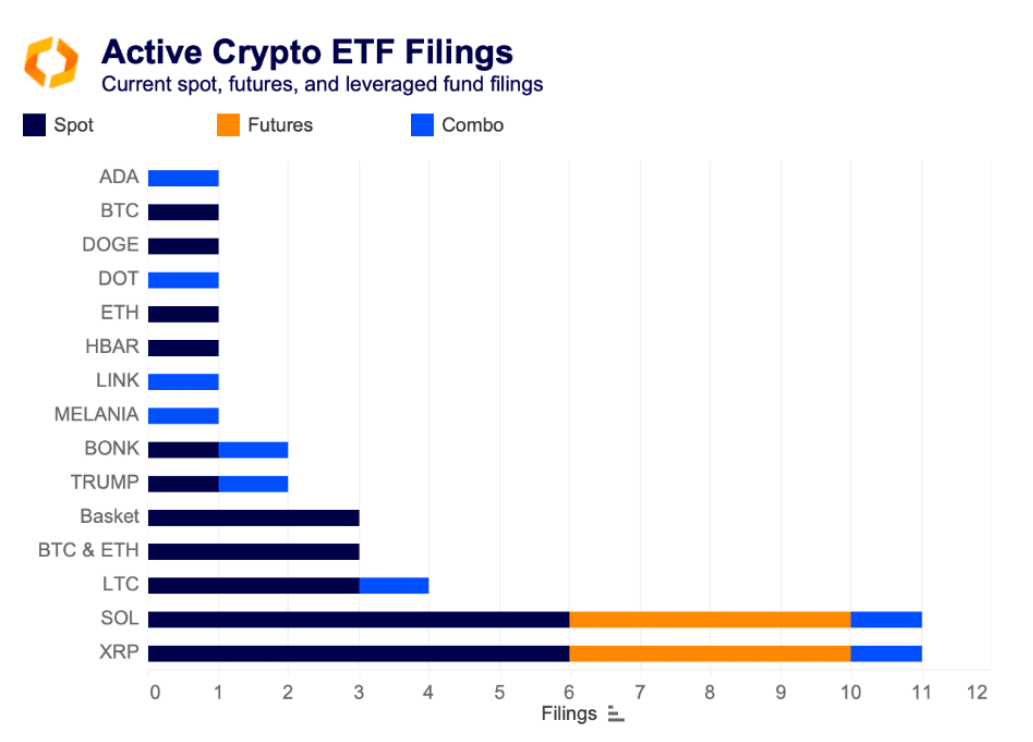

The cryptocurrency market is witnessing an unprecedented wave of ETF applications, with over 45 active filings now seeking approval.

This dramatic increase comes as the financial industry races to capitalize on growing institutional interest in digital assets, though market experts warn that many hurdles still need to be cleared.

Market Depth and Liquidity: Key Factors for ETF Success

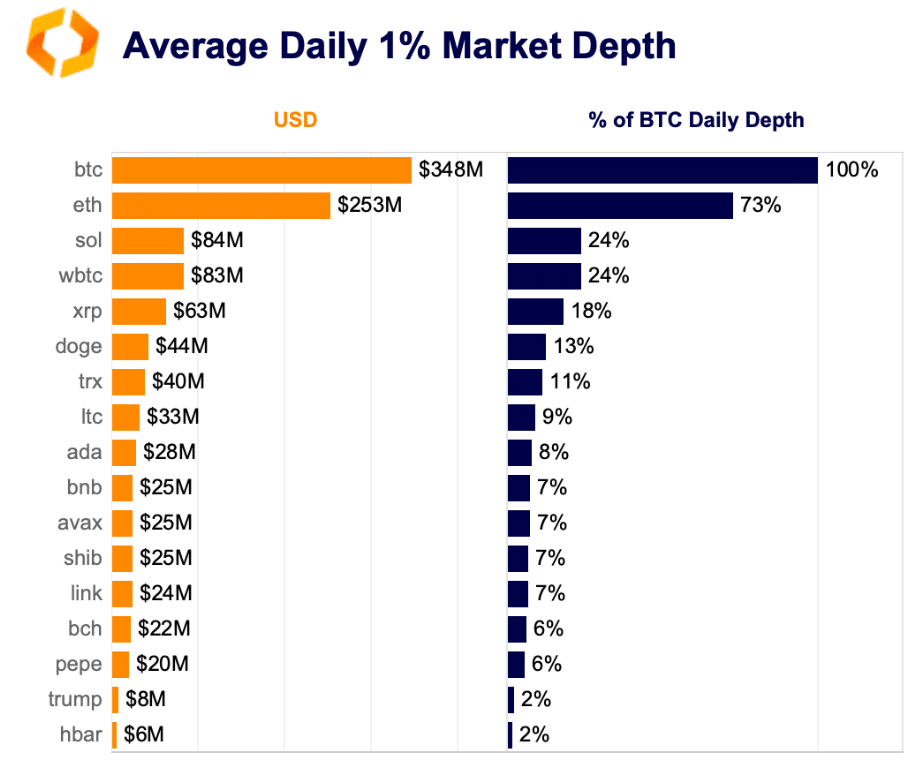

Recent data from Kaiko Research highlights a significant gap in market readiness between Bitcoin and other cryptocurrencies.

While Bitcoin’s market depth allows for efficient trading of large orders, most alternative cryptocurrencies have less than 10% of Bitcoin’s daily market depth. This disparity raises important questions about their suitability for ETF products.

The analysis shows that even established cryptocurrencies like XRP, Solana, and Litecoin still face liquidity challenges on U.S. exchanges. This becomes particularly important for authorized participants—the firms responsible for creating and redeeming ETF shares throughout the trading day.

Understanding the Offshore Trading Challenge

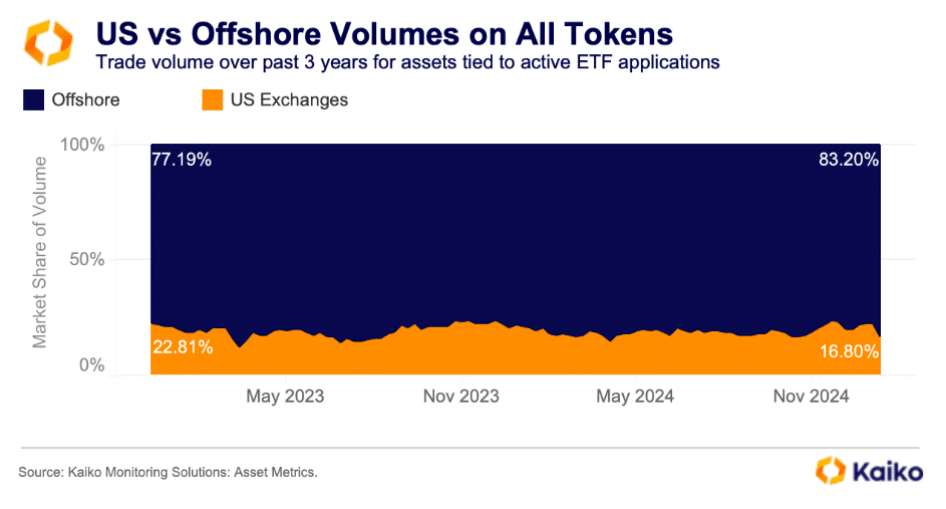

A major concern for potential ETF approval is that over 80% of trading activity for these prospective crypto ETF assets happens outside the United States. This heavy concentration in offshore venues could complicate regulatory oversight and investor protection measures.

The research also reveals high market concentration levels, measured using the Herfindahl-Hirschman Index. Most assets show scores above 2,500, indicating highly concentrated trading—a potential red flag for regulators concerned about market manipulation.

Another significant hurdle is the limited availability of USD trading pairs. Currently, only 13 exchanges offer USD-quoted Solana or XRP spot instruments, with most trading occurring against stablecoins. This limitation could affect the calculation of net asset values for ETF products.

The absence of regulated futures markets for cryptocurrencies beyond Bitcoin and Ethereum also restricts the strategies available to investors. While the Bitcoin basis trade has proven popular with hedge funds following spot Bitcoin ETF approval, similar opportunities don’t exist for other cryptocurrencies.

ETF Applications Continue to Troop In Unabated Despite Challenges

Despite these challenges, major financial firms continue submitting ambitious applications, including Tuttle Asset Management’s recent filing for ten leveraged ETF products.

ProShares and VanEck have also applied for futures products on Solana and XRP, even though no regulated futures markets currently exist for these assets in the U.S.

While the industry shows growing optimism about broader ETF approvals, market structure improvements may need to precede regulatory green lights.

The success of Bitcoin ETFs has demonstrated the potential, but other cryptocurrencies still need to develop more robust trading ecosystems to support ETF products effectively.

Interested In Trading The Market With A Trustworthy Partner? Try Eightcap Today.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.