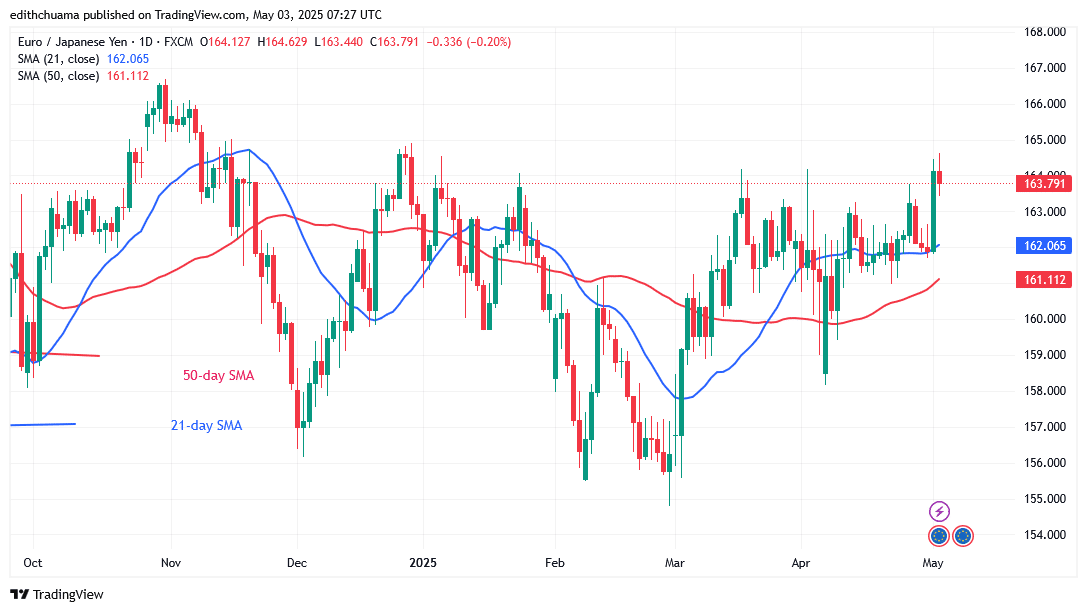

EUR/JPY Significant Levels

Resistance Levels: 164.00, 166.00, and 168.00

Support Levels: 158.00, 156.00 and 154.00

EUR/JPY Price Long-term Trend: Ranging

The EUR/JPY exchange rate has risen above the lines of the moving average but resumes its range below the level of 164.00. The currency pair oscillates below the resistance level at 164.00 but above the 21-day SMA support. Buyers have been unable to sustain the upward momentum above the 164.00 mark. The pair is presently retracing after hitting the resistance level at 164.00.

The current sideways trend may stop if buyers keep the price above 164.00. The positive trend of the Yen will begin. On the other hand, if the Yen drops below the 21-day SMA, its value will decrease. The Yen will return to its previous low of 160.00. The Yen is now trading at 163.69.

Daily Chart Indicators Reading:

The Yen will trade in the bullish trend zone as the price bars remain above the moving average lines. There are long candlestick wicks pointing across the resistance at level 164.00. There is a lot of selling pressure at the 164.00 high. The 50-day SMA and the horizontal 21-day SMA point to the current trend.

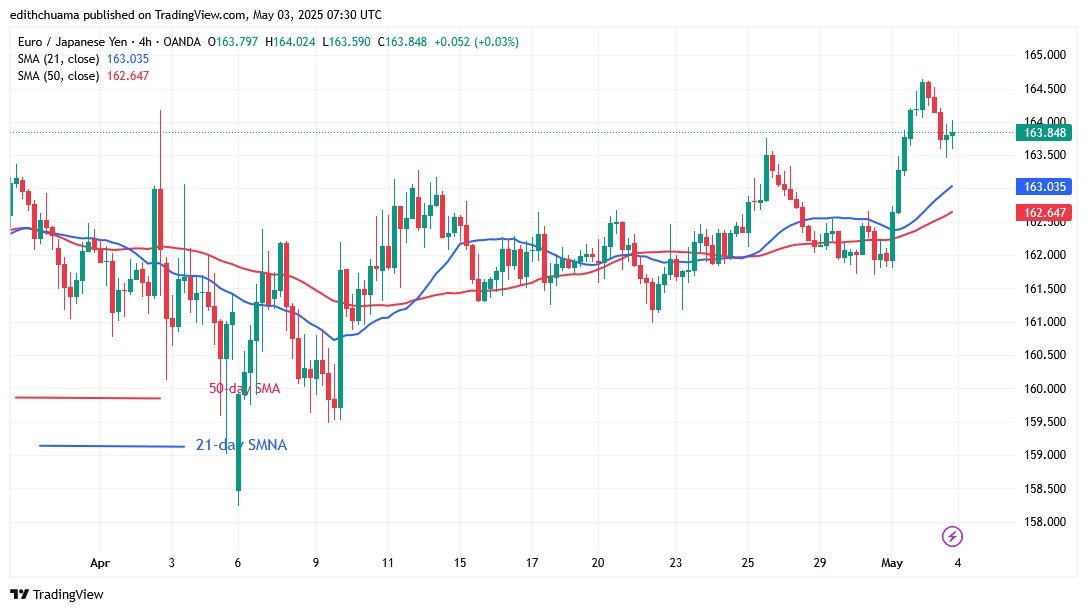

EUR/JPY Medium-term Trend: Ranging

The currency pair has started an upward correction on the 4-hour chart. The 164.00 barrier has halted the bullish momentum. The Yen recovered and is currently trading above the support level of 163.50. If the current support holds, the bullish trend will resume. The Yen will rise and retest the barrier at level 164.00. The downward trend will resume when the price falls below the moving average lines.

4-Hour Chart Indicators Reading

The price bars vary proportionately to the moving average lines, even though they are horizontal. The level of price volatility has been limited by the usage of Doji candlesticks. A bullish surge is indicated by the 21-day SMA’s position above the 50-day SMA.

General Outlook for EUR/JPY

The EUR/JPY has reached the overbought region of the market as it runs into resistance at a level of 164.00. The Yen is likely to encounter resistance as it starts its range-bound move between the price levels of 158.00 and 164.00. The Yen has stopped above 163.00 despite declining. The FX signal is sideways and being rejected at the high of 164.00.

Make money without lifting your fingers: Start using a world-class auto trading solution.

Note: Learn2.Trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.