this year and hinted at one more hike in December. However, there’s growing skepticism among some Fed officials regarding the necessity for further tightening. They cite concerns like low inflation and global risks as influencing their stance.

One such risk that could have implications for the dollar is the escalating conflict between Israel and Hamas. This conflict stimulated some safe-haven demand for the US currency earlier this week.

Try Out Our Trading Bot Services Today. Get Started Here

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.