The Canadian Dollar (USD/CAD) soared on Tuesday as China’s robust economic growth boosted the outlook for global commodities, especially crude oil. The world’s second-largest economy expanded by 6.8% in the first quarter of 2023, beating expectations and lifting both WTI and Brent prices. The Canadian dollar, which is closely linked to oil exports, benefited from the improved demand-side factors.

The rally in the Canadian Dollar was Short-Lived

However, the loonie’s rally may be short-lived as global recessionary fears still loom large. The Chinese data may not be sustainable as the country faces challenges from trade tensions, debt levels, and environmental issues. Moreover, the Canadian inflation data released today showed a continued decline in consumer prices, despite a slight uptick in core inflation on a monthly basis. The annual inflation rate dropped to 1.9% in March, the lowest since August 2021.

The soft inflation data is unlikely to change the Bank of Canada’s (BoC) current stance of keeping interest rates on hold at 4.5%, the highest level in 15 years. The BoC has paused its rate hike cycle since December 2022, citing uncertainties in the global economy and domestic housing market. The Canadian dollar may face further headwinds from a potential rate hike by the Federal Reserve in May, which would widen the interest rate differential between the two countries.

The US dollar, however, weakened on Tuesday as US building permit data showed a further slump in the housing market, adding to the signs of a slowing economy. The market will also pay attention to the Fed’s Bowman speech later today, which could offer some clues on the Fed’s policy outlook. In addition, the weekly API crude oil report could weigh on the loonie if it shows another increase in US oil inventories.

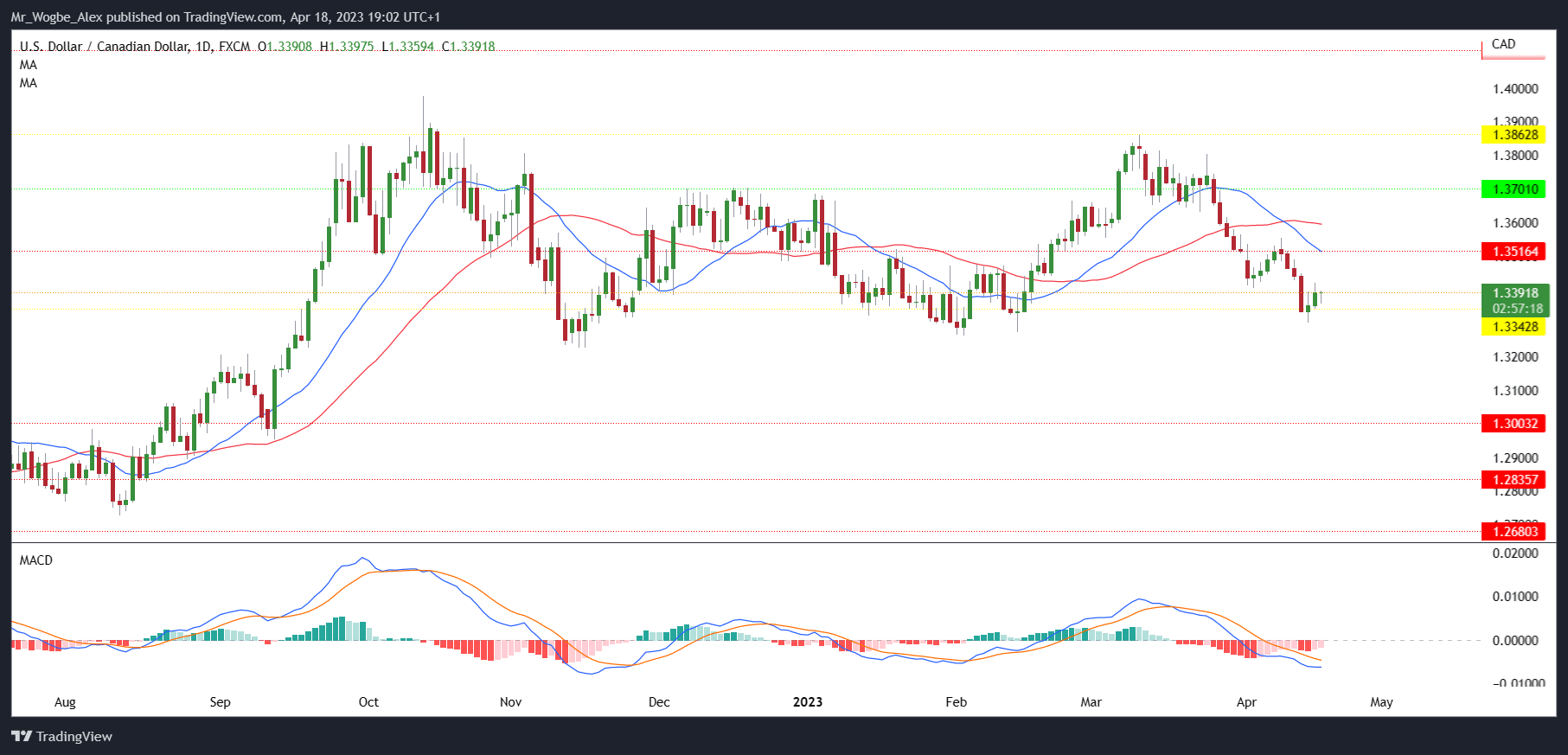

The loonie was trading at 1.3390 against the greenback at the time of writing, at break-even from Monday’s close.

You can purchase Lucky Block – Guide, Tips & Insights | Learn 2 Trade here. Buy LBLOCK

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.