Key Resistance Levels: 160.00, 162.00, 164.00

Key Support Levels: 150.00, 148.00, 146.00

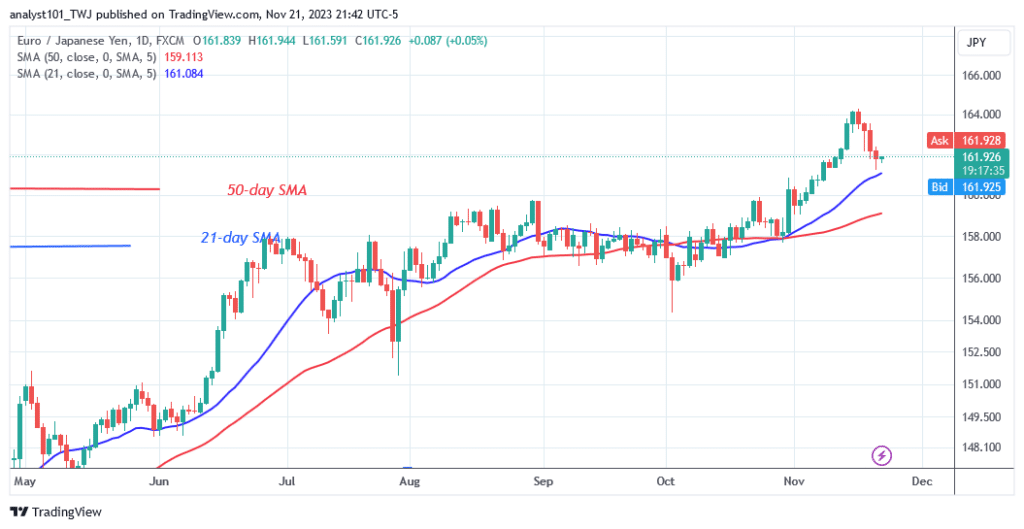

EUR/JPY Price Long-term Trend: Bullish

The EUR/JPY currency pair is rising but faces rejection at 162.50. Buyers were unable to break through the 164.00 price barrier. In the event that buyers prevailed, the Yen would have increased to 165.78. Today, the Yen has fallen to 161.24, which is above the 21-day SMA.

On the negative, the price indication predicts a further drop to level 160.90. Nonetheless, if the EUR/JPY remains above the 21-day simple moving average, the rise may resume. However, if the bears break below the 21-day SMA, selling pressure will resume.

The current surge could cease if the currency pair breaks below the 21-day SMA.

Daily Chart Indicators Reading:

The Yen has currently retraced above the 21-day SMA. Further price increases will be contingent on the Yen remaining above the moving average lines. The price forecast indicates that the bearish momentum can continue past the current price level.

Two times since the uptrend started on July 21, the bears have breached below the lines of the moving average.

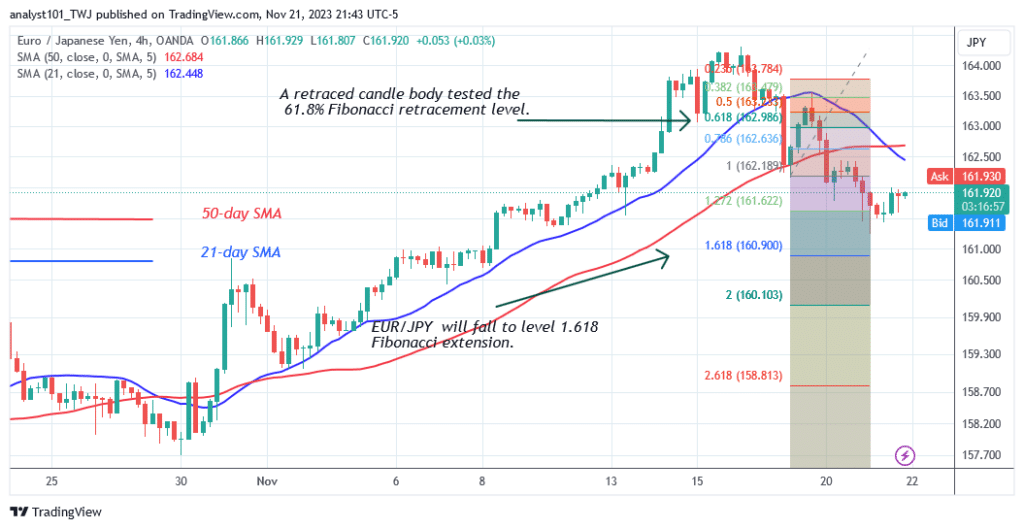

EUR/JPY Medium-term Trend: Bearish

The Yen has slipped below the moving average lines on the 4-hour chart. The Yen is now trading at a low of 161.85. The price indicator predicts that the market will reach a low of 160.90. The Yen is currently dropping as it meets rejection at the high of 162.00.

4–Hour Chart Indicators Reading:

The Yen has fallen below the moving average lines on the 4-hour chart. The 21-day SMA has crossed below the 50-day SMA, indicating that the Yen will continue to fall. The moving average lines are slanted to the downside.

General Outlook for EUR/JPY

The EUR/JPY pair has recovered above the moving average lines but faces rejection at 162.50. The currency pair is trading above the 21-day simple moving average, or level 161.47. The Yen will get trapped between the moving average lines if it drops any lower to a level of 160.90.

The currency pair will therefore trade sideways. The Yen will trend when the 50-day or 21-day SMAs are broken.

You can purchase crypto coins here: Buy LBLOCK

Note: Learn2.Trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.