Traders, you might want to keep an eye on the EUR/USD currency pair as it continues to rise. Since September 2022, the pair has been on a steep uptrend, thanks to a hawkish European Central Bank (ECB) and a weaker US dollar.

The ECB has remained committed to raising rates until inflation shows significant signs of easing, which has boosted the euro’s value. Meanwhile, market participants have been anticipating a slower pace of tightening or a near-term pivot from the Federal Reserve.

However, the EUR/USD pair can deflate quickly. The recent collapse of Silicon Valley Bank and Signature Bank has raised concerns about the health of the US banking system, causing the pair to fall to prior support at 1.0524 on March 8. However, investors should not be deterred, as there are many other factors at play.

The EUR/USD Pair Maintains an Upward Trajectory

After rising above trendline resistance taken from the January 2021 high, the euro has continued to gain against the greenback. This is due to a weaker dollar and a hawkish ECB, which have allowed the euro to outperform the dollar.

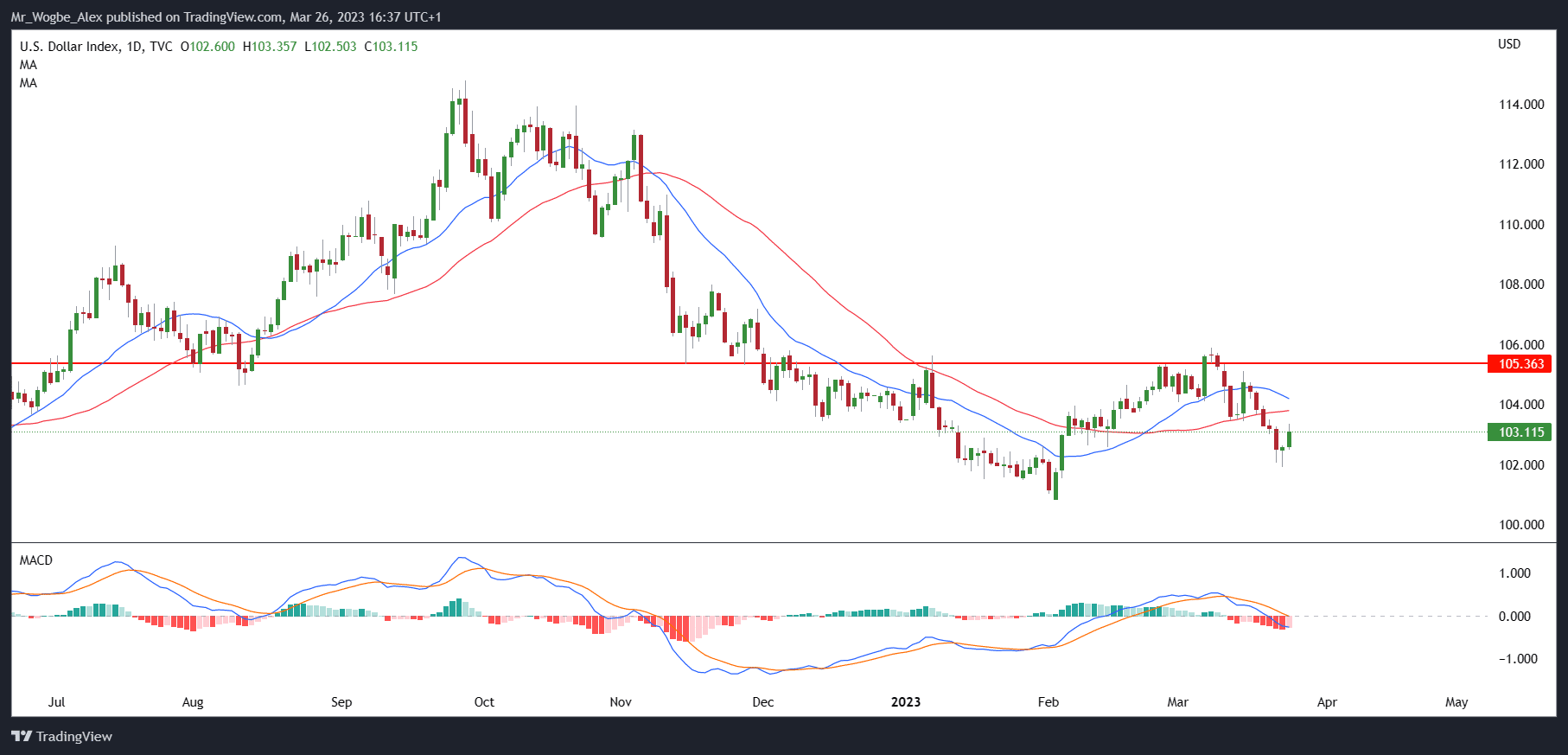

Despite the recent gains, the US dollar, as measured by the DXY index, gained ground last Friday, going up by about 0.6% to 103.35 amid a risk-off mood. However, it was still on track for a 0.7% drop on the week following the recent slump in US Treasury yields, which was accelerated by the Fed’s dovish hike at its March meeting.

The Federal Reserve raised interest rates by 25 basis points on Wednesday, in line with expectations. However, the Fed signaled that it could halt its hiking cycle soon in response to market fears over US banks in the wake of the rapid and unexpected collapse of SVB and SBNY.

So, what does all this mean for investors? Well, it’s essential to keep an eye on economic data and news that could impact the EUR/USD currency pair. With the ECB’s hawkish stance and the potential for further rate hikes, the euro could continue to outperform the dollar in the near future.

You can purchase Lucky Block – Guide, Tips & Insights | Learn 2 Trade here. Buy LBLOCK

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.