Brace yourselves, folks, because the Bank of England (BoE) is gearing up for some action! In response to the unyielding and downright stubborn inflationary pressures plaguing the UK, the central bank is set to unleash a 25 basis point increase in the bank rate during their highly anticipated monetary policy meeting next Thursday. They’re donning their armor, ready to combat the relentless inflation beast.

The UK headline inflation rate has been loitering in double-digit territory for a record-breaking seven months in a row. We’re talking about an eye-watering 10.1% here, people! And if that’s not enough to make your pockets feel lighter, UK inflation is prancing around at 6.2%, just a mere 0.3% away from its highest point in decades, which we witnessed back in September and October of last year.

BoE Governor’s Speech to Sway the Pound’s Price Action

As always, the spotlight is on BoE Governor Bailey. His words, like magical spells, have the power to sway Sterling’s fate. What he says in his post-decision statement and during the press conference will send ripples through the currency markets. If the BoE has faith that inflation will go down faster than a rollercoaster, they might hint that future rate hikes aren’t set in stone and will be determined by the data that comes their way.

GBP/USD Cedes Gains Partially Following Sharp Rise

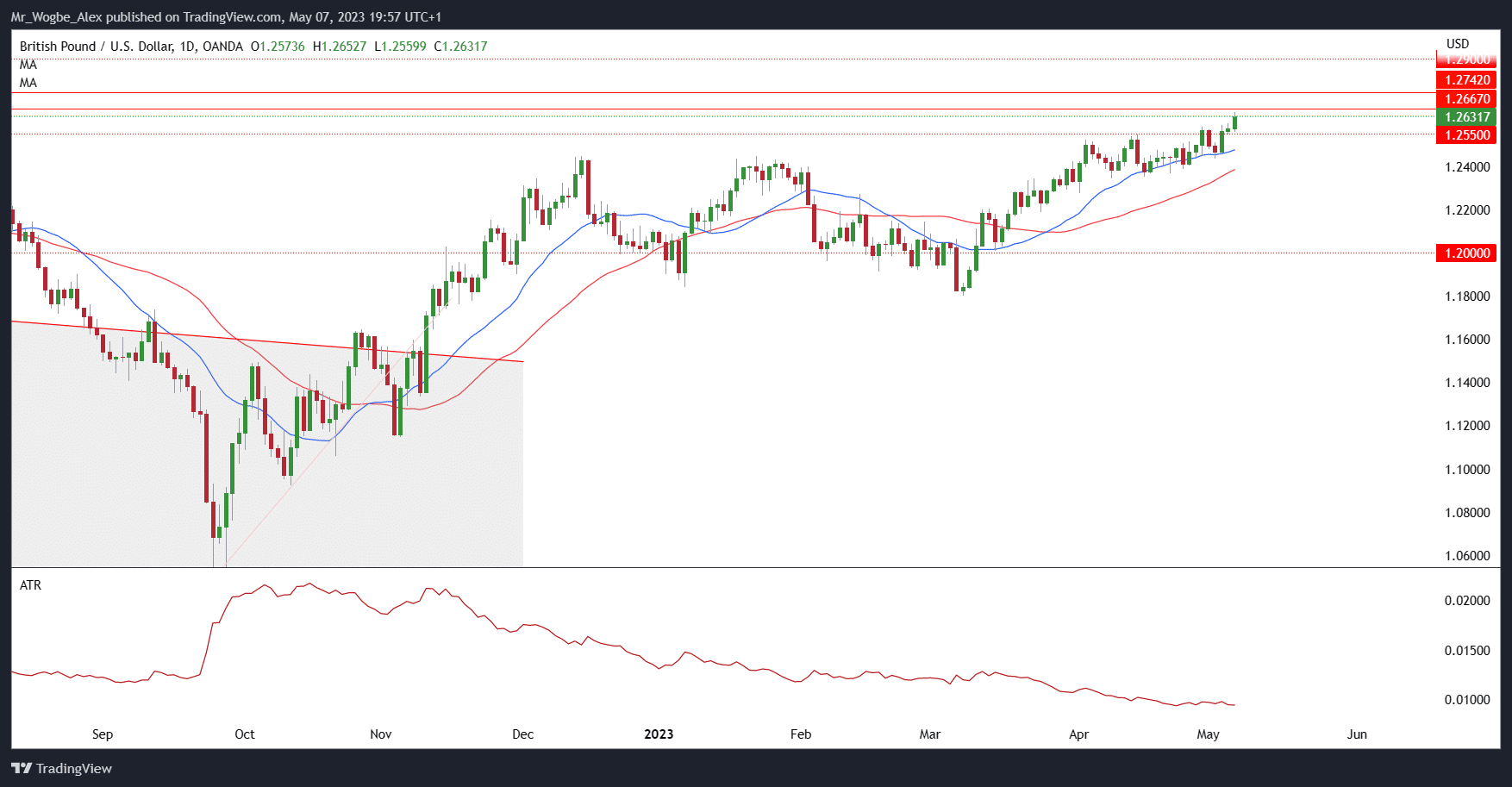

The GBP/USD pair is doing a little dance, giving back some of its recent gains. It had reached the dizzying height of 1.2634 on Friday, but it’s taking a breather now. Fear not, though, as it might gather its strength early next week in preparation for the big BoE showdown.

If it’s feeling feisty, it could attempt to recapture that mark with a few pesky resistance levels to contend with along the way. Keep an eye on 1.2667, followed by 1.2742.

Meanwhile, let’s peek at what the retail traders are up to. According to their data, 34.24% of traders are feeling pretty confident on the net-long side of GBP/USD. They’re outnumbered by the shorters, though, with a short-to-long ratio of 1.92 to 1.

Now, compared to last week’s figures, the number of traders hopping on the net-long train has increased by 3.58%, but it’s still 12.29% lower than the excitement we witnessed last week. On the flip side, the number of traders joining the net-short party has taken a slight dip of 0.21% since yesterday. However, don’t be fooled, because they’re still 18.32% higher in numbers compared to last week.

You can purchase Lucky Block – Guide, Tips & Insights | Learn 2 Trade here. Buy LBLOCK

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.