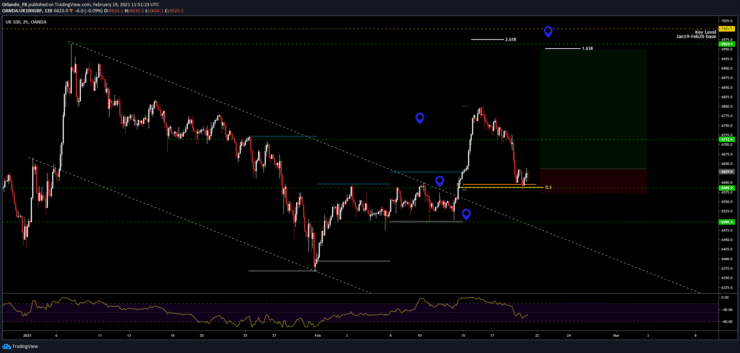

Key Support: 6585 – 6500

Key Resistance: 6715 – 6950

Long term view

After 95 days of trading inside of a very choppy range the FTSE broke last Friday with a mid-term bullish flag. We couldn´t catch the first impulse since the breakout occurred late on Friday.

On Sunday the FTSE opened higher and never pulled back to our buy zone, until today.

2H analysis and setup

The FTSE has pulled back to the previous 2 week highs right at the weekly pivot in confluence with the % pullback of the entire February rally.

This is a very simple high probability dip buy at a key area.

⚠️For the remainder of this analysis and the signal to place this trade, please join our VIP group here https://learn2.trade/forex-signals ⚠️

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.