Candlestick patterns are among the most reliable trading techniques for traders. When it comes to the shooting star candlestick pattern, we must differentiate between a bearish shooting star and a bullish inverted hammer pattern, which is very similar yet gives a completely opposite signal. While shooting star patterns are very easy to identify, it is important to realize that candlestick patterns shouldn’t be the only reason you enter a trade.

3

Payment methods

Trading platforms

Regulated by

Support

Min.Deposit

Leverage max

Currency Pairs

Classification

Mobile App

Min.Deposit

$100

Spread min.

Variables pips

Leverage max

100

Currency Pairs

40

Trading platforms

Funding Methods

Regulated by

FCA

What you can trade

Forex

Indices

Actions

Cryptocurrencies

Raw Materials

Average spread

EUR/GBP

-

EUR/USD

-

EUR/JPY

0.3

EUR/CHF

0.2

GBP/USD

0.0

GBP/JPY

0.1

GBP/CHF

0.3

USD/JPY

-

USD/CHF

0.2

CHF/JPY

0.3

Additional Fee

Continuous rate

Variables

Conversión

Variables pips

Regulation

Yes

FCA

No

CYSEC

No

ASIC

No

CFTC

No

NFA

No

BAFIN

No

CMA

No

SCB

No

DFSA

No

CBFSAI

No

BVIFSC

No

FSCA

No

FSA

No

FFAJ

No

ADGM

No

FRSA

71% of retail investor accounts lose money when trading CFDs with this provider.

Min.Deposit

$100

Spread min.

- pips

Leverage max

400

Currency Pairs

50

Trading platforms

Funding Methods

Regulated by

CYSECASICCBFSAIBVIFSCFSCAFSAFFAJADGMFRSA

What you can trade

Forex

Indices

Actions

Cryptocurrencies

Raw Materials

Etfs

Average spread

EUR/GBP

1

EUR/USD

0.9

EUR/JPY

1

EUR/CHF

1

GBP/USD

1

GBP/JPY

1

GBP/CHF

1

USD/JPY

-

USD/CHF

1

CHF/JPY

1

Additional Fee

Continuous rate

-

Conversión

- pips

Regulation

No

FCA

Yes

CYSEC

Yes

ASIC

No

CFTC

No

NFA

No

BAFIN

No

CMA

No

SCB

No

DFSA

Yes

CBFSAI

Yes

BVIFSC

Yes

FSCA

Yes

FSA

Yes

FFAJ

Yes

ADGM

Yes

FRSA

71% of retail investor accounts lose money when trading CFDs with this provider.

Min.Deposit

$50

Spread min.

- pips

Leverage max

500

Currency Pairs

40

Trading platforms

Funding Methods

What you can trade

Forex

Indices

Actions

Raw Materials

Average spread

EUR/GBP

-

EUR/USD

-

EUR/JPY

-

EUR/CHF

-

GBP/USD

-

GBP/JPY

-

GBP/CHF

-

USD/JPY

-

USD/CHF

-

CHF/JPY

-

Additional Fee

Continuous rate

-

Conversión

- pips

Regulation

No

FCA

No

CYSEC

No

ASIC

No

CFTC

No

NFA

No

BAFIN

No

CMA

No

SCB

No

DFSA

No

CBFSAI

No

BVIFSC

No

FSCA

No

FSA

No

FFAJ

No

ADGM

No

FRSA

71% of retail investor accounts lose money when trading CFDs with this provider.

In fact, experienced traders are always looking for a confluence of different indicators and patterns, because multiple confirmations increase the probability of a successful trade tremendously. So without further ado, let’s dive right into the explanation of the shooting star candlestick pattern.

What Is A Candlestick Pattern?

Candlestick patterns are all patterns related to the formation of the candlesticks. A candlestick shows the price movement of any given security/asset in any given timeframe. E.g. if you have chosen the weekly chart as your timeframe, one candlestick represents the price movement of one week for your selected pair. A candlestick consists of a wick and a body. While the body shows the opening and closing prices of the given timeframe, the wick shows us where the price was within the timeframe. The position and formation of the candlestick give us either a bullish or a bearish signal.

What Is A Shooting Star Candlestick Pattern?

The shooting star candlestick pattern is a bearish candlestick pattern, therefore it indicates us to sell our position or to open a short position. It must appear after an uptrend and typically marks the end of such uptrend. While the shooting star pattern might indicate a potential sell-off, it can be invalidated if the candlestick pattern is followed by a continuation of the uptrend. However, this is less frequently the case as that uptrend is followed by a price correction towards the downside after such a candlestick pattern has been formed. That’s why it is a pattern in the first place and not just a regular, irrelevant candlestick.

How Does A Shooting Star Candlestick Pattern Look Like?

Whether the shooting star candlestick is colored red or green is irrelevant. Furthermore, the distance between the top of the wick and the opening price must be more than twice as big as the shooting star candlestick’s body. In addition, there should be little to no wick below the real body. It can appear in many different variations:

A typical shooting star candlestick pattern which formed a red shooting star which was followed by a green candle. The green candle was a false invalidation signal and was quickly followed by a steep decrease in price.

A perfect example of a shooting star, although the candle is green. As you can see, it appeared after a strong uptrend and was directly followed by a harsh downturn movement. The wick is long and to the upside, while the body is short and there is almost no wick underneath the shooting star’s body.

Another great example of how a shooting star candlestick pattern can look like: It can also appear after a downtrend tries to reverse the trend by upward movements. However, the reversal failed as the shooting star candlestick initiated a continuation of the downtrend.

It is important to differentiate between the bearish shooting star pattern and the bullish inverted hammer pattern. Both show the same candlestick formation; however, the position is different. In fact, the bullish inverted hammer candlestick pattern indicates an uptrend and is often followed by a bullish hammer-like candlestick formation.

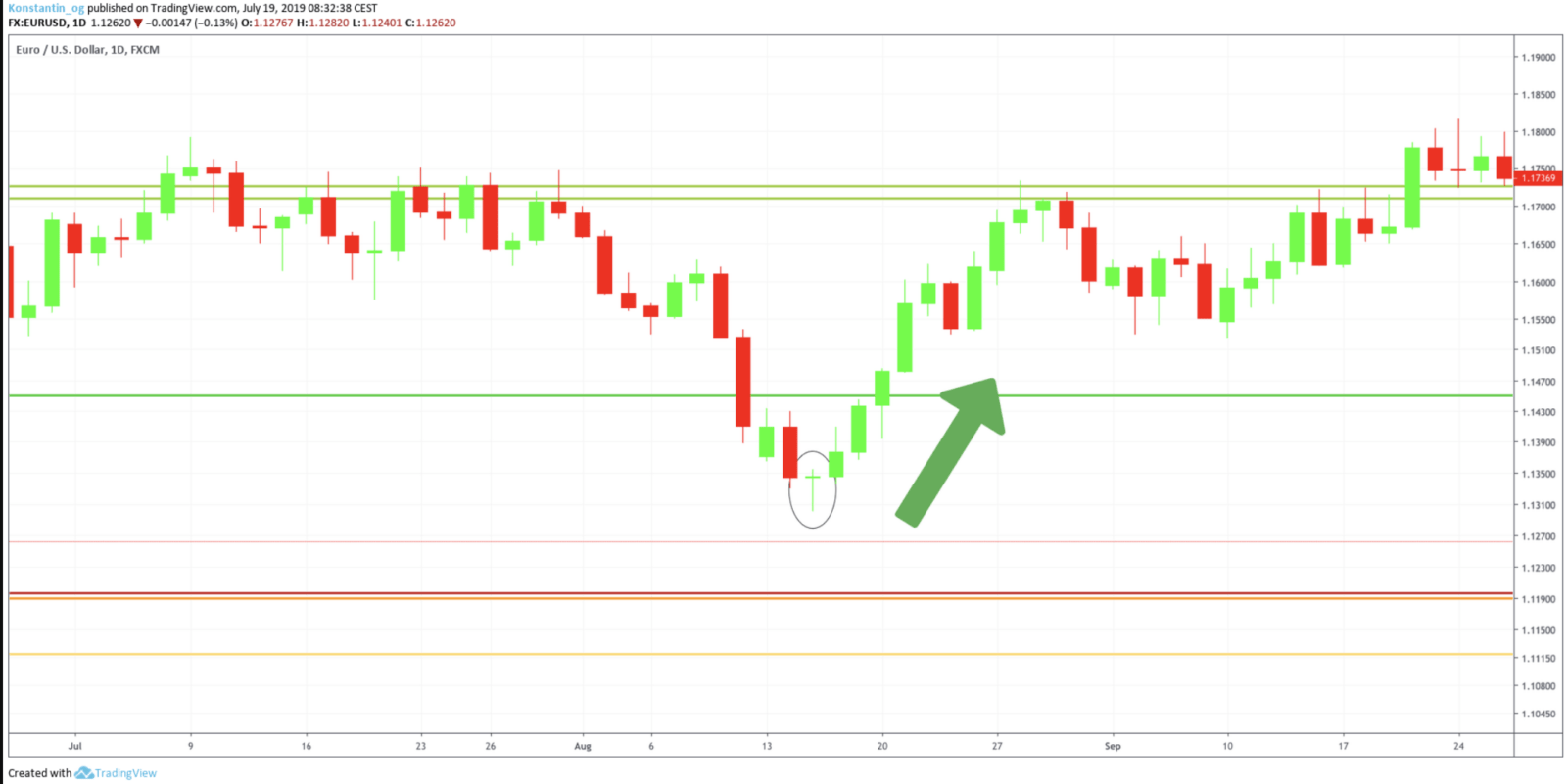

As seen in the chart, both inverted hammer candlestick patterns resulted in a heavy upward movement.

Another differentiation is the bullish hammer, which is exactly the opposite of a shooting star candlestick formation. The bullish hammer appears after a price correction or downtrend and indicates a trend reversal towards the upside. Here, the position of the bullish hammer candlestick formation is perfectly positioned, although the candlestick’s body is quite small. Ideally, there is nil to very little space above the hammer’s body.

Limitations Of Candlestick Analysis

It is important to acknowledge that one candle is often not meaningful enough to estimate the chances of a potential reversal. First and foremost, the timeframe is a very important factor for the significance of candlestick analysis. The higher the timeframe, the more significant is the candlestick pattern. For example, a shooting star in the weekly chart is more bearish than a shooting star in the 4-hour chart.

Confluence Of Technical Indicators

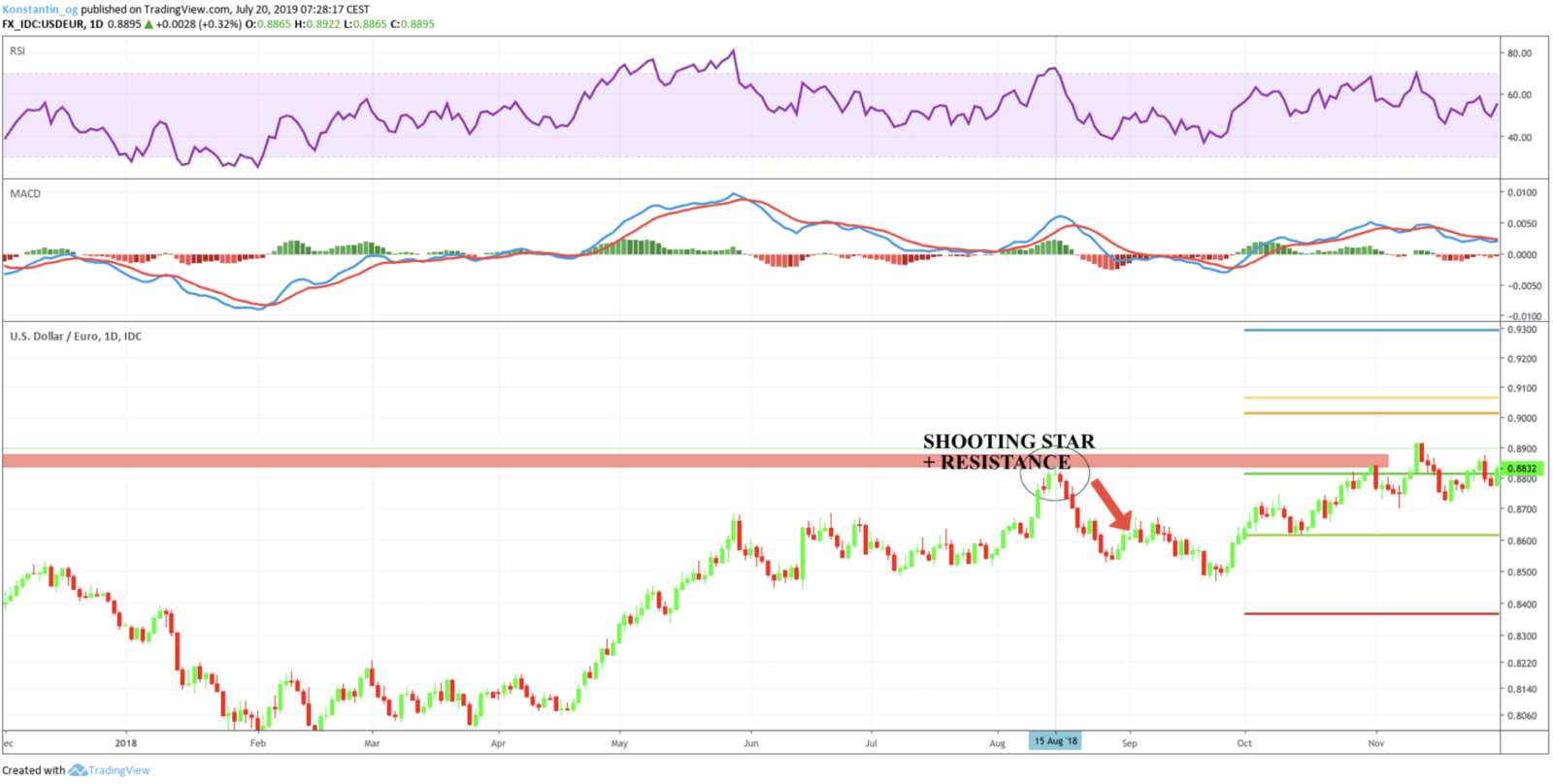

Furthermore, experienced traders always look out for confluence. Confluence describes the event of multiple indicators pointing in the same direction. Therefore, we will always search for multiple confirmations, e.g. one could only sell a shooting star candlestick formation if the price reaches a resistance area at the same time. Also, it is very important to wait for the candlestick to be formed and not to sell a shooting star candlestick formation as long as the candlestick wasn’t closed yet.

In the example above, you can see a perfect example of the confluence of two different tools of technical analysis: The shooting star candlestick pattern was formed exactly at the resistance area, which was followed by an immense downturn.

What’s more, this would have been a perfect trade as we could have found multiple confirmations: Not only was a shooting star candlestick pattern formed in strong resistance area, but the RSI was in overbought regions while the MACD lines peaked at a very high range. The combination of multiple indicators pointing in the same direction gives us great probability to win a trade.

Confirmation & Stop-Loss

However, even with confirmation, there is no guarantee that the price will continue to fall, or how far it will go. Unlike other patterns, a shooting star candlestick pattern gives no hint or target on how much the price will move. In fact, a shooting star candlestick patterns only indicate the price to decline, but the price could still keep advancing in alignment with the longer-term uptrend.

That’s why stop-loss orders are always advised to make use of. Stop-loss orders enable you to manage your risk if your original plan doesn’t work out as you wanted it to.