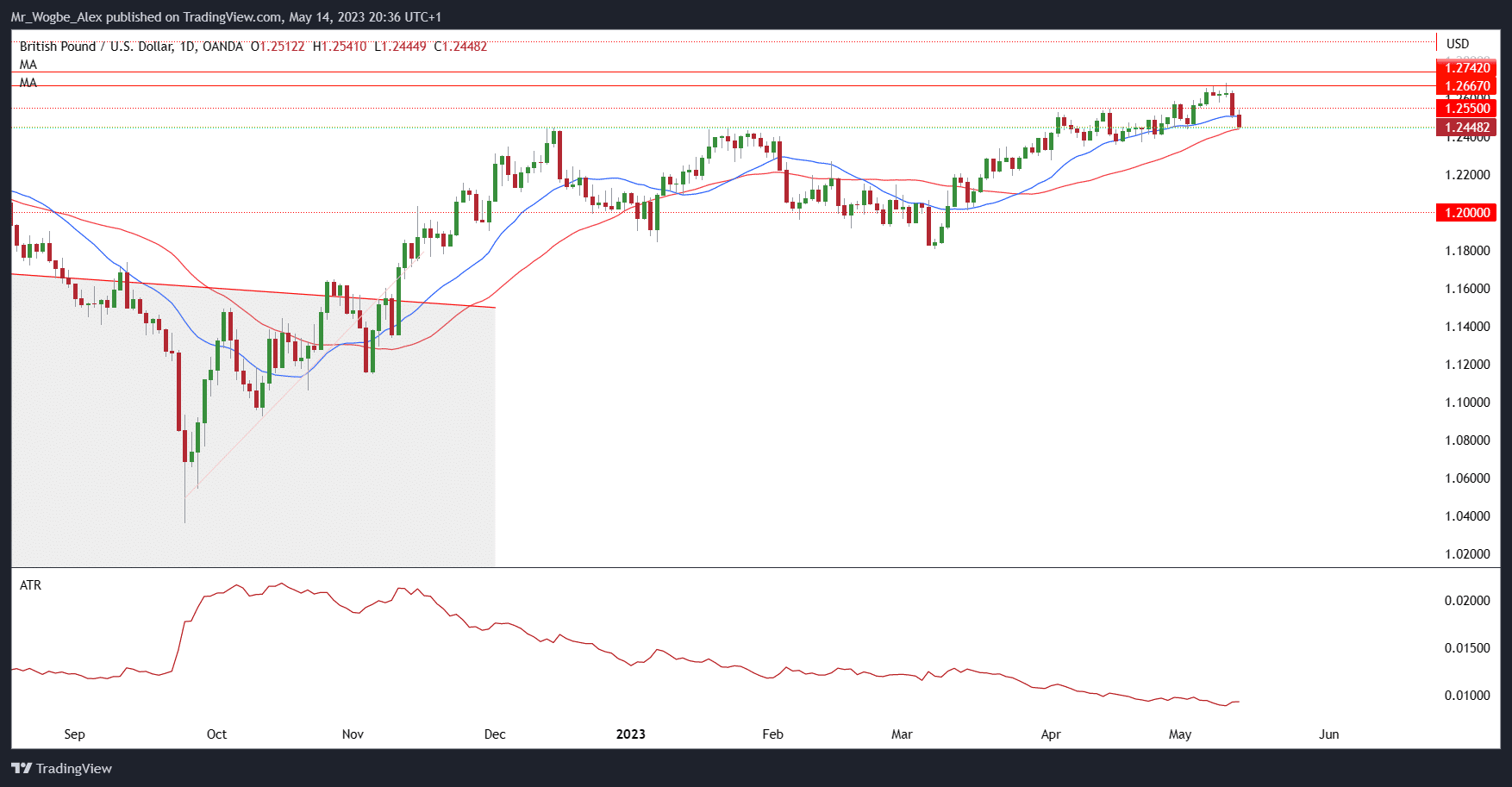

The British pound (GBP) is enduring a continued decline following the recent meeting of the Bank of England (BoE). In Friday’s trading, the GBP/USD pair slipped below the critical psychological level of 1.2500, hitting 1.2448.

Although the sell-off is primarily influenced by the strength of the US dollar, it’s worth noting that the pound managed to make modest gains against the euro. As we shift our focus to the week ahead, all eyes are on key economic indicators, particularly UK employment and wage data, as these factors are poised to play a significant role in shaping the future movement of the GBP.

The Weight of Wage Data on GBP

The Bank of England has made it abundantly clear that the path it chooses in June will heavily depend on two crucial sets of wage and inflation data releases. With two policymakers, Dhingra and Tenreyro, already voting in favor of holding off on rate hikes, wage growth figures will hold tremendous significance in influencing the Bank’s decisions.

While recent indicators from the BoE Business Survey hint at a potential moderation in wage growth, all eyes are fixed on Tuesday’s reading. If wage growth exceeds expectations, it could raise the probability of rate hikes, sparking renewed demand for the pound. Conversely, a decline in wage growth may solidify the belief among market participants that the BoE will opt for a pause in its tightening measures come June.

Delicate Market Sentiment and Lingering US Debt Ceiling Concerns

The overall market sentiment remains rather fragile, with mounting uncertainty surrounding the US debt ceiling casting a shadow over traders’ moods. While this particular issue may not have a direct impact on the pound, the GBP/USD pair could face challenges from a US dollar perspective.

Surprisingly, the US debt default situation has unexpectedly favored the US dollar as investors flock to safe-haven assets in search of stability. In this context, the Japanese yen (JPY) has also enjoyed the benefits. This poses a downside risk for GBP/USD, as any developments related to the US default or increased fears of a global recession are likely to send ripples across financial markets.

You can purchase Lucky Block – Guide, Tips & Insights | Learn 2 Trade here. Buy LBLOCK

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.