Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you are unlikely to be protected if something goes wrong. Take 2 minutes to learn more

TONUSD Analysis – January 21

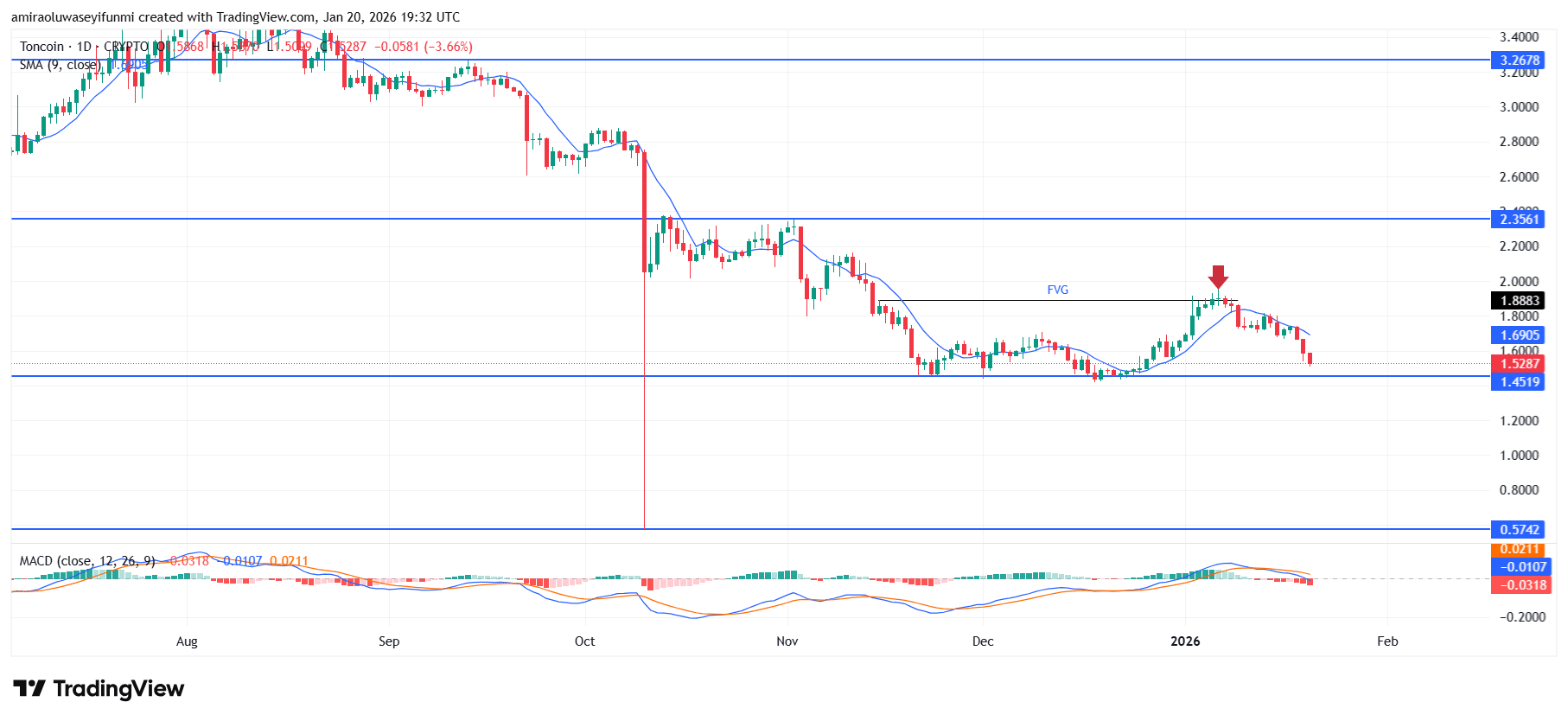

TONUSD falls lower after a liquidity grab above $1.8890. The pair continues to trade within a broader bearish framework, with daily price action holding below the 9-period moving average and momentum indicators remaining aligned to the downside. The MACD stays below the zero line with a fading histogram, indicating sustained selling pressure rather than short-term exhaustion. This technical setup suggests the dominant trend remains defensive, with upside moves viewed as corrective instead of impulsive.

TONUSD Key Levels

Supply Levels: $2.3560, $3.2680

Demand Levels: $1.4520, $0.5740

TONUSD Long-Term Trend: Bearish

TONUSD has been unable to reclaim prior support between $1.880 and $1.690, both of which have now transitioned into overhead supply zones, while price continues to register lower highs. Bearish control was reinforced by the recent rejection from the fair value gap area around $1.880, which triggered further downside continuation. At current levels, price is rotating marginally above the $1.450 support zone, pointing to a fragile and subdued demand response.

A sustained daily close below $1.450 would likely expose TONUSD to further downside toward the macro support near $0.570. Any short-term rebounds below $1.690 are expected to attract renewed selling interest, keeping the broader bias tilted to the downside. Overall, the outlook remains skewed toward continuation of the bearish trend until price can recover and hold above $1.880.

TONUSD Short-Term Trend: Bearish

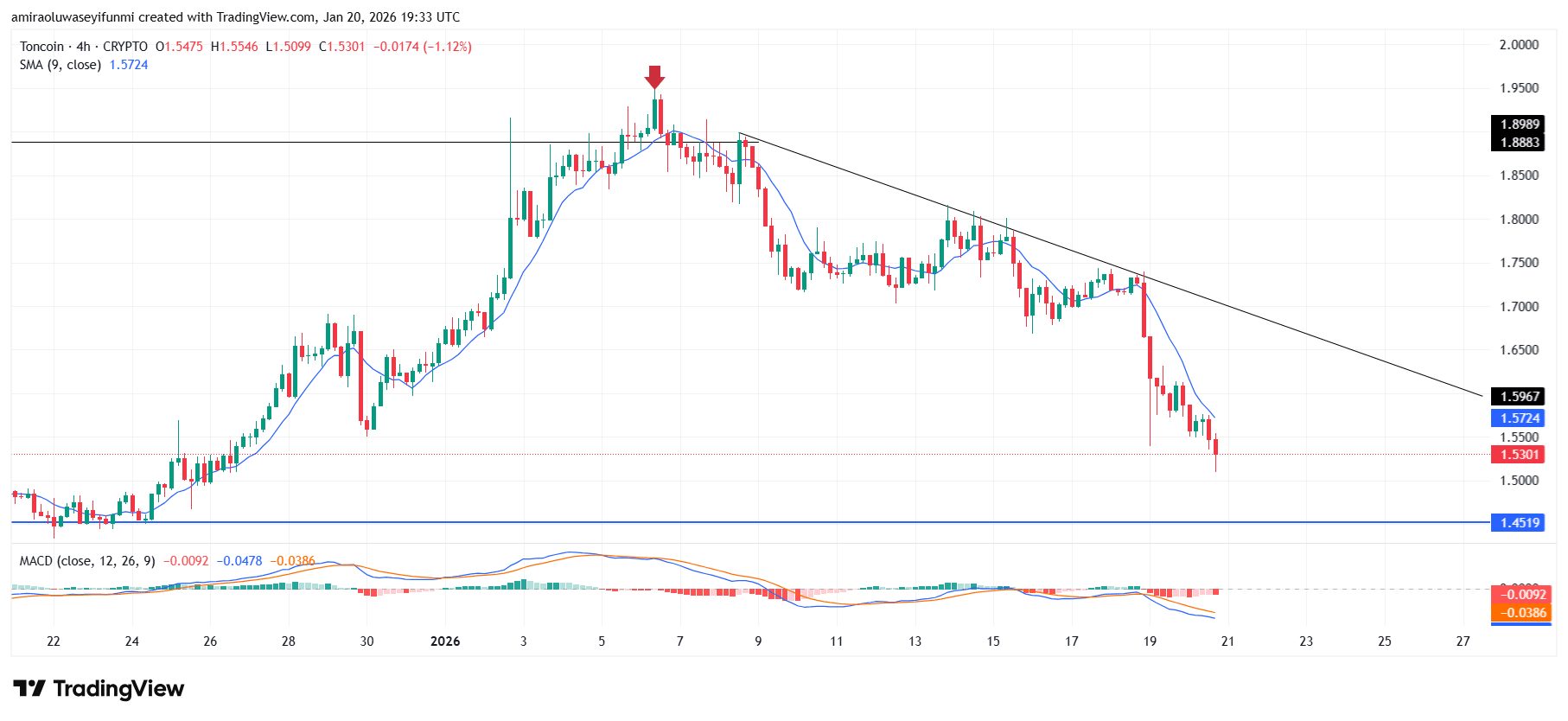

On the four-hour chart, TONUSD remains firmly under bearish control, with price trading below the descending trendline and the 9-period moving average. The sharp breakdown from the $1.720–$1.750 zone confirms renewed selling pressure and continuation of the lower-high structure. Momentum indicators reinforce the downside bias, as the MACD remains below zero with expanding negative momentum. As long as price stays below $1.600, downside risk persists toward the $1.450 support area, a scenario closely monitored through prevailing crypto signals.

Make money without lifting your fingers: Start using a world-class auto trading solution

How To Buy Lucky Block

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset, product, or event. We are not responsible for your investment results.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.