Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you are unlikely to be protected if something goes wrong. Take 2 minutes to learn more

After price action in the SNX market recovered from exhaustion near the 50 Fibonacci Retracement level. The price retracement in this market continues in the upside direction and has regained the momentum to poke through the earlier mentioned resistance. Let’s examine what may happen in this market.

SNX Analysis Data

Synthetix Value Now: $2.475

SNX Market Cap: $649,261,528

SNX Moving Supply: 259,369,735.24

Synthetix Total Supply: 318,625,021.09

SNX CoinMarketCap Ranking: 65

Major Price Levels:

Top: $2.475, $2.500, and $2.600

Base: $2.450, $2.20, and $2.00

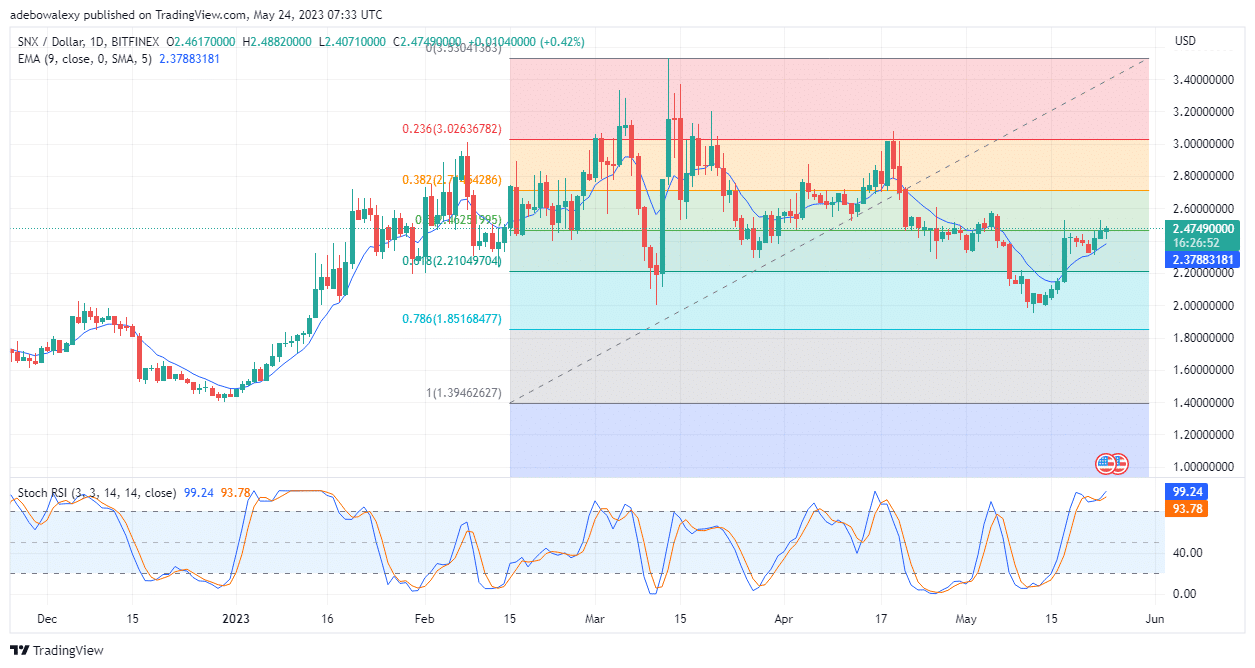

Synthetic Price Action Pokes Through the 50 Fibonacci Level

During a recent trading session on the Synthetix daily market, price action rebounded off the 9-day Moving Average curve in an upward direction. Consequently, the rebound has propelled prices just past the $2.70 mark. Furthermore, the lines of the Relative Strength Index (RSI) indicator have resumed their upside path to indicate that price action has continued its upside trajectory. Also, observing the Fibonacci Retracement tool reveals that price action is still in buyers’ territory, and at least a bit more upside retracement may be expected.

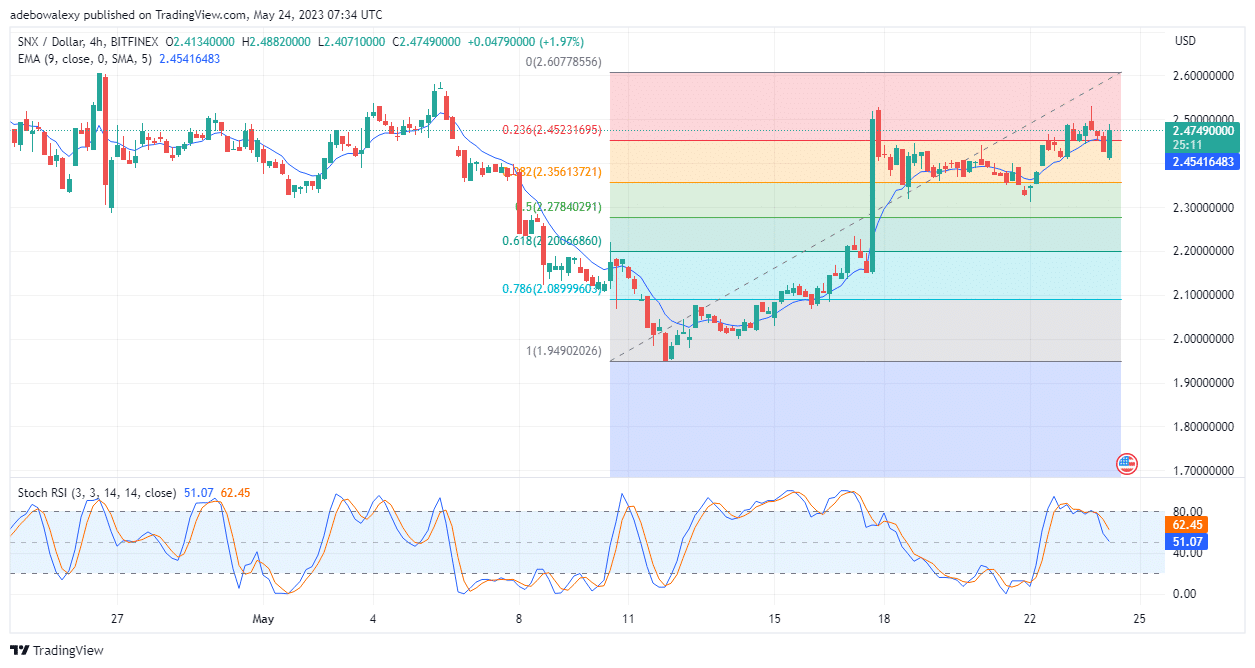

SNX Price Action May Trigger Headwind Soon

Considering SNX market activity in a shorter time frame of 4 hours, one can see that the ongoing upward retracement may soon face opposition. Here, price action has crossed above the 23.60 Fibonacci Retracement level. Also, the price level of $2.50, which is above this level, seems to have been a strong resistance mark in recent times. At this point, the last bullish price candlestick is very close to hitting this level. At the same time, the lines of the RSI have taken a downward bearing to indicate a subsiding tailwind. Consequently, traders can only anticipate a retracement of the $2.550 price mark.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.