EUR/JPY Significant Levels- Remains Above 163.00

Resistance Levels: 164.00, 166.00, and 168.00

Support Levels: 158.00, 156.00, and 154.00

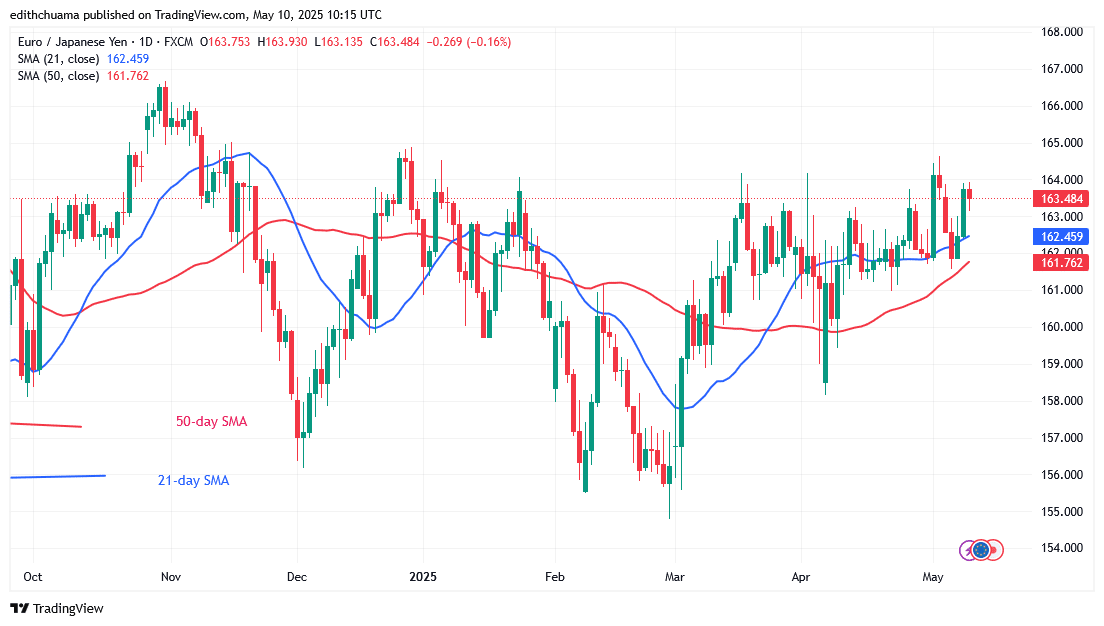

EUR/JPY Price Long-term Trend: Ranging

The EUR/JPY pair remains above 163.00 since its breakthrough on April 11. The Yen has been trading above the 21-day SMA support and below the barrier at level 164.00. The currency pair has been rejected twice in the past week as buyers attempt to push the price above the level of 164.00. However, the bulls have failed to break through the overhead barrier at level 164 since December 2024.

The Yen is likely to be strong once it passes above the overhead barrier. Selling pressure will resume when the price falls below the 21-day SMA support. The Yen will reach its next level of support at 161.00.

Daily Chart Indicators Reading:

The 21-day SMA is above the 50-day SMA, indicating the currency pair’s upward correction, even though the moving average lines are horizontal. If the 21-day SMA support remains in place, the bullish trend will continue. The Yen is distinguished by extended candlestick wicks pointing across level 164.00 in the positive trend zone. Strong selling pressure is indicated by these candlestick wicks.

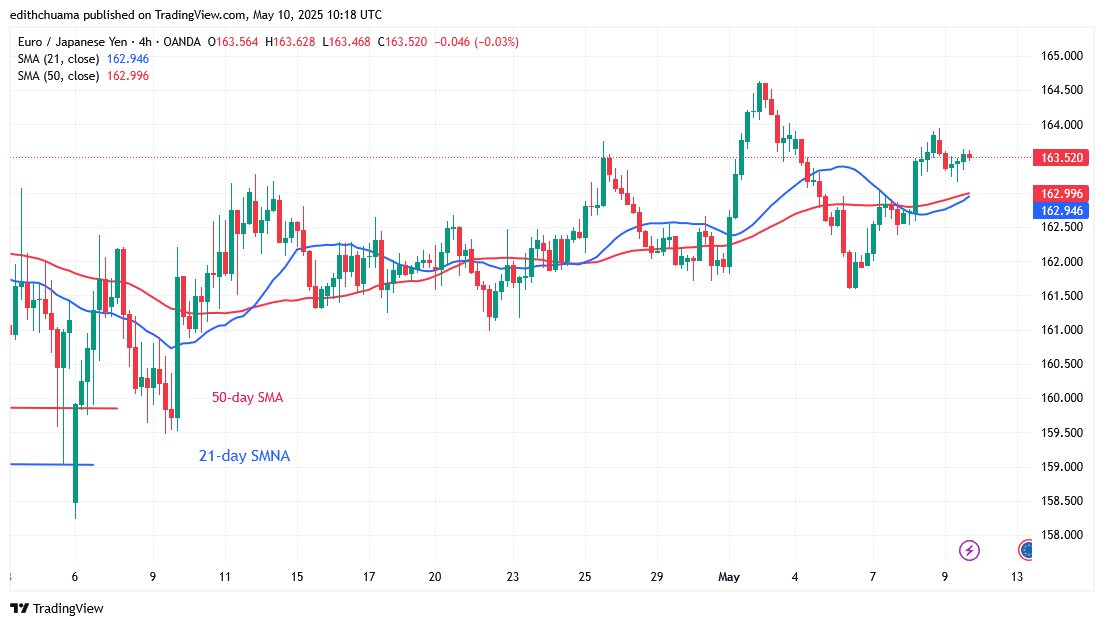

EUR/JPY Medium-term Trend: Ranging

On the 4-hour chart, the Yen is moving horizontally while undergoing an upward reversal. The price of the Yen has been oscillating between the moving average lines and above them. Prior to the upward corrective stop at level 164.00, the currency price was making higher highs and lows. The overhead resistance is where the price movement has stopped.

4-Hour Chart Indicators Reading

The price bars are below the upward-sloping moving average lines. The price bars are above the moving average lines after the rejection at the most recent high. This indicates additional sideways movement while in the positive trend zone. The price fluctuation is limited by the Doji candlesticks.

General Outlook for EUR/JPY

EUR/JPY halts below the overhead resistance of 164.00 but remains above 163.00. The Yen has been above the moving average lines since April 11. It trades above the moving average lines but below the barrier at 164.00. The Yen can drop below the 21-day SMA support if it can’t break through the above resistance. The forex signal has remained horizontal as a result of the rejection.

Make money without lifting your fingers: Start using a world-class auto trading solution.

Note: Learn2.Trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product, or event. We are not responsible for your investing results.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.