Stablecoins have become the talking point on the lips of most of Washington. This comes after TerraUSD (UST) posted a debilitating crash below its $1 peg, worsening the already bearish sentiment in the cryptocurrency market.

That said, US lawmakers have called for emergency regulation of Stablecoins. Yesterday, US Treasury Secretary Janet Yellen used UST as an example for her explanation of a “Stablecoin run” in her testimony with the Senate Committee on Banking, Housing, and Urban Affairs on the Financial Stability Oversight Council (FSOC) Annual Report.

Confirming if the Treasury Secretary had any plans of regulating Stablecoins, Senator Pat Toomey (Republican-Pennsylvania) asked: “I would like to ask if you can confirm for the record here that it is still your view that it is important, I would argue even urgent, for Congress to pass legislation governing the regulations of the payment stablecoins.” Yellen responded: “Yes, I’m happy to confirm that, Senator Toomey.” Yellen added:

“The president’s working group issued a report concluding that the current statutory and regulatory frameworks don’t provide consistent and comprehensive standards for the risks of stablecoins as a new type of payment products, and urges Congress to enact legislation to ensure that stablecoins and such arrangements have a federal prudential framework.”

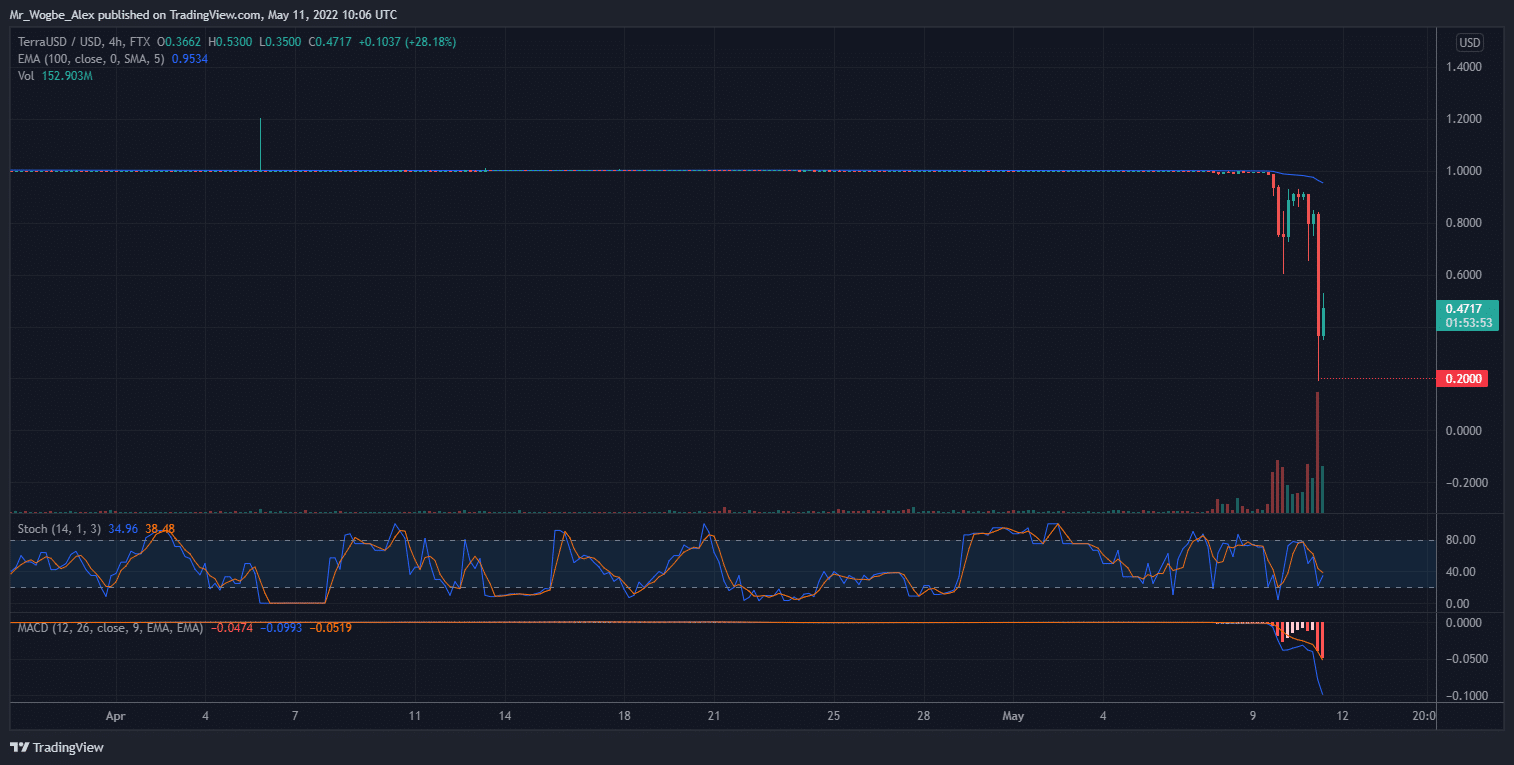

TerraUSD Lose $1Peg Following Bitcoin Crash

UST tumbled to the $0.20 this morning after losing its $1 peg amid one of the worst crypto market sell-offs recorded in history over the past few days. Terra Founder Do Kwon previously announced that the crypto project had amassed billions of dollars worth of Bitcoin as Stablecoin reserve. However, the recent sell-off, which saw BTC crash below the $30,000 mark, triggered fears that the Luna Foundation Guard would dump those tokens, and led to an even bigger sell-off.

You can purchase Lucky Block – Guide, Tips & Insights | Learn 2 Trade here. Buy LBlock

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.