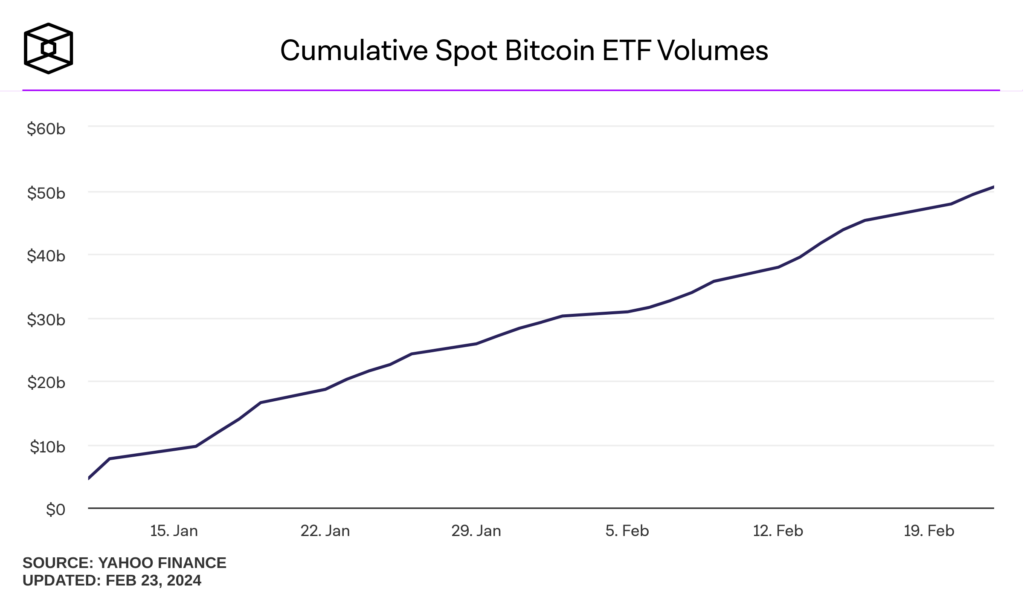

In the last six weeks, demand for spot Bitcoin exchange-traded funds (ETFs) has surged, with trading volumes surpassing $50 billion, according to data from The Block.

This growth follows the Securities and Exchange Commission’s (SEC) approval of the first batch of spot Bitcoin ETFs on January 11, which paved the way for fund providers like BlackRock, Fidelity, and Bitwise to launch their products.

Trading Volume of Bitcoin ETFs Surged By 78% in February

From early February to the end of trading on Thursday, volumes for spot Bitcoin ETFs surged from $28.3 billion to $50.5 billion.

The highest daily trading volume reached over $2.5 billion on Tuesday, with Thursday’s volume at $1.2 billion. Among the leading funds, BlackRock’s IBIT led with $457.2 million, followed by Grayscale’s GBTC and Fidelity’s FBTC at $348.8 million and $255.7 million, respectively.

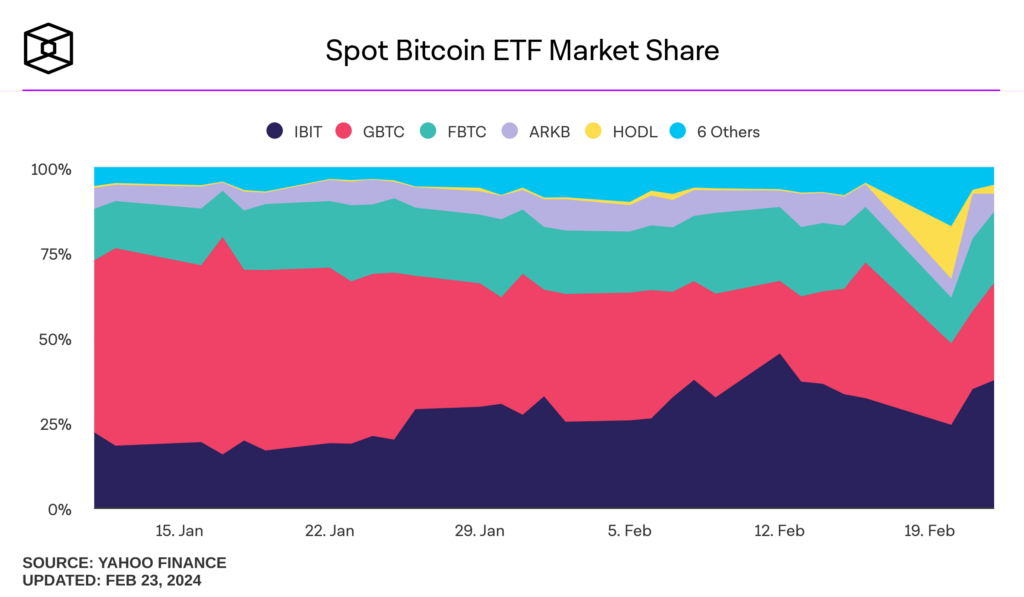

Grayscale’s GBTC, previously a trust, saw its market share drop to 28.6% from 50.5% as investors favored lower-fee alternatives. Conversely, BlackRock’s IBIT increased its market share from 22.1% to 37.4%, with Fidelity’s FBTC at 20.9%.

On Thursday, net inflows for spot Bitcoin ETFs reached $251.4 million, following net outflows of $35.7 million on Wednesday. Fidelity’s FBTC attracted the most inflows, adding $158.9 million, while Grayscale’s GBTC experienced the most outflows, losing $55.7 million. Total net flows now stand at around $5.3 billion.

[1/3] Bitcoin ETF Flow – Up to 22 Feb 2024

All data in. +$251.4m net flow on 22nd Feb. A strong day. pic.twitter.com/IdrCmgq5u8

— BitMEX Research (@BitMEXResearch) February 23, 2024

Excluding Grayscale’s GBTC, the nine new spot Bitcoin ETFs have accumulated nearly 300,000 BTC, with 292,615 BTC in assets under management, equivalent to around $14 billion, according to BitMEX Research.

In contrast, Grayscale’s GBTC has seen a drop in Bitcoin holdings, decreasing from around 619,000 BTC on January 11 to 454,660 BTC ($24 billion) as of Thursday.

Bitcoin is currently trading at $51,138, down approximately 2% over the past week but up 29.4% this month and 21% year-to-date.

Interested In Getting The “Learn2Trade Experience?”Join Us Here

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.