Looking at cloud-based indicators such as Ichimoku.

Our Forex Signals

1 - month

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiomonth

3 - month

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiomonth

Most popular

Most popular

6 - month

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiomonth

Lifetime

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratioSeparate Swing Trading Group

Up to 3 signals weekly

Up to 3 signals weekly 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiomonth

1 - month

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiotime

What Is Ichimoku Trading?

The Ichimoku trading strategy is an abbreviation of “Ichimoku Kinko Hyo,” developed by Japanese journalist Goichi Hosoda in the 1960s. This technique has been popular in Japan for quite some time, gaining popularity in other parts of the world as well.

3

Payment methods

Trading platforms

Regulated by

Support

Min.Deposit

Leverage max

Currency Pairs

Classification

Mobile App

Min.Deposit

$100

Spread min.

Variables pips

Leverage max

100

Currency Pairs

40

Trading platforms

Funding Methods

Regulated by

FCA

What you can trade

Forex

Indices

Actions

Cryptocurrencies

Raw Materials

Average spread

EUR/GBP

-

EUR/USD

-

EUR/JPY

0.3

EUR/CHF

0.2

GBP/USD

0.0

GBP/JPY

0.1

GBP/CHF

0.3

USD/JPY

-

USD/CHF

0.2

CHF/JPY

0.3

Additional Fee

Continuous rate

Variables

Conversión

Variables pips

Regulation

Yes

FCA

No

CYSEC

No

ASIC

No

CFTC

No

NFA

No

BAFIN

No

CMA

No

SCB

No

DFSA

No

CBFSAI

No

BVIFSC

No

FSCA

No

FSA

No

FFAJ

No

ADGM

No

FRSA

71% of retail investor accounts lose money when trading CFDs with this provider.

Min.Deposit

$100

Spread min.

- pips

Leverage max

400

Currency Pairs

50

Trading platforms

Funding Methods

Regulated by

CYSECASICCBFSAIBVIFSCFSCAFSAFFAJADGMFRSA

What you can trade

Forex

Indices

Actions

Cryptocurrencies

Raw Materials

Etfs

Average spread

EUR/GBP

1

EUR/USD

0.9

EUR/JPY

1

EUR/CHF

1

GBP/USD

1

GBP/JPY

1

GBP/CHF

1

USD/JPY

-

USD/CHF

1

CHF/JPY

1

Additional Fee

Continuous rate

-

Conversión

- pips

Regulation

No

FCA

Yes

CYSEC

Yes

ASIC

No

CFTC

No

NFA

No

BAFIN

No

CMA

No

SCB

No

DFSA

Yes

CBFSAI

Yes

BVIFSC

Yes

FSCA

Yes

FSA

Yes

FFAJ

Yes

ADGM

Yes

FRSA

71% of retail investor accounts lose money when trading CFDs with this provider.

Min.Deposit

$50

Spread min.

- pips

Leverage max

500

Currency Pairs

40

Trading platforms

Funding Methods

What you can trade

Forex

Indices

Actions

Raw Materials

Average spread

EUR/GBP

-

EUR/USD

-

EUR/JPY

-

EUR/CHF

-

GBP/USD

-

GBP/JPY

-

GBP/CHF

-

USD/JPY

-

USD/CHF

-

CHF/JPY

-

Additional Fee

Continuous rate

-

Conversión

- pips

Regulation

No

FCA

No

CYSEC

No

ASIC

No

CFTC

No

NFA

No

BAFIN

No

CMA

No

SCB

No

DFSA

No

CBFSAI

No

BVIFSC

No

FSCA

No

FSA

No

FFAJ

No

ADGM

No

FRSA

71% of retail investor accounts lose money when trading CFDs with this provider.

Ichimoku Kinko Hyo means “instant look at the balance chart”. Based on other charting indicators like candlesticks and moving averages, it is considered to be a technical strategy. Basically, Ichimoku trading involves a group of indicators or strategies that identify the prevailing trend. It uses multiple-point moving averages that are calculated based on the median price of the candlesticks or (high+low)/2.

Goichi Hosoda: Developer of Ichimoku Trading

The Six Components Of The Ichimoku Indicator

Tenkan Sen (red line): Calculated as the middle price for the last 9 candlestick highs-lows. This is an important line in Ichimoku trading because it is an early indicator of the trend. There´s no trend when this line is horizontal but once it takes a direction it is very likely that a trend has begun.

Kijun Sen (blue line): This line follows the last 26 candlesticks. It is slower than the red line so it moves with a time lag. The blue line is used as an indicator of trends.

Senoku span A (green interrupted edge of the cloud): This forms one of the edges of the Kuomo cloud and is the fastest moving line. Seen here crossing over the other; shifting the cloud at its squeezing point. It is calculated as a sum of the two sen lines, divided by two and then plotted 26 periods in advance.

Senoku span B (red interrupted edge of the cloud): This line is the lower edge of the cloud and it is calculated as the average of the high/low of the last 562 candlesticks. It is plotted 26 periods in advance as well, and that’s the reason the cloud stretches further than the last price candlestick.

Kuomo cloud (the gridded area): The space between the two Senoku span lines is called the Kuomo cloud. This cloud changes shape — when the market trades in a horizontal range the cloud is thinner, and when the market is trendy the cloud widens. The stronger the trend the greater the cloud width.

Chikou span (wrinkled green line): This is a lagging indicator because it is calculated by projecting 26 days from today’s closing price. The Chikou span indicates a trend in the same direction that crosses over where the price occurs, earning it the nickname “momentum line.”

Applying The Ichimoku Indicator

On the chart below there is a straighter green line which comes up automatically on the MT4 platform when you add the Ichimoku indicator. While it is not considered a true indicator, it can be very useful to integrate it within the Ichimoku trading strategy. We’ll elaborate on this below.

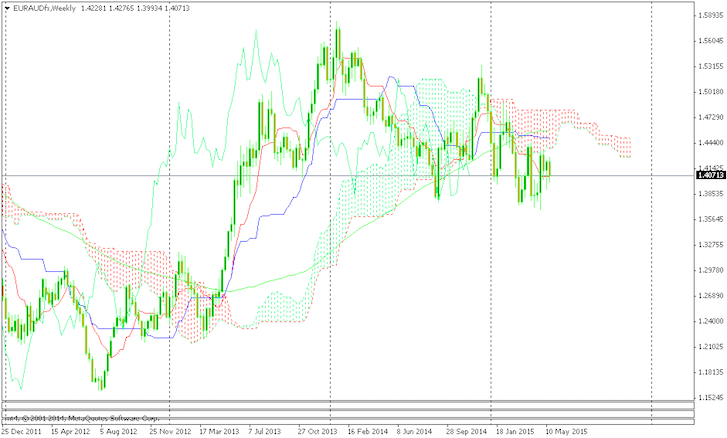

The figure below is the EUR/AUD weekly chart where we see the Ichimoku indicator.

As we explained above, there are many smaller indicators within the more complex Ichimoku indicator. These are more than enough to build several trading strategies, either individually or in combination.

Since the Ichimoku is a trend indicator, it is most effective in trending markets. It may be used in all time frame charts as well. Let’s start by explaining the strategies that each component offers the trader, starting with the leading indicators.

The tenkan sen and the kijun sen are both moving averages. One of the most popular strategies offered by normal moving averages is the crossover. This is the primary Ichimoku trading strategy of these two lines and of the leading indicator.

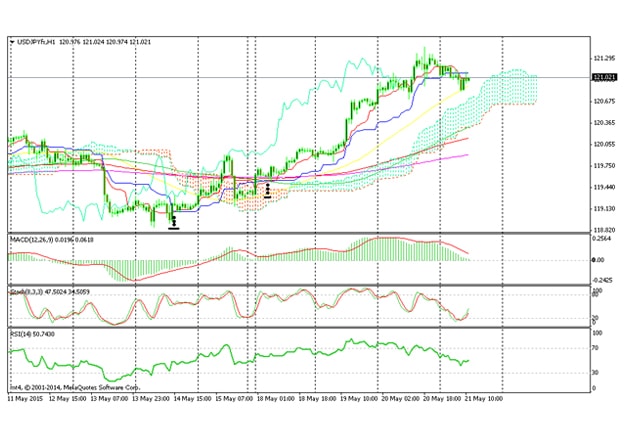

As we can see on the USD/JPY chart above the black dots, the first signal of a possible trend reversal is when the tankan sen (trigger line) crosses over the kijun sen (baseline). This signal alone is enough for the most daring traders to open a buy position. But I prefer to get further confirmation before jumping in feet first.

The main component of the Ichimoku indicator is the cloud. As we said above, the cloud widens when the trend strengthens and minimizes when there is a weak trend. It also changes colors, red when the price is in a downtrend and green when the price is up. These are the default settings but you can always change them.

The main purpose of the cloud is to indicate the trend. If price is above the cloud then we are in an uptrend and vice versa. So, the ultimate confirmation that this indicator offers is price crossing over the cloud.

The Two MA Crossovers Are Buy Signals

I still hesitate to enter a trade immediately after the price breaks above the cloud. Instead, I prefer to sit on the sidelines and wait until the price retraces. This way I can define the risk better and minimize it by placing the stop loss below the lower line of the cloud. After getting in, you can ride the uptrend as long as the price remains above the cloud and the cloud is green. I usually add to the position on the retraces to the tenkan and the kijun lines and trace the original stop below these two lines.

The crossover strategy of these two lines can be applied before the price moves above the cloud. However, the safest way is to use this strategy is after price has crossed the cloud, as you can see on the chart above the second black mark.

Last but not least is the Chickou span line which serves as a momentum indicator. Adding this line to the Ichimoku trading strategy might seem a little complicated but it’s actually quite simple. Since it is a lagging indicator, it acts as trade confirmation. The Japanese traders that implement Ichimoku trading methodology consider this to be the main component. They view the Chickou as confirmation after price has moved above the cloud and the crossover of the tenkan and the kijun lines has occurred.

This strategy is for the more conservative traders and requires patience as it lags price action. It is most effective on the longer period time-frames because you can get whipsawed if you use it on the smaller time-frame charts. You can also add extra indicators to the chart, such as longer period moving averages and a Stochastic. You can combine them with the Ichimoku indicator for an added probability of success.

Summary

The Ichimoku indicator has 5-6 smaller indicators built within, which can be used to form several trading strategies. With so many indicators you have several signals, starting from leading signals to lagging, so you have multiple chances to enter a trade. Ichimoku trading can be used by the impulsive traders who jump in after their leading signal, as well as those traders who are more reserved and prefer to have more than one confirmation before entering a trade.